CROP Infrastructure Corp. (CSE:CROP, OTC:CRXPF, Frankfurt:2FR) (“CROP” or the “Company”), announces today a warrant exercise incentive program (the “Program”) intended to encourage the exercise of up to 31,811,536 outstanding common share purchase warrants

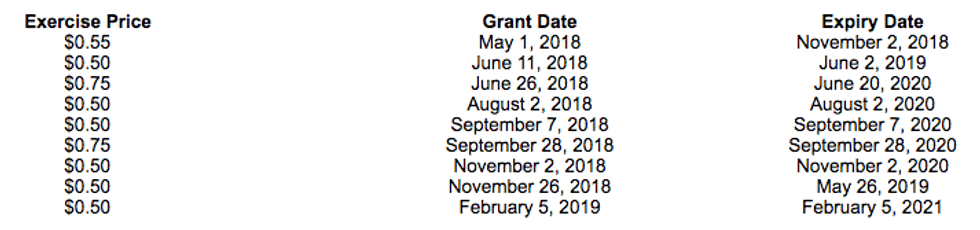

CROP Infrastructure Corp. (CSE:CROP, OTC:CRXPF, Frankfurt:2FR) (“CROP” or the “Company”), announces today a warrant exercise incentive program (the “Program”) intended to encourage the exercise of up to 31,811,536 outstanding common share purchase warrants (collectively, the “Eligible Warrants”) of the Company with expiry dates as follows:

Pursuant to the Program, the Company is offering an inducement to each holder of Eligible Warrants (collectively, the “Warrant Holders”) that exercises Eligible Warrants during an early exercise period (the “Early Exercise Period”) that includes:

- a reduced exercise price of $0.13 per common share (each, a “Share”); and

- an additional Share purchase warrant (each an “Incentive Warrant”), with each Incentive Warrant entitling the Warrant Holder to purchase one additional Share until 5:00 p.m. (Vancouver time) on such date as is two years from the date of issuance of the Incentive Warrant at a price of $0.35 per Share.

The Early Exercise Period will commence on August 21, 2019, at 9.00 a.m. (Vancouver time) and expire on September 6, 2019 at 5:00 p.m. (Vancouver time). Eligible Warrants that remain unexercised following the completion of the Early Exercise Period will continue to be exercisable for Shares on the original terms as they existed prior to the Program.

If, at any time during the Early Exercise Period, the closing price of the Shares on the Canadian Stock Exchange (“CSE”) exceeds $0.1625 per Share for 10 consecutive trading days, the term of the Eligible Warrants will be decreased to 30 days commencing 7 days following the end of the 10 day trading period.

Proceeds received by the Company from the exercise of Eligible Warrants under the Program will be used for advancing the construction of its Nevada extraction lab, hiring additional sales teams to increase revenues and speed to market, as well as for general working capital purposes.

Only Warrant Holders who are “accredited investors” under applicable Canadian securities laws or who provide satisfactory evidence that they meet the requirements of an alternative exemption from the prospectus requirements of applicable Canadian securities laws may participate in the Program. U.S. holders of the Eligible Warrants are not eligible to participate in the Program.

The Incentive Warrants will be subject to a four month hold period from the date of the Incentive Warrant issuance pursuant to applicable Canadian securities laws. No fractional Incentive Warrants will be issued and the number of Incentive Warrants to be issued shall be rounded down to the nearest whole number.

In connection with the Program, an aggregate of 17,500,000 Share purchase warrants (the “Financing Warrants”) held by subscribers under the Company’s secured convertible debentures financings of February 7, 2019 and June 11, 2019 will be reduced to an exercise price of $0.35 per Share. If, at any time during the term of the Financing Warrants, the closing price of the Shares on the CSE exceeds $0.4375 per Share for 10 consecutive trading days, the term of the Financing Warrants will be decreased to 30 days commencing 7 days following the end of the 10 day trading period.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein to, or for the account or benefit of, persons in the United States or U.S. persons (“U.S. Persons”), as such term is defined in Regulation S under the United States Securities Act of 1933, as amended (the “1933 Act”). The securities described herein have not been and will not be registered under the 1933 Act or any state securities laws, and may not be offered or sold to, or for the account or benefit of, persons in the United States or U.S. Persons unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration is available.

About CROP

CROP is a publicly listed company trading on the CSE under the symbol “CROP” and on the OTC Markets under the symbol “CRXPF”. CROP is focused on cannabis branding and real estate assets through its wholly and partially-owned subsidiaries. CROP’s portfolio of projects includes cultivation properties in California, two in Washington State, a 1,000-acre Nevada cannabis farm, 2,115 acres of Hemp CBD farms, and a growing portfolio of share equity in various companies within the cannabis space.

CROP has developed a portfolio of assets including Canna Drink, a cannabis infused functional beverage line and 16 cannabis brands.

Contact

Michael Yorke – CEO & Director

info@cropcorp.com

www.cropcorp.com

(604) 484-4206

Disclaimer for Forward-Looking Statements

This news release contains forward-looking statements that involve various risks and uncertainties regarding future events. Such forward-looking statements are based on current expectations of management, involve a number of risks and uncertainties, and are not guarantees of future performance of the Company. These statements generally can be identified by the use of forward-looking words such as “may”, “should”, “will”, “could”, “intend”, “estimate”, “plan”, “anticipate”, “expect”, “believe” or “continue”, or the negative thereof or similar variations. Such factors are qualified in their entirety by the inherent risks and uncertainties surrounding the number of Warrant Holders and the proposed use of proceeds from the Program. Such forward-looking statements should therefore be construed in light of such factors, and the Company is not under any obligation, and expressly disclaims any intention or obligation, to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law.

Source: www.globenewswire.com