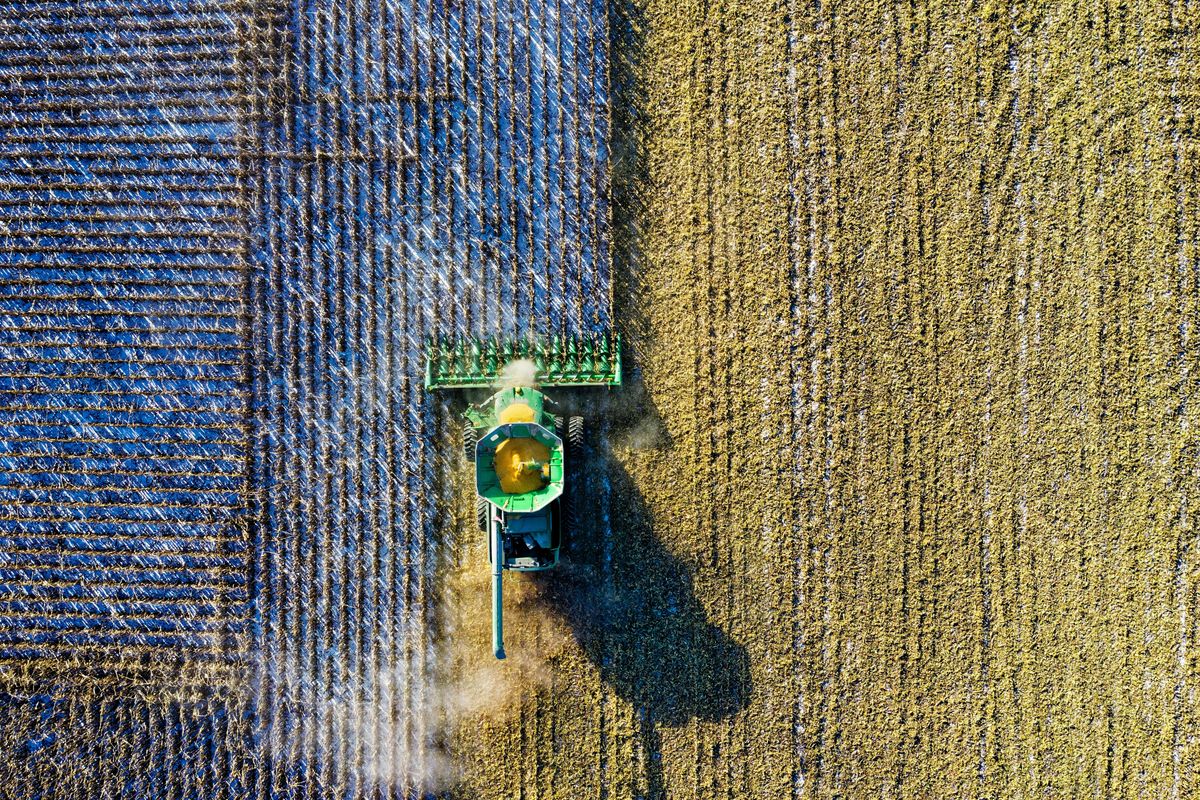

Agriculture Market Update: H1 2023 in Review for Potash and Phosphate

The days of high fertilizer prices are long gone as uncertainty rules the market. Find out what key trends affected the industry in the first half of 2023.

After last year's high levels, fertilizer prices dropped during the first half of 2023.

This volatility has created a challenging market, especially as the war between Russia and Ukraine continues. Here the Investing News Network (INN) presents a recap of the first half of the year in the fertilizer space.

Major fertilizers face price compression in 2023

One expert told INN that in 2023 the name of the game in the fertilizer space has been uncertainty.

Referring to potash, phosphate and nitrogen, Josh Linville, director of fertilizer at StoneX, said prices for the three major fertilizers "came off significantly” in the first part of the year. This happened in part due to what he described as a self-fulfilling prophecy — buyers saw prices declining and waited for them to fall further before making purchases.

“But we can't wait too long, because eventually just-in-time demand meets supply. That's a big issue that we've had,” he said.

Linville added that fertilizer prices have shifted quickly as the world has gone from the throes of the COVID-19 pandemic to a recovery period and now to a post-recovery time. “A kind of a classroom theory that I always work with is that uncertainty generally pushes prices higher,” he said. “And that's what we dealt with.”

Russia’s invasion of Ukraine leads to volatility

The fertilizer industry has been impacted by the war between Russia and Ukraine, but Linville said western sanctions on Russia haven't had as severe an impact as market watchers initially expected.

"(The market) thought we were losing Russian exports in general," he said. "They were really one of the biggest exporters of all three major fertilizers.” But in reality, Russia’s role in the market has not been curbed.

“European production has come back online. Largely they're still sort of offline, but most of it is back,” he told INN. “A lot of these fears that drove prices up were found to be unfounded, and now we're starting to correct lower.”

As the conflict continues to evolve, Linville told INN that market participants want to see business go back to normal.

He also spoke about how arrangements made during times of high prices are now weighing on the fertilizer sector.

“A lot of these plans looked very, very good when these prices were at all-time highs (or) very close to it,” Linville explained during the conversation. “Now all of a sudden, some of these are half of what they were, some of these are a third or lower than what they were, and that return is just not there. Everybody's being reminded that these crazy high values that we saw that became normal for a year or two are the exception, not the norm."

Investor takeaway

Uncertainty has certainly dominated the landscape for the fertilizer space, but Linville told INN there is one key certainty in the space: demand will continue to grow as the world's population increases.

According to one report, the potash market is expected to reach a global value of US$23.03 billion this year, representing a 4.5 percent compound annual growth rate (CAGR) compared to 2022. When it comes to the phosphate sector, the industry is expected to reach a total valuation of US$16.8 billion in 2023 and grow at a CAGR of 2.4 percent over the next 10 years.

“Every single day there are more mouths to feed around the world, and we have to feed those mouths — we have to create food for everybody — and that means more fertilizer," said Linville.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.