AdvisorShares Files Prospectus for New US Marijuana ETF

ETF operator AdvisorShares has filed a prospectus for its second marijuana fund, which according to documents will be focused on the US marijuana and hemp industries.

AdvisorShares, the investment management firm behind one of the biggest US-based cannabis exchange-traded funds (ETFs) on the market, has filed a prospectus to add a second actively managed cannabis fund to its portfolio.

The document for the prospective fund, to be called the AdvisorShares Pure US Cannabis ETF, has been filed with the US Securities and Exchange Commission (SEC), with plans for the fund to trade on the NYSE Arca under the ticker MJUS.

The proposed ETF will be the first to focus primarily on companies that derive at least 50 percent of their revenue from the marijuana or hemp businesses in the US.

The prospectus indicates that in addition to companies that are currently in the marijuana industry, the fund may also turn its attention to firms that may have “future revenues from cannabis-related business or that are registered with the DEA specifically for the purpose of handling marijuana for lawful research and development of cannabis or cannabinoid-related products.”

According to the SEC filing, the fund will concentrate at least a quarter of its investments in the pharmaceutical, biotechnology and life science industries.

Dan Ahrens, managing director with AdvisorShares, and Robert Parker, director of capital markets with AdvisorShares, will act as the portfolio managers for MJUS.

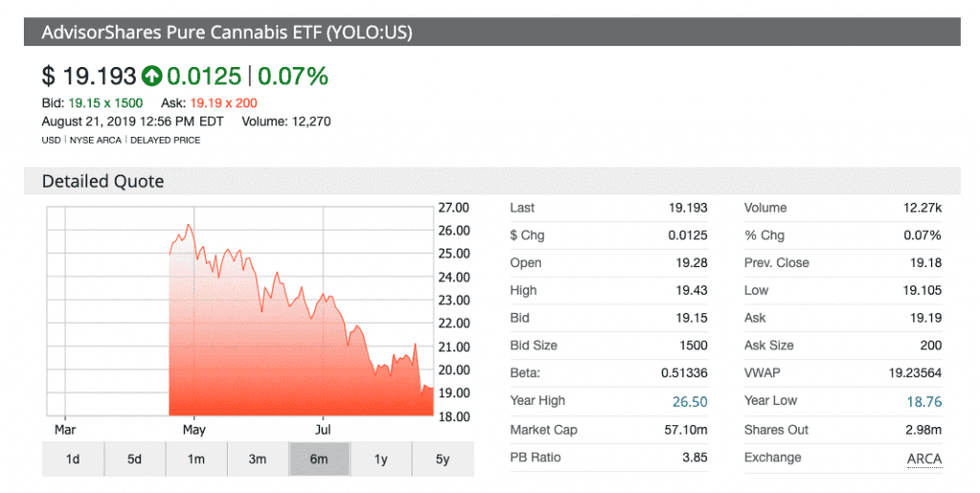

In April, AdvisorShares made its debut in the cannabis ETF market with the launch of the AdvisorShares Pure Cannabis ETF (ARCA:YOLO). AdvisorShares’ first fund currently has almost US$57 million in assets under management. Ahrens also manages this fund.

The holdings of the YOLO fund include some of the big names from Canada’s cannabis industry, such as OrganiGram Holdings (TSXV:OGI,NASDAQ:OGI) and Village Farms International (NASDAQ:VFF,TSX:VFF). As of Monday (August 20), both OrganiGram and Village Farms were in the fund’s top five holdings with weights of 4.99 percent and 5.95 percent, respectively.

In July, the fund announced it would seek exposure to multi-state operators (MSOs) in the US market. YOLO’s holdings now include a variety of MSOs, such as Curaleaf Holdings (CSE:CURA,OTCQX:CURLF), Green Thumb Industries (CSE:GTII,OTCQX:GTBIF) and Cresco Labs (CSE:CL,OTCQX:CRLBF).

This move puts YOLO ahead of other US-based ETFs that aren’t investing in companies that deal directly with the drug since it’s still illegal federally. It’s an advantage that Canada-based cannabis ETFs, like the Horizons Marijuana Life Sciences Index ETF (TSX:HMMJ) and the Evolve US Marijuana ETF (NEO:USMJ), have touted as a boon in the ETF space.

Mark Noble, senior vice president of ETF strategy at Horizons ETFs Management (Canada), previously told the Investing News Network (INN) that the recent rush of marijuana ETFs based in the US would not be able to offer any investments into MSOs, one of the leading growth sectors of the entire space.

Elliot Johnson, chief investment officer at Evolve Funds Group, echoed the sentiment and told INN he thinks investing in US ETFs with no exposure to MSOs could limit investors.

“I think there may be some investors who are US domiciled buying these funds, thinking that they are getting access to the growth of the US cannabis, but in fact they are not,” Johnson said.

YOLO’s share price has dropped almost 23 percent since its inception, but it’s not alone. Other recently launched ETFs, including the Cambria Cannabis ETF (CBOE:TOKE), the Amplify Seymour Cannabis ETF (ARCA:CNBS) and the Cannabis ETF (ARCA:THCX), have also experienced slumps in the weeks since they launched.

This new addition to the marijuana ETF market could further concerns about saturation in a market that has little diversity as it is; however, its position as a completely US-focused ETF might prove to be a standout feature as the cannabis market matures.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Danielle Edwards, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.