December 28, 2023

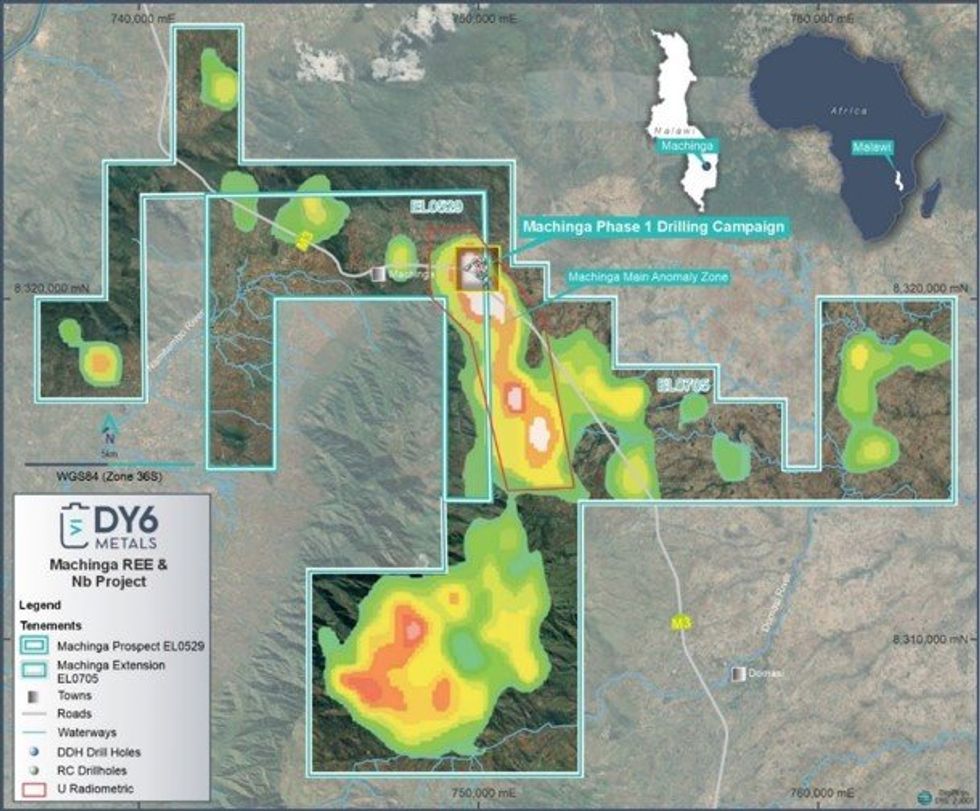

DY6 Metals Ltd (ASX: DY6, “DY6” or “Company”), a strategic metals explorer targeting Heavy Rare Earths (HREE) and critical metals in southern Malawi, is pleased to announce the assay results from the 8-diamond drill (DD) holes (totalling 900m) at its flagship Machinga Project in southern Malawi.

HIGHLIGHTS

- Assays received from the 8-diamond drill hole program (totalling 900m) at Machinga

- Significant intercepts include:

- 15.1m @ 1.01% TREO, 0.36% Nb2O5 from 23.9m (3.71% DyTb/TREO) incl. 4m @ 1.75% TREO, 0.63% Nb2O5 from 33m (3.8% Dy/Tb/TREO) drilled downdip (MDD007)

- 9m @ 0.70% TREO, 0.3% Nb2O5 from 3m (3.84% DyTb/TREO) incl. 2m @ 1.2% TREO, 0.58% Nb2O5 from 6m (3.64% Dy/Tb/TREO) and 5.2m @ 1.61% TREO, 0.66% Nb2O5 from 41.4m (3.99% DyTb/TREO) incl. 1m @ 2.67% TREO, 1.01% Nb2O5 from 44m (3.9% Dy/Tb/TREO) drilled downdip (MDD006)

- 6.1m @ 1.09% TREO, 0.4% Nb2O5 from 22.5m (3.78% DyTb/TREO) (MDD004)

- 7.3m @ 0.8% TREO, 0.33% Nb2O5 from 22.7m (3.70% DyTb/TREO) (MDD005)

- 9m @ 1.11% TREO, 0.41% Nb2O5 from 41m (3.72% DyTb/TREO) incl. 3m @ 1.56% TREO, 0.49% Nb2O5 from 45m (4.1% Dy/Tb/TREO) drilled downdip (MDD008)

- Results returned an average of 29% HREO:TREO and 3.6% DyTb:TREO at a cutoff grade of >0.25%TREO (consistent with RC holes’ final results)

- Results highlight the near-surface and thick intersection intercepted in RC holes MARC005 and MARC016

The Company’s CEO, Mr Lloyd Kaiser said:

“The assay results are showing outstanding intersections across multiple drill holes, especially MMD007 returning 15.1m @ 1.01%TREO with substantial Niobium grade, and a high proportion of valuable heavy rare earth elements from holes drilled for metallurgical material. The successful RC and DD drilling program has greatly improved the geological team’s interpretation of the Machinga system including the structural and lithological controls. The final assay results and historic intersections will feed into our current geological model to guide our next exploration program design. The Company now moves towards progressing a technical evaluation of the mineralisation to target a REO concentrate and Niobium by-product”.

A strongly mineralised hydrothermal breccia system striking NW-SE and dipping shallowly ~35° to the NE has been confirmed by the recent drilling. Pleasingly, very high-grade zones have been intersected from the diamond drill holes, as well as the suggestion of the mineralised zones thickening at depth and open to the NE. Significant drill intercepts received from the final batch of assays are included in Table 2. Significant intercepts include:

- 15.1m @ 1.01% TREO, 0.36% Nb2O5 from 23.9m (3.71% DyTb/TREO) incl. 4m @ 1.75% TREO, 0.63% Nb2O5 from 33m (3.8% Dy/Tb/TREO) (MDD007);

- 9m @ 0.70% TREO, 0.3% Nb2O5 from 3m (3.84% DyTb/TREO) incl. 2m @ 1.2% TREO, 0.58% Nb2O5 from 6m (3.64% Dy/Tb/TREO) and 5.2m @ 1.61% TREO, 0.66% Nb2O5 from 41.4m (3.99% DyTb/TREO) incl. 1m @ 2.67% TREO, 1.01% Nb2O5 from 44m (3.9% Dy/Tb/TREO) (MDD006);

- 6.1m @ 1.09% TREO, 0.4% Nb2O5 from 22.5m (3.78% DyTb/TREO) (MDD004);

- 7.3m @ 0.8% TREO, 0.33% Nb2O5 from 22.7m (3.70% DyTb/TREO) (MDD005); and

- 9m @ 1.11% TREO, 0.41% Nb2O5 from 41m (3.72% DyTb/TREO) incl. 3m @ 1.56% TREO, 0.49% Nb2O5 from 45m (4.1% Dy/Tb/TREO) (MDD008).

(Results returned an average of 29% HREO:TREO and 3.6% DyTb:TREO at a cutoff grade of >0.25%TREO)

Diamond drill holes MDD006, MDD007 and MDD008 were drilled downdip to obtain sufficient sample material to initiate the metallurgical test work program in Q1, 2024. The assay results are positive and significant for the Company as they continue to demonstrate continuity of mineralisation down dip and along strike of Machinga with excellent width and grade of mineralisation for a heavy rare earth rich deposit. As part of the upcoming metallurgical test work program, using core from this campaign, the Company will assess the amenability of the mineralisation to be treated through a relatively simple beneficiation process.

The diamond drill program consisted of 5 holes to 150m and 3 holes to 50m depths to determine the structural setting and geology of the Machinga deposit and to obtain material for initial metallurgical studies.

The first 5 holes were to understand the geological nature of the deposit, its structural configuration and obtain contextual data to the results of the RC drillholes, both recent and historical.

Click here for the full ASX Release

This article includes content from DY6 Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

DY6:AU

The Conversation (0)

10 July 2024

DY6 Metals

Developing new sources of critical minerals to power the green energy transition

Developing new sources of critical minerals to power the green energy transition Keep Reading...

24 July 2024

Quarterly Activities Report for the Period Ended 30 June 2024

Heavy rare earths and critical metals explorer DY6 Metals Ltd (ASX: DY6) (“DY6”, “the Company”) is pleased to present its quarterly activities report for the June 2024 quarter. Tundulu (REE)Historical high-grade drill intercepts reported at Tundulu including1:101m @ 1.02% TREO, 3.6% P2O5 from... Keep Reading...

02 July 2024

Reconnaissance Sampling Program Commences at Ngala Hill PGE Project to Follow up Historical Targets

DY6 Metals Ltd (ASX: DY6, “DY6” or the “Company”), a strategic metals explorer targeting Heavy Rare Earths (HREE) and Niobium (Nb) in southern Malawi, is pleased to report it is preparing for commencement of a reconnaissance program at the Company’s highly prospective PGE project at Ngala Hill... Keep Reading...

29 June 2023

Heavy Rare Earths & Niobium Explorer DY6 Metals Lists On ASX Following Successful $7M IPO

Heavy rare earths and niobium explorer DY6 Metals Limited (ASX: DY6) (“DY6”, “the Company”) is pleased to announce that its shares will begin trading on the Australian Securities Exchange at 9am Perth today. $7 million successfully raised via IPO, including $2.5 million from Hong Kong- based... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00