Better Choice Shares Jump as Bruce Linton Joins as Special Advisor

For the second time this year the involvement of Bruce Linton with a relatively unknown public company causes a significant jump in value for its investors.

The return of Bruce Linton to the marijuana industry causes the shares of a little known cannabidiol (CBD) company to jump over 20 percent.

It was just in July when Bruce Linton, the co-founder and former CEO of cannabis juggernaut Canopy Growth (NYSE:CGC,TSX:WEED), was fired from his position as company leader. Now, a few months later, Linton is making his comeback into the cannabis space.

On Tuesday (September 17), Better Choice Company (OTCQB:BTTR) announced the former cannabis executive would be joining its ranks as a special advisor.

With Better Choice, a global animal health and wellness CBD firm, Linton will be tasked with expanding the firm’s cannabinoid research across the globe and building out an internal intellectual property, data and analytics platform. He’ll also help the company explore its strategic partnership opportunities.

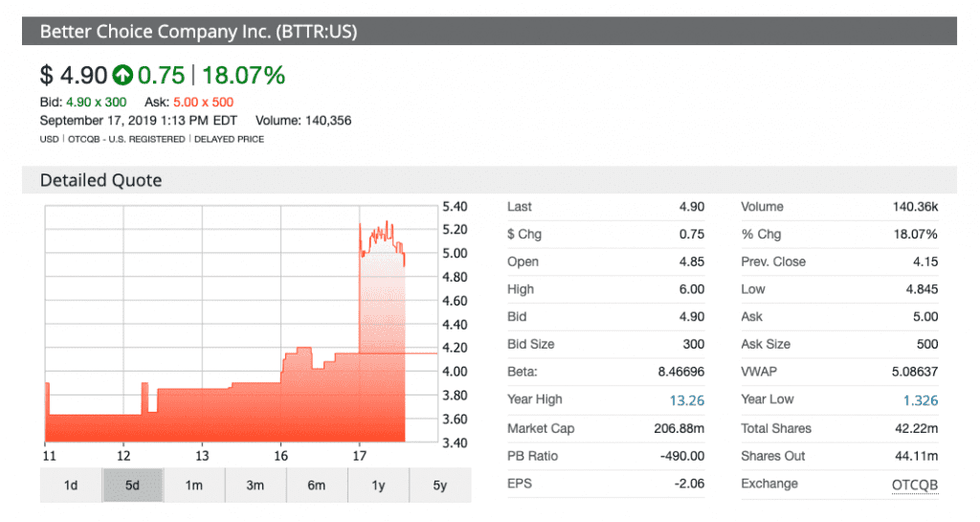

Share prices for the company jumped on Tuesday, opening at US$4.85, an increase of almost 17 percent from Monday’s (September 16) closing price of US$4.15.

In a statement, Linton said the company has an advantage in the CBD market thanks to the merger of all its operations, including brands and intellectual property development.

“I look forward to working closely with the Better Choice team to solidify its global expansion plans, identify other strategic opportunities that will increase shareholder value and expand my role at the company in the future,” Linton said.

The former Canopy CEO was ousted from the company after the board of directors, largely composed of executives from alcohol maker Constellation Brands (NYSE:STZ); a company that invested C$5 billion into Canopy last year, were left unimpressed by some poor quarterly results.

Canopy Growth released a tweet regarding Linton’s new position, giving the executive “kudos” on his recent moves in the industry.

Progress comes as like-minded people push forward together. In that spirit, kudos are due to Bruce Linton today as he starts his next chapter in the cannabis sector. #FutureGrowth

— Canopy Growth (@CanopyGrowth) September 17, 2019

Linton cited Better Choice’s access to funding for its research in animal health as an attractive feature in a press release.

Better Choice made a name for itself creating pet products and hemp-derived CBD supplements, which has been a growing sector in cannabis.

Fellow public cannabis companies have shown interest in the increasing potential for pet products, such as Colombian-based cannabis firm PharmaCielo (TSXV:PCLO,OTC Pink:PHCEF), which signed a sales agreement in August with the Uruguay-based animal health company Laboratorios Adler. As a part of the deal, PharmaCielo will ship CBD extracts, oils and veterinary products to Adler to be distributed across Latin America.

PharmaCielo’s chief corporate officer David Gordon told the Investing News Network (INN) previously that pet care is underserved by the industry.

“Whether it’s (at) the industrial-level livestock or family pets, it’s an area that’s taken seriously. And as we explore it, it hasn’t been a primary focus for anybody at this stage,” Gordon told INN. “There’s very little done in the area, so we see a legitimate opportunity there for substantial growth.”

Leading CBD producer Charlotte’s Web Holdings (CSE:CWEB,OTCQX:CWBHF) is another player setting up operations in CBD pet care space. In May, the company launched 12 new canine-focused products for its pet lineup, including CBD-infused chewable items, oils and a topical balm.

“So many of our customers share amazing stories about the noticeable improvements in their dog’s lives when incorporating our hemp-extract into their diets,” Kelsey Morrison, associate director of product development for the Colorado-based hemp-derived manufacturer, said in a press release.

Linton isn’t stopping at CBD pet care. In a press release, he announced additional advisory roles in Michigan-based cannabis retail chain Gage Cannabis as executive chairman, and as a director at Mind Medicine, a producer of medical psychedelics.

He also expects to reveal another advisory position for a multi-state operator in the near future.

Linton will be expanding his investment interests, as well. In the release, he said he would take on the role of “activist investor” in SLANG Worldwide (CSE:SLNG), a US-based cannabis consumer packaged goods company, and OG DNA Genetics, a cannabis brand based in California.

The decision to choose his current roster of companies was an attempt to “develop a specific view of how we build enterprise value from the current activities and limit disruption,” he said.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Danielle Edwards, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.