- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

5 Biggest Clean Energy ETFs in 2026

Top 9 Global Lithium Stocks (Updated January 2026)

Top 5 US Lithium Stocks (Updated January 2026)

Overview

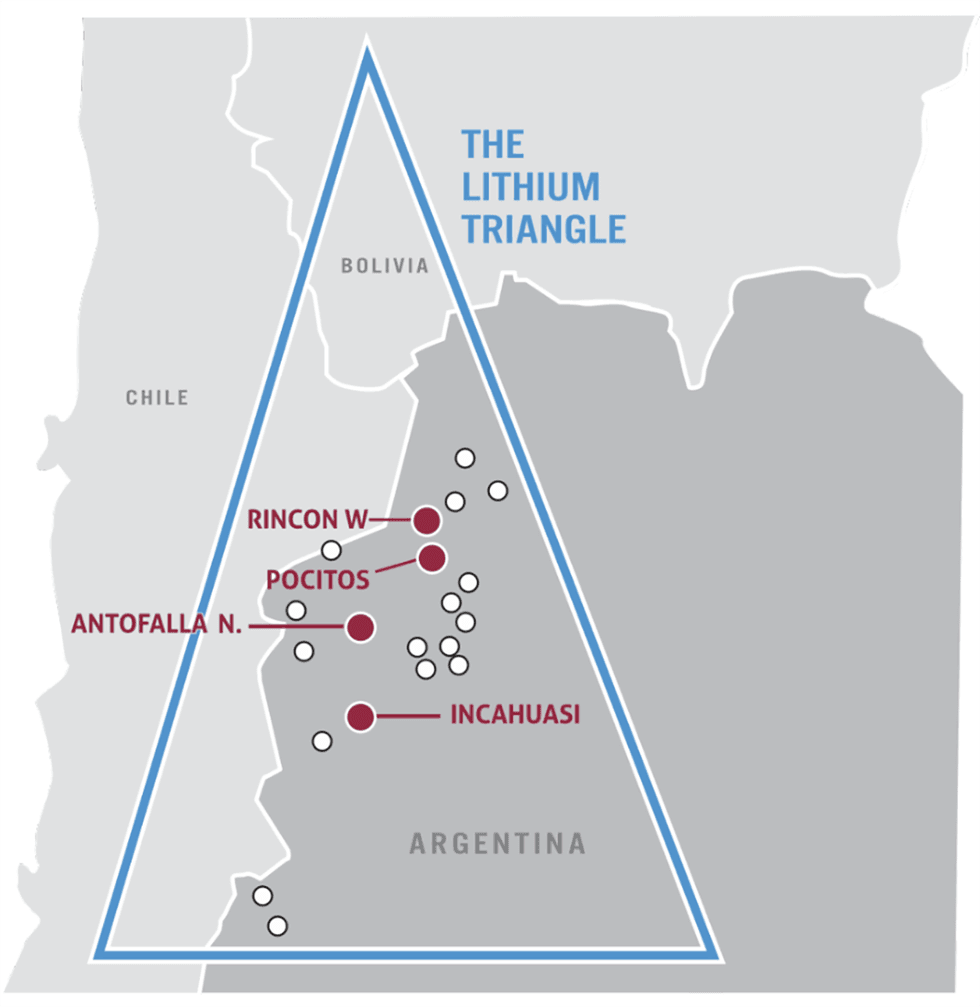

Demand for lithium is expected to reach 3.8 million tons by 2035, driven by increased demand for batteries for electric vehicles (EVs). This renewed focus on lithium is also shining a spotlight on the famed Lithium Triangle, where about 60 percent of the world’s lithium reserves are located. The Lithium Triangle spans portions of Chile, Bolivia and Argentina. With its rich lithium resource base and a stable, mining-friendly regulatory environment, Argentina has the perfect formula to become a leader in lithium production.

Argentina Lithium and Energy (TSXV:LIT,OTC:PNXLF,FWB:OAY3,OTCQX:LILIF) is a mineral exploration company focused on developing a portfolio of highly prospective lithium projects in Argentina. The company is a member of the Grosso Group, a resource management firm that has pioneered exploration in Argentina since 1993.

Argentina Lithium has a strong land position and extensive mining track record in Argentina with nearly 67,000 hectares in four key projects located in the Salta and Catamarca provinces. The company’s properties are strategically located next to some of the world’s leading lithium producers and near key infrastructure.

In September 2023, Argentina secured an important strategic investor. Peugeot Citroen Argentina S.A., a subsidiary of global automaker Stellantis, invested US$90 million in Argentina pesos to acquire a 19.9 percent interest in Argentina Lithium’s subsidiary Argentina Litio y Energia S.A. The two companies also negotiated a seven-year offtake agreement, in which Stellantis will buy up to 15,000 tons per year of lithium produced by Argentina Lithium.Get access to more exclusive Lithium Investing Stock profiles here