Nelson Peltz joins the marijuana industry as new strategic advisor with Aurora Cannabis, adding another layer of legitimacy to the emerging industry.

Shares of Aurora Cannabis (NYSE:ACB,TSX:ACB) jumped on Wednesday (March 13) following the appointment of a revered investing figure as a strategic advisor.

Nelson Peltz, founder and CEO of the Trian Fund Management in New York, joined the marijuana company as a strategic advisor, earning himself a chance to become one of the top shareholders in the firm.

Analysts covering the space expect to see a wide variety of suitors for a large established corporation partnership thanks to the hiring.

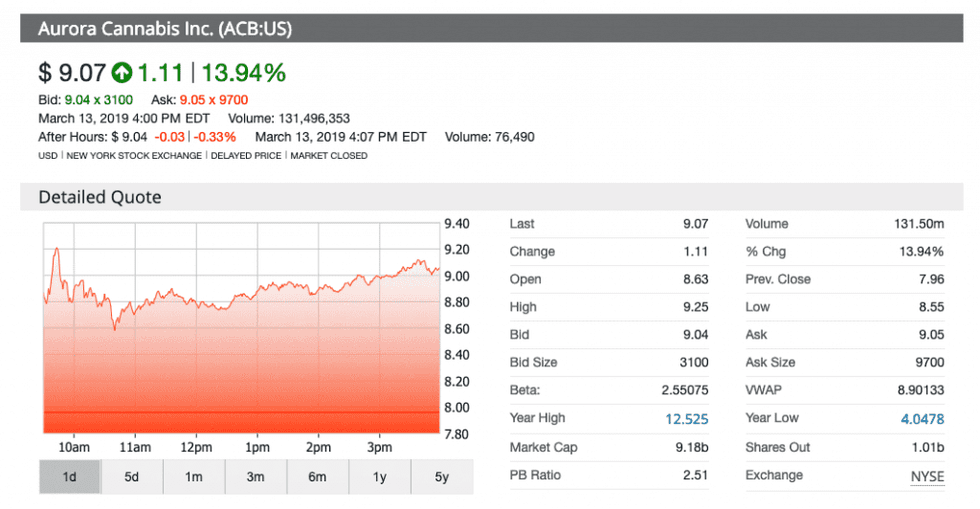

Aurora holders took in an increase in value of of 13.94 percent and 12.97 percent in New York and Toronto, respectively.

The Canadian firm finished the day with a price of US$9.07 and C$12.02.

Over a year-to-date period shares of the company have increased 51.91 percent in New York.

“We look forward to working with Nelson to further extend our global cannabis industry leadership by aligning Aurora with each of the major market segments cannabis is set to impact,” Terry Booth, CEO of Aurora, said in a press release.

Aurora is giving Peltz the option to purchase over nearly 20 million shares of the company at an adjusted price of C$10.34 per share.

“The Senior Advisor may exercise any portion of the Option that has vested on or prior to the seventh anniversary of the date of grant,” Aurora indicated to shareholders.

Peltz said he sees Aurora as having “strongly differentiated from its peers” and is “poised to go to the next level across a range of industry verticals.”

Aurora’s new hiring added he expects Canadian cannabis producers to lead the charge in the international cannabis market.

The announcement was well received by analysts covering the Canadian cannabis firm, who lauded the vote of confidence by Peltz to the cannabis industry.

Cantech Letter reported Martin Landry, GMP Securities analyst, increased his one-year target price projection on Aurora to C$15. The analyst also upgraded his take on Aurora shares from “Hold” to “Buy.”

“Trian has been involved with a number of CPG companies such as PepsiCo, Dr Pepper Snapple, Procter & Gamble, Kraft Foods, Heinz, Mondelez, among others.

Landry highlighted Trian has worked with large consumer packaged goods (CPG) such as PepsiCo (NASDAQ:PEP), Keurig Dr Pepper (NYSE:KDP) and Procter & Gamble (NYSE:PG).

“We believe he could be instrumental in facilitating discussions with large CPG companies,” Landry wrote in his note to investors.

Vivien Azer, analyst with Cowen covering the cannabis sector, said Peltz gives Aurora a dynamic “network of relationships with large potential strategic companies,” for Aurora to partner with.

“In addition, we think (Aurora) will be more patient in partnership selection than its peers, particularly regarding equity investment,” she said according to a report from MJBiz Daily.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in contributed article. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.