Overview

The global transition to clean energy technologies is placing increased attention on the critical minerals essential to manufacturing emerging technologies. These critical minerals include rare earth elements (REEs), which are required to produce permanent magnets and catalytic components in clean technologies.

Canada hosts significant REE deposits that have become central to the country’s plan to build a domestic and global supply chain to support the energy transition. The country hosts globally significant REE deposits, with over 15.1 million tonnes of rare earth oxides (REOs) estimated as of 2022.

To support Canada’s net-zero ambitions, the Government of Saskatchewan is spearheading the construction of North America’s first integrated and commercial REE processing plant. Home to some of the world’s most prolific mining assets, Saskatchewan is ideally positioned to become a hub for minerals processing and aid the development of a sustainable domestic supply chain for critical minerals. Mining and exploration companies in this region stand to benefit from an accessible facility to process raw materials into usable components for manufacturers.

Appia Rare Earths and Uranium (CSE:API,OTCQX:APAAF) is a mining exploration and development company with properties targeting REEs and uranium in Saskatchewan and Ontario. The Alces Lake prospect in the Athabasca Basin of Saskatchewan, Appia Rare Earths and Uranium's flagship operation, contains the highest-grade monazite REE occurrences in North America and is among the highest globally. Alces Lake and the company’s additional REE prospects are poised to benefit greatly from the future REE processing facility in Saskatchewan.

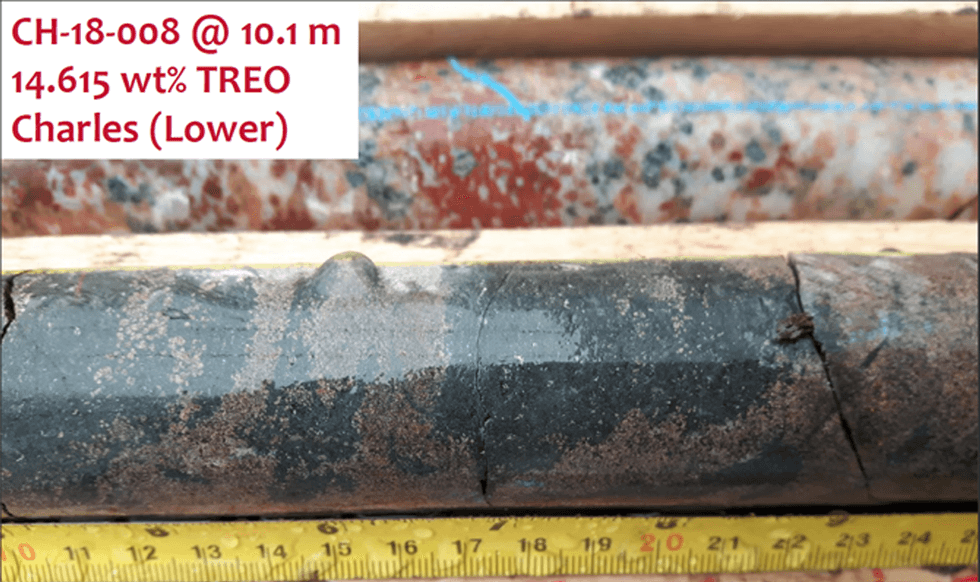

Figure 1. Monazite-rich, rare-earth element (REE) drill core from the Charles subzone of WRCB.

The presence of monazite-rich REE mineralization zones (Figure 1) at the Alces Lake property creates a significant opportunity for Appia Rare Earths and Uranium, especially as additional monazite occurrences continue to be discovered in the area. Rare earth elements are not technically rare as they’re found in many rock types and geological environments, even trace amounts in most soil. However, it’s difficult to find deposits with high grades and in volumes sufficient enough to be mined economically, while also present in a mineral phase that can be efficiently processed.

Monazite comprises 50 to 60 percent total rare earth oxides (TREO), with 23 to 25 percent of these oxides designated as critical minerals by Canada and other countries. To put those numbers in context, monazite deposits contain up to 50 percent more critical REEs than bastnaesite deposits, another economically justifiable type of REE deposit. Additionally, the Alces Lake monazites contain economic-grade gallium as a by-product.

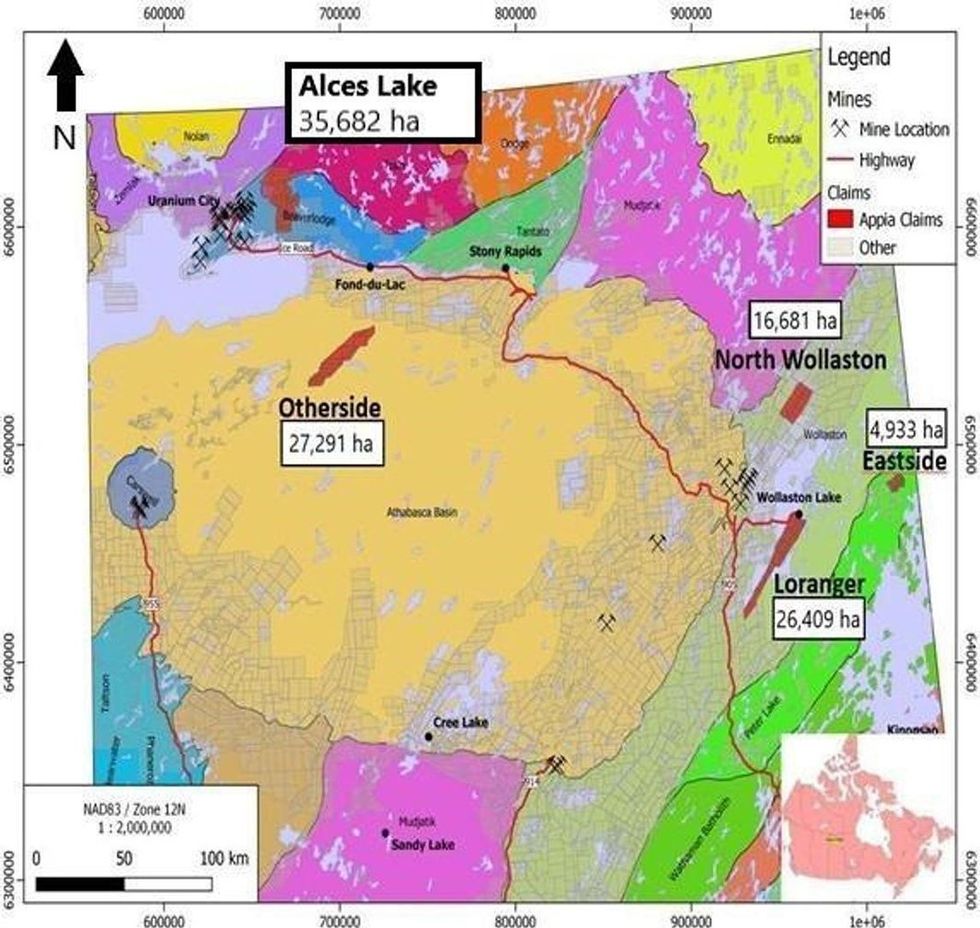

In addition to Alces Lake, the company operates four other 100-percent-owned properties throughout the prolific uranium-rich Athabasca Basin (Figure 2). Loranger, North Wollaston and Eastside projects each contain the potential for significant amounts of uranium and REEs. Uranium has recently grown in demand as nuclear energy surges in popularity, increasing demand for the heavy metal. The company also has 100 percent ownership of the Elliot Lake uranium and REE property in Ontario.

Figure 2. Location of Alces Lake and current Appia claims in Northern Saskatchewan displayed on a geological domain map.

Appia Rare Earths and Uranium is led by a management team in the natural resource industry, leveraging decades of specialized expertise to guide the company through the exploration and development of its properties.

Company Highlights

- Appia Rare Earths and Uranium is a mining exploration and development company with rare earth elements (REE) and uranium assets strategically positioned in the mineral rich regions of Saskatchewan and Ontario, Canada, as well as the Goias State of Brazil.

- The company’s flagship Alces Lake property in the Athabasca Basin contains high-grade monazite occurrences, which are known to contain a higher concentration of REEs than other types of deposits.

- Appia Rare Earths and Uranium operates four additional properties in the Athabasca Basin in Saskatchewan, each containing substantial amounts of REEs and uranium with significant economic potential.

- The company's assets are positioned to significantly benefit from the planned REE processing facility in Saskatoon, Saskatchewan.

- A seasoned management team with extensive experience in the natural resource industry guides Appia Rare Earths and Uranium in the exploration and development of its promising assets.

Get access to more exclusive Rare Earth Investing Stock profiles here