Cannabis Weekly Round-Up: Aurora Shares Dip After New Offering

Aurora Cannabis shareholders faced a turbulent ride this past week as the company announced a new offering.

Shares of a Canadian cannabis producer took a double-digit downturn this past week as the company proposed a new public offering.

Meanwhile, two leading US-based multi-state operators (MSOs) gave new expansion strategy details.

Keep reading to find out more cannabis highlights from the past five days.

Aurora’s gamble causes share price dip

This past week has been a turbulent one for Aurora Cannabis (NYSE:ACB,TSX:ACB) shareholders.

On Monday (November 9), the producer reported an adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) loss of C$57.9 million for its first fiscal quarter of 2021. Aurora also indicated its cannabis net revenue reached C$67.8 million.

According to Aurora CEO Miguel Martin, the firm’s CBD brand Reliva is ranked as the top choice by data set company Nielsen Holdings (NYSE:NLSN). Aurora entered the US market by acquiring Reliva in May.

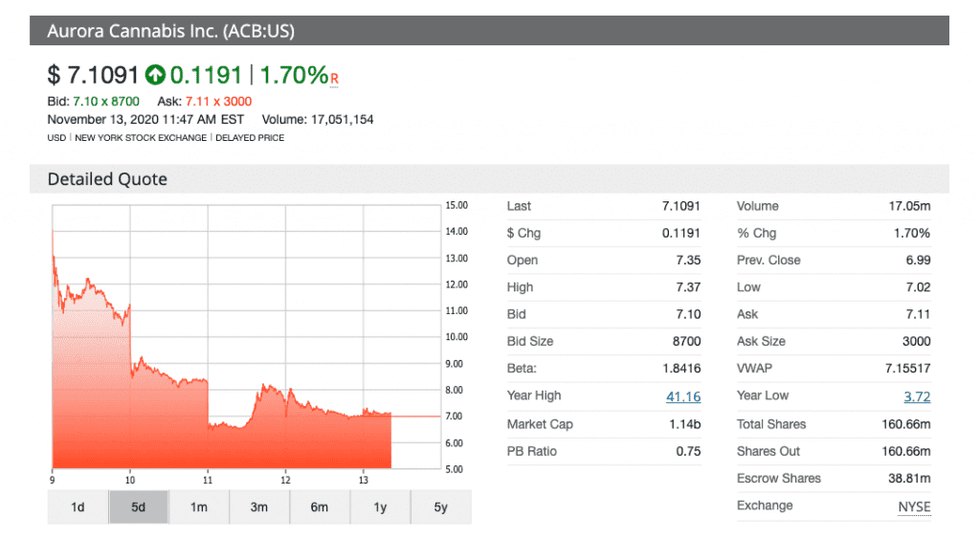

The company kicked off the week at US$13.15 in New York, but has since dropped in value by over 40 percent. As of Friday (November 13) at 10:43 a.m. EST, Aurora was down to a price tag of US$7.17.

The volatile period was aggravated after Aurora introduced a new public offering for gross proceeds of US$125 million. The offer prices shares of the company at US$7.50 apiece.

A report from Barron’s released mid-week shows that analysts were left unimpressed by Aurora’s recent performance, along with its new offering.

“We do not believe the company has demonstrated an enduring right-to-win for new market opportunities, particularly in the US, with the increasing competitiveness of the Canadian market challenging the company’s ability to achieve profitability while contending with liquidity issues,” Stifel analyst W. Andrew Carter wrote in a note, according to the report.

MSO expansion into new markets

Also during this past trading week, Curaleaf Holdings (CSE:CURA,OTCQX:CURLF) and Trulieve Cannabis (CSE:TRUL,OTCQX:TCNNF) outlined their respective expansion plans. Both MSOs are making critical moves into the Pennsylvania state market.

Kim Rivers, CEO of Trulieve, said Pennsylvania is “one of the most attractive medical marijuana markets in the United States.” Her company is acquiring local producer PurePenn and the Solevo Wellness dispensary network in a combined share-and-cash deal worth US$66 million.

Meanwhile, Curaleaf said its Select line of cartridge products has become available in the state market.

Pennsylvania is a medical-only market with 425,000 patients registered, according to a FOX29 report.

Cannabis company news

Earnings report season kicked off with a variety of cannabis companies reporting numbers. Here are several that shared data this past week.

- Avicanna (TSX:AVCN,OTCQX:AVCNF) reported a net loss attributable to shareholders of C$0.35 per share for its most recent quarter; it also saw an adjusted EBITDA loss of C$2.6 million. Following the report, the company announced a new public offering.

- Canopy Growth (NYSE:CGC,TSX:WEED) recorded C$135.5 million in net revenue, fueled by sales in the Canadian recreational cannabis market. However, the firm is still identifying cost-saving measures in the range of C$150 million to C$200 million.

- Canopy Rivers (TSX:RIV,OTC Pink:CNPOF) told investors the value of its investment in TerrAscend (CSE:TER,OTCQX:TRSSF) has jumped thanks to the US election. “We believe that we will be well positioned to capitalize on opportunities in the US once we are permitted to do so,” President and CEO Narbe Alexandrian said.

- The Green Organic Dutchman Holdings (TSX:TGOD,OTCQX:TGODF) reported a net loss of C$76.24 million and also confirmed the dismissal of CEO Brian Athaide.

- Harvest Health & Recreation (CSE:HARV,OTCQX:HRVSF) upsized its 2020 target revenue after reporting an 86 percent increase in total revenue for the most recent quarter.

- Sundial Growers (NASDAQ:SNDL) indicated that its net cannabis revenue dropped to C$12.9 million during the latest quarter. While CEO Zach George didn’t shy away from discussing the firm’s struggles, he is confident the company has made strides to correct its direction.

- Village Farms International (NASDAQ:VFF,TSX:VFF) saw its net sales rise to C$22.6 million for the Q3 period as its cannabis division reported another positive performance.

- Zenabis Global (TSX:ZENA) reported a net loss of C$17 million for the third quarter, which CFO Eric Rasmussen said has been attributed to “significant one-time charges related to financial transactions.”

Next week, research firm Prohibition Partners will reprise its online event “Prohibition Partners LIVE,” offering cannabis investors a place to listen to expert discussions about the state of the industry and key trends in areas like Canada, the US, Europe and Oceania.

The event kicks off on Tuesday (November 17) and will feature investment speakers like Merida Capital partner Mitch Baruchowitz and Karan Wadhera, managing director of Casa Verde Capital.

Don’t forget to follow us @INN_Cannabis for real-time updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.