Crypto Market Update: Grayscale Files for Binance-Linked Investment Fund

Elsewhere in the crypto sector, Ledger is reportedly preparing for a New York IPO, signaling that crypto infrastructure firms are moving back into public markets.

Here's a quick recap of the crypto landscape for Friday (January 23) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ether price update

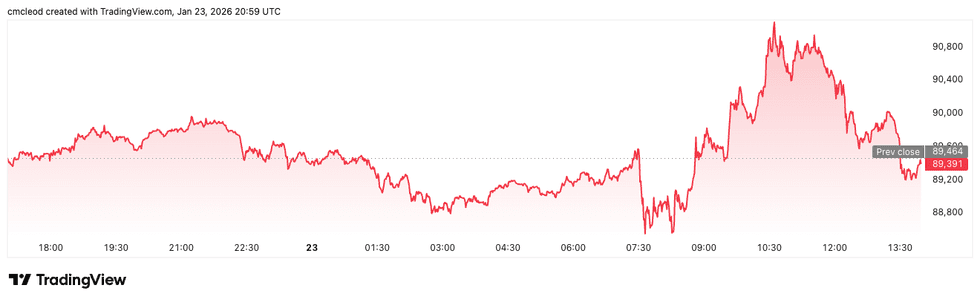

Bitcoin (BTC) was priced at US$89,425.01, trading flat over 24 hours.

Bitcoin price performance, January 23, 2026.

Chart via TradingView.

Linh Tran, senior market analyst at XS.com, told the Investing News Network that Bitcoin's slip below the US$90,000 mark is primarily due to pressure from the high interest rate environment, macroeconomic uncertainty and cautious institutional capital flows, leading to a near-term outlook of cautious consolidation with persistent downside risks.

“With the 10-year yield holding around the 4.2 to 4.3 percent range, global funding costs remain elevated, encouraging capital to favor assets with clear yields over non-yielding assets such as Bitcoin," she said.

"In such an environment, Bitcoin struggles to attract sustained new inflows unless markets begin to believe that the monetary policy cycle is approaching a turning point."

Tran believes that institutional flows will be the most decisive factor for Bitcoin's near-term outlook:

"Recent data show several sessions of heavy net outflows, with total net withdrawals for the week reaching US$1.19 billion so far. While total net assets held by Bitcoin exchange-traded funds (ETFs) remain elevated … the flow dynamics suggest that institutions are willing to take profits or reduce risk when the macro backdrop deteriorates. This signal should not be overlooked, as past cycles have shown that BTC only establishes a durable uptrend when ETF flows remain consistently positive, rather than through sporadic inflows that are quickly reversed.

“Without the support of fresh inflows, each rebound risks turning into a profit-taking opportunity, leaving the short-term trend choppy and lacking clear direction. From my perspective, the most plausible near-term scenario is for Bitcoin to continue consolidating in a cautious manner, with downside risks persisting if ETF outflows continue."

Tran added that Bitcoin will likely face renewed downward pressure due to its high sensitivity to risk appetite if bond yields rise or global markets become risk averse.

Ether (ETH) was priced at US$2,936.38, trading flat over the last 24 hours.

Altcoin price update

- XRP (XRP) was priced at US$1.91, down by 0.4 percent over 24 hours.

- Solana (SOL) was trading at US$126.86, down by 1.2 percent over 24 hours.

Today's crypto news to know

Grayscale files for BNB-linked investment fund

Grayscale has filed for permission from the US Securities and Exchange Commission to launch a new investment fund tied directly to BNB, the digital currency linked to the Binance ecosystem.

According to the filing, the fund will trade on Nasdaq under the ticker symbol GBNB, subject to regulatory approval.

If approved, it would allow investors to bet on the price of BNB through a traditional brokerage account, rather than having to use a specialized crypto exchange.

Ledger lines up US$4 billion New York listing

Ledger is preparing a New York Stock Exchange listing that could value the French hardware wallet maker at more than US$4 billion, the Financial Times reported. The company was last valued at US$1.5 billion in a 2023 funding round, underscoring how sharply sentiment has shifted toward crypto infrastructure firms.

Major firms Goldman Sachs (NYSE:GS), Jefferies Financial Group (NYSE:JEF) and Barclays (NYSE:BCS) are said to be advising on the deal, which could launch as soon as this year.

The move follows BitGo Holdings' (NYSE:BTGO) debut, which helped reopen public markets for crypto-native companies. Ledger has benefited from surging demand for self custody as high-profile crypto hacks continue to mount.

If completed, the listing would rank among the largest US initial public offerings by a European crypto firm.

Capital One to acquire Brex

Capital One Financial (NYSE:COF) announced its intention to acquire Brex, a software platform that uses artificial intelligence agents to automate complex workflows, in a deal valued at US$5.15 billion.

“Brex invented the integrated combination of corporate credit cards, spend management software and banking together in a single platform," said Richard D. Fairbank, founder, chairman and CEO of Capital One.

The transaction is expected to close in the middle of calendar year 2026, subject to customary closing conditions.

“Together, we’ll maximize founder mode by combining Brex’s payments expertise and spend management software with Capital One’s massive scale, sophisticated underwriting, and compelling brand to accelerate growth and increase the speed at which we can offer better finance solutions to the millions of businesses in the US mainstream economy,” said Pedro Franceschi, founder and CEO of Brex.

Revolut abandons US merger to focus on banking license application

Digital banking firm Revolut has reportedly decided abandon its to merge with a US lender and is instead focusing on building its own foundation in the US by applying for a formal banking license, according to the Financial Times.

Insiders added that executives at Revolute determined that a takeover would prove too complicated, requiring brick-and-mortar branches as well as engagement with US regulators, but that the deregulatory push under the Trump administration will likely result in a speedy approval process for a de novo bank licence application.

Kansas weighs Bitcoin reserve using unclaimed digital assets

Lawmakers in Kansas are considering a bill that would create a state-run Bitcoin and digital assets reserve without buying crypto directly. Senate Bill 352 proposes funding the reserve using unclaimed digital property already held by the state, including abandoned crypto, airdrops, staking rewards and interest.

The fund would sit within the state treasury and be administered by the Kansas treasurer.

Under the proposal, 10 percent of each deposit would flow into the general fund, while Bitcoin itself would be retained exclusively in the reserve.

UBS explores crypto trading for private banking clients

UBS Group (NYSE:UBS) is evaluating plans to offer cryptocurrency trading to select private banking clients, Bloomberg reported, citing people familiar with the matter.

The Swiss lender is said to be choosing partners to support buying and selling of Bitcoin and Ether for clients in Switzerland. The offering could later expand to Asia-Pacific and the US if demand holds.

While UBS has not confirmed the plans publicly, the move would align it with peers that are gradually opening crypto access. JPMorgan Chase (NYSE:JPM) and Morgan Stanley (NYSE:MS) have both signaled expanded digital asset offerings in recent months.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.