Copper Forecast 2021: CEOs Optimistic About Copper’s Future

What’s the copper forecast for 2021? The Investing News Network caught up with CEOs from copper companies to find out.

Click here to read the latest copper forecast.

In a year that was filled with uncertainty and volatility, copper has been overlooked by some despite its sharp rebound since March.

The coronavirus pandemic was front and center in 2020, with demand for metals taking a hit during the first few months of the year as measures to contain the virus took place around the world.

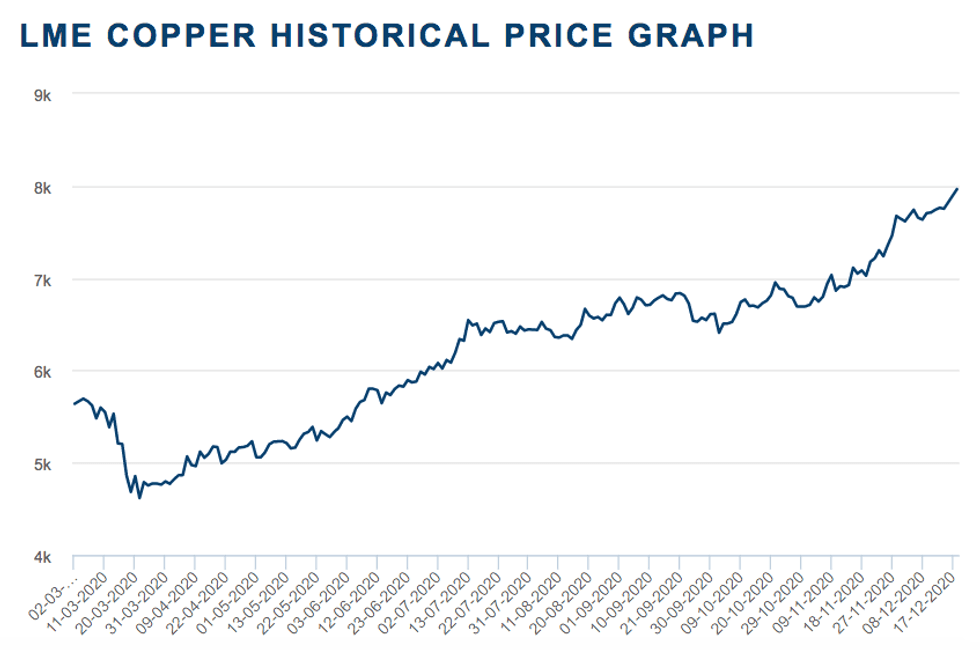

Copper hit its lowest point of the year on March 23 at US$4,617.50 per tonne, but since then prices have bounced back, jumping to their highest level since February 2013 ― above US$8,000.

Analysts agree that the outlook for copper is bright, although they have cautioned that prices will remain both high and volatile as there’s little certainty about what next year might bring at a global scale.

Copper-mining companies are also optimistic about 2021, with many expecting to see a better market for the red metal next year.

Unsurprisingly, this year has superseded most of the expectations that Eurasian Resources Group (ERG) held for the copper market in 2020 at this time last year.

“The coronavirus pandemic is one of those ‘once-in-a-lifetime’ events, however some of our expectations held true,” Benedikt Sobotka, CEO of ERG, told the Investing News Network (INN).

“Notably, China’s new regulations on scrap imports continued to disrupt supply flows, while copper-intensive ‘green growth’ initiatives continued to gain traction across the world, although at a much faster pace than we had envisaged.”

ERG mines copper and cobalt in the Democratic Republic of Congo, while in Zambia the company owns Chambishi Metals, its central cobalt and copper refinery.

The company’s expectation for a stronger price in 2020 compared to 2019 also came true, but with many surprises along the way.

Copper prices started the year above US$6,000, but by March, after the World Health Organization declared COVID-19 a pandemic, copper plummeted to its lowest point at US$4,617.50.

2020 copper price performance. Chart via the London Metal Exchange.

But the second quarter started to show signs of recovery in China, the world’s top copper consumer, with the second half of the year turning the story to the upside for copper prices. Copper touched the US$8,000 level on December 18, increasing more than 73 percent from its lowest level.

“We expected copper to do well this year, as the fundamentals of the copper market had been indicating a copper rally for quite some time, but we have been surprised at how quickly the copper price went to US$3.50 per pound,” Paul West-Sells, president and CEO of Western Copper and Gold (TSX:WRN), said.

Without a doubt, the word that guided markets this year was uncertainty, which was a challenge for most mining companies.

“The world has not gone through a pandemic of this scale in recent history, so preparing for the future was a challenge from the outset. At first, our market outlook expectations were defined by the speed at which widespread lockdowns were coming into force,” Sobotka said.

“However, what immediately followed was unprecedented, including the levels of economic stimulus and the lightning pace of vaccine development, as well as sporadic lockdown-related mine disruptions.”

He highlighted how quickly ERG moved to implement a business continuity plan, putting precautionary measures in place across its sites and safeguarding its supply chains. This allowed the company to weather the storm and to ride the wave of recovery, which Sobotka said not all of its peers could do.

West-Sells agreed about the truly unprecedented times that 2020 brought to the space.

“Operating an exploration program during the COVID-19 crisis was definitely a challenge,” he said. Western Copper and Gold is developing the Casino project in Canada’s Yukon, and kicked off a preliminary economic assessment at the asset on December 14.

Copper forecast 2021: What’s ahead

When asked about his expectations for the year ahead, Sobotka said 2021 is shaping up to be a bumper year for the copper market. He anticipates that prices for the red metal will hold above US$8,000 as the market continues to be undersupplied.

“We expect to see very strong demand next year as lockdowns are lifted and end users begin replenishing their inventories as the economic recovery accelerates, especially outside of China,” he said.

“In addition, the effects of governments’ copper-intensive ‘green’ stimulus packages will begin to be strongly felt.”

Overall, ERG foresees 2021 as the beginning of a period of strong global economic growth, with global refined copper demand growth reaching 4 to 5 percent ― the highest level in close to a decade.

Looking over to the supply side, Sobotka anticipates modest growth in mine production, but said many producers may be prevented from reaching their pre-coronavirus output targets for 2021.

“Moreover, we expect scrap supply to undershoot expectations. While historically scrap supply has been closely tied to copper prices, low scrap stockpiles due to weak generation in the first half of 2020 and China’s new scrap import regulations will continue to squeeze availability in 2021,” he added.

With visible cathode inventories already at very low levels and spot copper concentrate treatment and refining charges at multi-year lows, Sobotka expects prices to respond accordingly in 2021.

“Some say that we may soon see copper prices in the five digits ― we think that’s bullish, but not necessarily unrealistic,” he said.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Western Copper and Gold is a client of the Investing News Network. This article is not paid-for content.

The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.