Uranium Price 2025 Year-End Review

Rising investment demand, an accelerating long-term contracting cycle and surging electricity needs emerged as some of the strongest tailwinds for the uranium market in 2025.

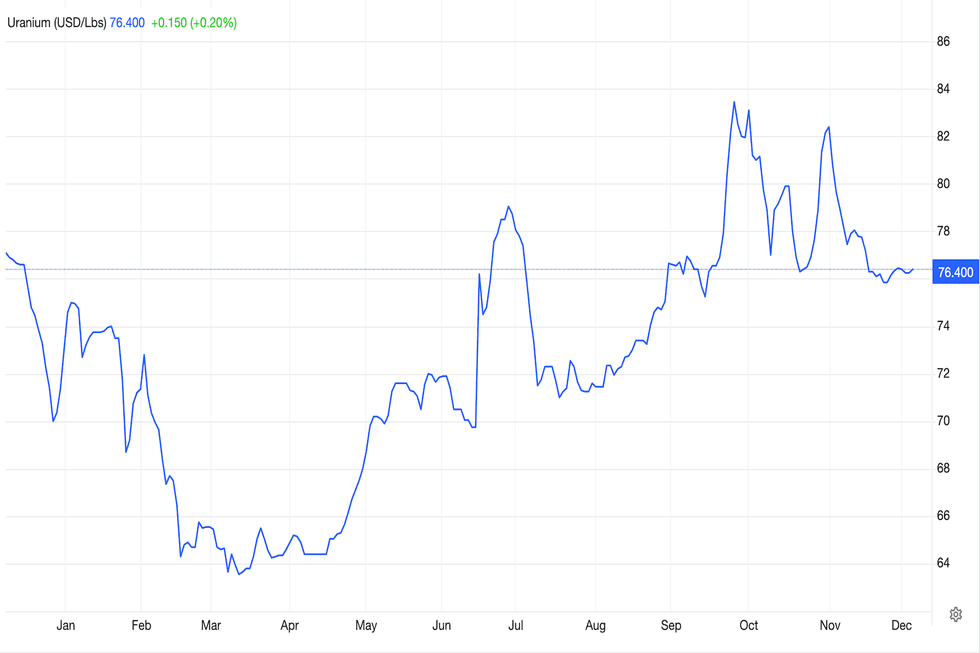

After 2024’s rapid rise, the U3O8 spot price remained more constrained through 2025, fluctuating between a relatively short range of US$63.17 (March 13) and US$83.33 (September 25) per pound.

Entering the year, the price was sitting at US$74.56 before economic and geopolitical uncertainty pushed values to a year-to-date low of US$63.71 in mid-March. Long-term positivity in the demand forecast began pushing the price upward in April through to the end of June, when spot U3O8 touched US$78.93, an H1 high.

Following a brief dip to an H2 low of US$70.98 in mid-July, investor appetite, supply concerns and government support converged, driving the price to US$83.33 on September 25, a year-to-date high. Starting December at US$76.36, U3O8 appears to have found a floor at the US$75 level, holding above the threshold since the end of August.

U3O8 spot price, December 5, 2024, to December 5, 2025.

Chart via Trading Economics.

Despite a subdued stretch for the price, uranium’s long-term drivers remain firmly intact, and arguably have only improved over the course of the year. Combined with renewed investor appetite, that strength has helped lift uranium equities throughout 2025, reinforcing confidence in the sector’s long-term thesis.

Uranium investment demand surges

For Joe Kelly, CEO of Uranium Markets, one of the most compelling uranium market trends in 2025 was the growth in investor demand, particularly for physical uranium.

“In 2025, one of the key factors was the continuous buying of the Sprott Physical Uranium Trust (SPUT) (TSX:U.U,OTCQX:SRUUF), which really made the opportunity for physical uranium to be purchased in the market by the retail investor,” he told the Investing News Network (INN).

SPUT had added 7.8 million pounds, growing its uranium holdings to 74.04 million pounds, as of December 2, a 12 percent increase from 2024’s tally. Its net asset value had increased to US$5.68 billion.

Kelly explained that SPUT's momentum was the result of broader investor enthusiasm, allowing the trust to purchase millions of pounds from the spot market, which “drove the price considerably higher.”

That dynamic extended beyond institutional vehicles.

“You also had investors buying uranium directly because they thought it was cheap and a good investment,” he said.

The result was a layer of financial demand on top of utility needs. According to Kelly, this speculative interest created demand outside of the nuclear power plants in the world. “That drove the price up a little bit higher than it would have been otherwise, without that enthusiasm from the investing community,” he added.

SPUT’s aggressive accumulation has become a clear market signal.

The trust’s growing holdings highlight how institutional investors increasingly view uranium as scarce, tightening available supply by removing material from the open market. As inventories shrink, upward pressure on prices builds.

At the same time, SPUT’s rising net asset value reflects renewed investor confidence tied to reactor buildouts, energy security priorities and the broader clean energy shift.

If the trust keeps buying while mine output lags and utilities lock in long-term contracts, the market could be moving toward a structural deficit, drawing even more attention to uranium equities and physical vehicles.

Uranium term price underscores market momentum

In a conversation with INN, Lobo Tiggre, CEO of IndependentSpeculator.com, pointed to strong long-term uranium contracting prices as one of 2025’s most impactful trends.

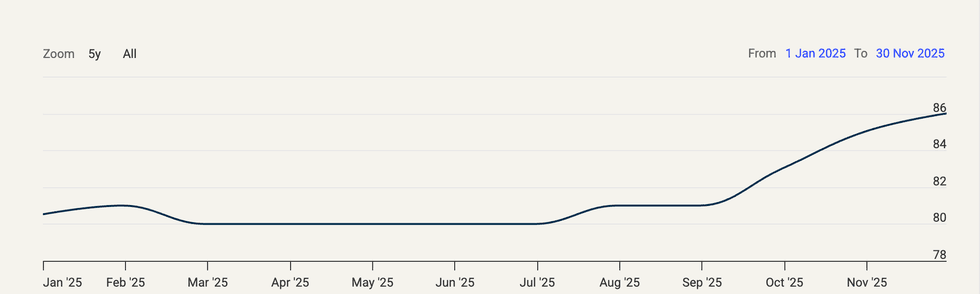

Often described as a more accurate barometer of market activity and sentiment, the long-term contract price displayed less volatility in 2025, starting the 12 month period at US$80 and reaching US$86 at the end of November.

Tiggre stressed that the uranium sector’s “real market is the long-term contract price,” not the day-to-day noise of the spot price. Long-term contracting, he said, is where “actual buyers, sellers, users and suppliers” negotiate prices that determine what it really takes to bring new pounds to market.

The challenge, however, is opacity. “It’s not transparent … they don’t disclose individual contracts,” he said. That leaves analysts to piece together trends from quarterly averages.

Long-term contract price, January 1 to November 30, 2025.

Chart via Cameco.

That underlying market has continued to strengthen from 2024 to 2025.

As Tiggre noted, the long-term price has been “going up, pausing, consolidating, going up,” reaching levels that “clearly do incent production” — yet even the world’s biggest producers have struggled to deliver.

Global uranium majors Cameco (TSX:CCO,NYSE:CCJ) and Kazatomprom “both failed to hit their targets and have officially moved their goal posts,” a signal he called “significant and … bullish.”

Meanwhile, would-be junior producers have not stepped in to fill the gap.

“None of them have been able to say, ‘Yeah, we’re going to build this or rehabilitate that’ and deliver on time,” he noted. What looked like low-hanging fruit has proven “thorny,” reinforcing that supply remains constrained.

At the same time, demand momentum has only accelerated. Headlines showcasing new reactor builds are now “weekly,” Tiggre said, with BRICS nations expanding aggressively and western governments shifting decisively pro-nuclear. Even in the US, he noted, “Trump has doubled down … he’s strongly pro-nuclear.”

The result: A structurally tight market where volatile spot moves obscure a far more durable trend.

“The fundamentals are just super strong,” Tiggre said. “I’m very bullish.”

Uranium doubles as a tech play

Part of uranium’s demand story is tied to forecast growth in artificial intelligence (AI) data center deployment, a segment where electricity consumption has grown by 12 percent since 2019, as per the International Energy Agency (IEA).

Currently data centers use 415 terawatt hours (TWh), representing 1.5 percent of global electricity demand, and that number is projected to increase rapidly over the next five years.

“Our Base Case finds that global electricity consumption for data centres is projected to double to reach around 945 TWh by 2030 in the Base Case, representing just under 3 percent of total global electricity consumption in 2030,” the IEA’s Energy Demand from AI report reads. “From 2024 to 2030, data centre electricity consumption grows by around 15 percent per year, more than four times faster than the growth of total electricity consumption from all other sectors.”

For Gerardo Del Real, publisher at Digest Publishing, the uranium sector’s momentum has shifted as an unexpected coalition of “tech bros” and “mining bros” reshapes the narrative around nuclear power.

“Who would have thought?” said Del Real, noting that after an 18 month stretch where the uranium trade “seemed stuck in the mud,” sentiment turned sharply once markets began viewing nuclear as a technology story.

“The market is one part fundamentals and the other part psychology,” Del Real explained, adding that the psychological boost from the booming tech sector has been powerful.

While he’s skeptical that every AI-fueled data center proposal will materialize, Del Real argued that even limited progress could supercharge energy demand. If tech companies “fulfill 35 percent to 50 percent of their promises,” he said, the resulting power requirements would be “absolutely spectacular.”

This comes as the uranium market was already heading toward a significant deficit by 2026, a trend Del Real believes has now accelerated. Leaning into his contrarian instincts, he said he has written “more checks than ever” for early stage uranium companies with trusted management teams.

“I am thrilled with the results thus far,” said Del Real.

“I think 2026 is going to be an inflection year where the breakout is really pronounced across the board.”

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Affiliate Disclosure: The Investing News Network may earn commission from qualifying purchases or actions made through the links or advertisements on this page.

- When Will Uranium Prices Go Up? (Updated 2024) ›

- What Was the Highest Price for Uranium? (Updated 2024) ›