Overview

The Timmins Gold camp in Ontario, Canada, stands as the country's most prolific gold-producing camp. With over 85 million ounces of gold production across the last 100 years, the large region continues to present investors with world-class gold and mineral discovery possibilities.

Mineral exploration companies operating gold projects in this famous gold district leverage excellent infrastructure and positioning near some of the most economic gold players in mining. However, with multiple junior developers in the region, finding the gold mining company with the best gold assets is what stands the best investments apart.

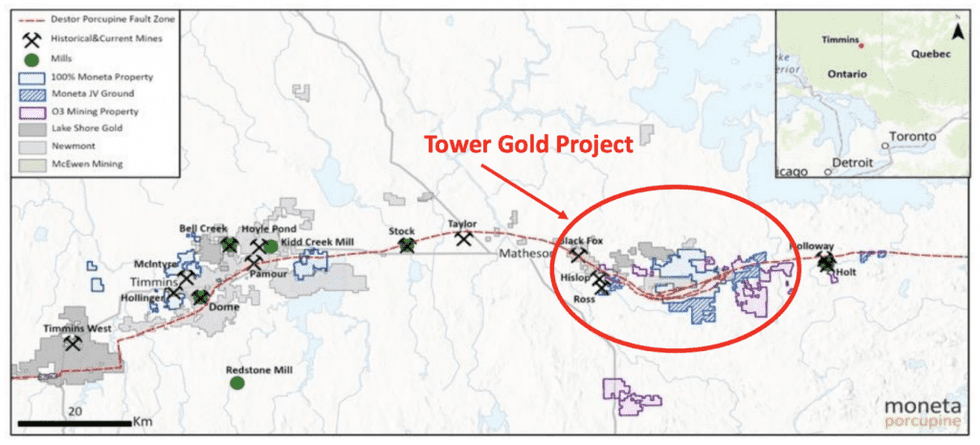

Moneta Gold (TSX:ME), formerly Moneta Porcupine Mines is one of these companies with a large position in the camp. Focused on its highly prospective flagship Tower Gold Project on the Destor Porcupine Fault corridor in the prolific Timmins gold camp in Ontario, Canada, Moneta Gold holds a 100 percent interest in several gold projects and a 50 percent joint venture with Kirkland Lake Gold Ltd. (TSX:KL).

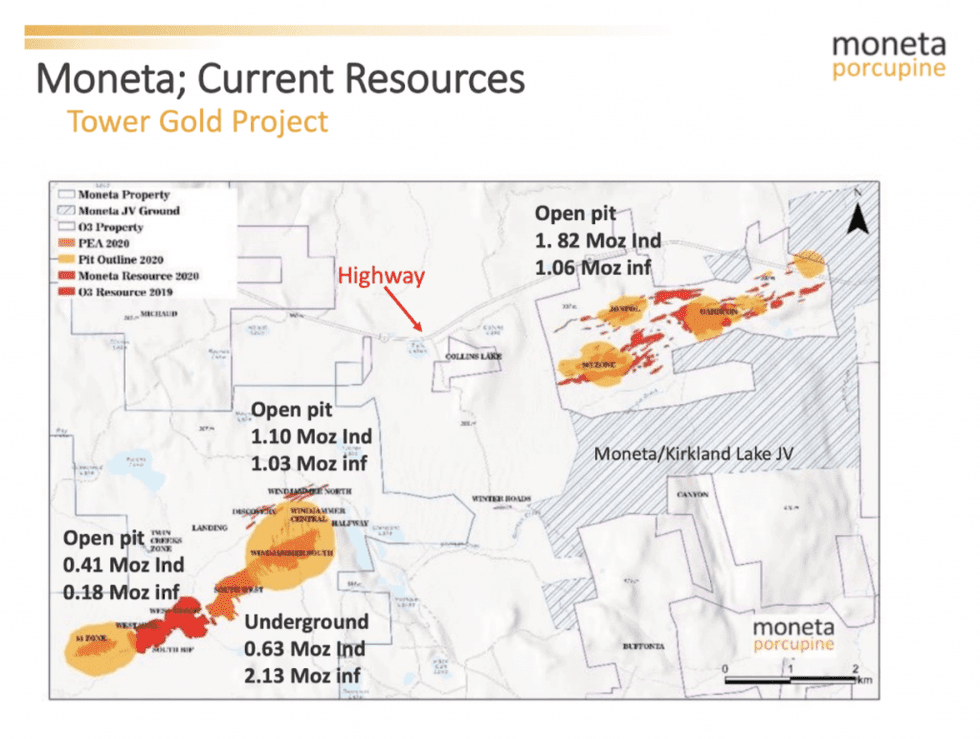

Moneta Gold's Tower Gold Project hosts a total gold resource of 4.0 million ounces indicated and 4.4 million ounces inferred. The Tower Gold project is a combination of the Golden Highway Gold project and the adjacent Garrison Gold project acquired from O3 Mining (TSXV:OIII, OTCQX:OIIIF). The Garrison gold project consists of the large Garrison open pit gold resource containing 1.8 Moz indicated and 1.1 Moz inferred resources.

Operating in the Timmins Gold camp allows the company to leverage the existing excellent infrastructure in Timmins, which helps support future gold production scenarios.

The future of the Tower Gold Project which contains the Garrison Project and Golden Highway projects remains highly prospective with tremendous resource and economic growth opportunities. Moneta has 100% ownership of one of the largest undeveloped gold projects in North America with regional-scale potential. The company plans an extensive 70,000 m drill program this year followed by an updated resource estimate followed by an updated preliminary economic assessment (“PEA") which will examine a development scenario with significantly expanded scope and production profile.

During 2020 the underground South West deposit within the Golden Highway Project and the Garrison open pit gold deposits were subjected to PEA studies which showed robust economics with solid gold production profiles. New open pit and underground deposits and discoveries at Golden Highway were not included in the PEA studies.

The company is focusing 2021 on testing the significant resource expansion potential identified at Golden Highway and Garrison to expand the total gold resource endowment on the total Tower Gold project and believes the project will be large enough to support milling infrastructure. It is expected that the expanded resource base will result in a significantly expanded scope and production profile in the planned updated PEA study which will address the combined project.

Moneta Gold has a robust capital structure and strategic shareholder portfolio. The company's market cap stands at CAD$213 million with 557.5 million shares outstanding and no debt. The company is supported by a loyal and strong institutional shareholder base, significant insider ownership, the backing and support of O3 Mining and a good retail investor following.

Moneta Gold's management team combines over 35 years of financial management, geology, and mineral exploration experience. Moneta Gold's CEO, Gary O'Connor, has a proven track record of project development and brings world-class expertise in mining investment. Together, he and his team are preparing the company for outstanding economic growth and mineral exploration opportunities.

Get access to more exclusive Gold Investing Stock profiles here