December 10, 2023

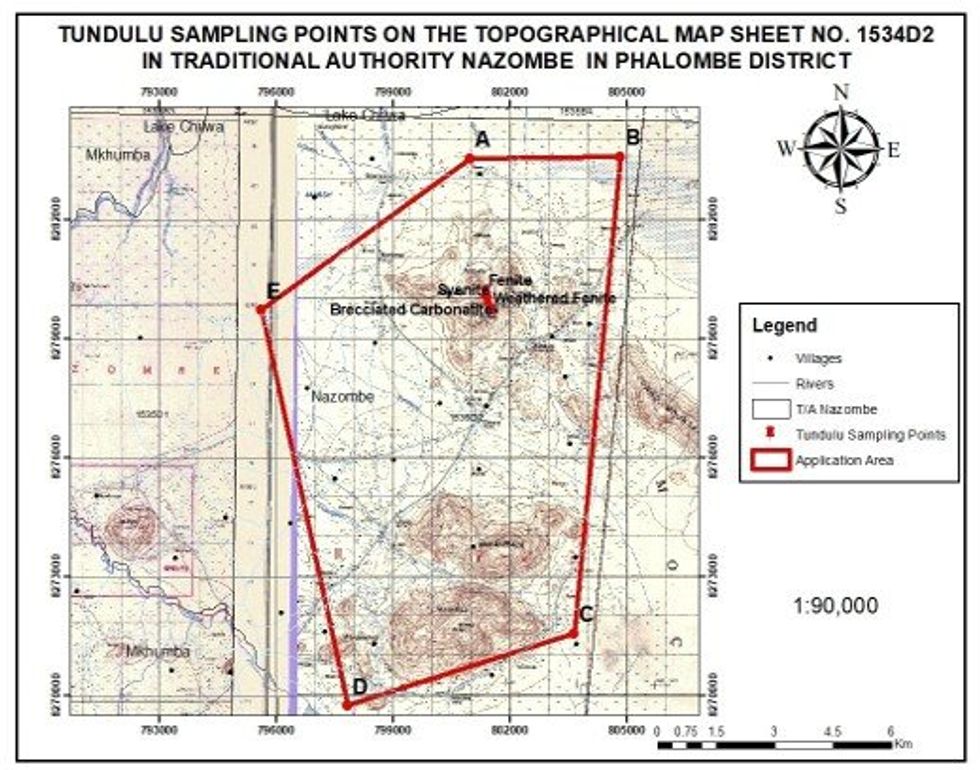

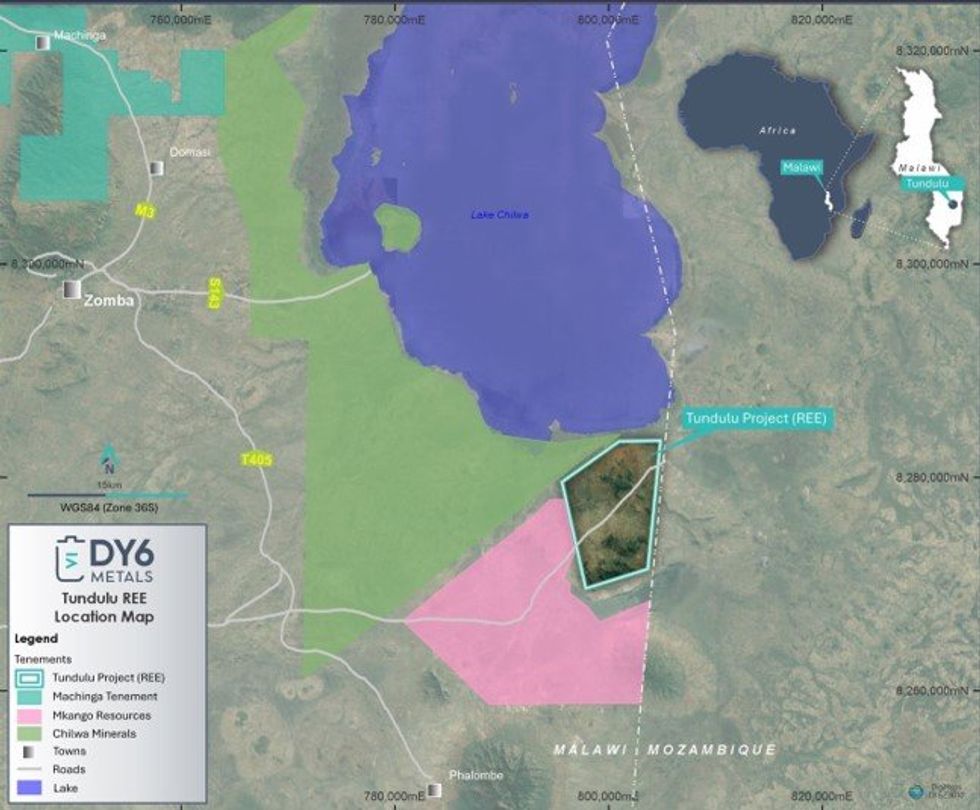

DY6 Metals Ltd (ASX: DY6, “DY6” or “Company”), a strategic metals explorer targeting Heavy Rare Earths (HREE) and Niobium (Nb) in southern Malawi, is pleased to announce that it has submitted an exclusive prospecting license application (91.5km2) over a carbonatite ring complex in southern Malawi known as Tundulu, with significant potential for REE (“Tundulu” or the “Project”).

HIGHLIGHTS

- DY6 has applied for an exclusive prospecting licence over a project area with significant REE potential in southern Malawi

- ‘Tundulu’ is a known carbonatite ring complex with abundant REE mineralisation, predominantly in the form of bastnaesite and apatite

- Shallow historical drilling (1988) (>max depth of 50m), includes:

- 41m @ 3.7% TREO, from 8m (JMT-22)

- 17m @1.3% TREO, from surface and 14m @1.1% TREO, from 21m (JMT-14)

- 11m @ 2.2% TREO, from 17m and 14m @ 4.1% TREO, from 36m (JMT-17)

- 14m @ 1.1% TREO, from 3m (JMT-07)

- Samples from recent reconnaissance field visit at Tundulu have been despatched for laboratory analysis

- Tundulu complements the Company’s existing REE & critical metals portfolio in Malawi

Shallow historical drilling at Tundulu undertaken by JICA (“Japanese International Cooperation Agency”) in 1988 (up to a max depth of 50m), included:

- 41m @ 3.7% TREO, from 8m (JMT-22);

- 17m @1.3% TREO, from surface and 14m @1.1% TREO, from 21m (JMT-14);

- 11m @ 2.2% TREO, from 17m and 14m @ 4.1% TREO, from 36m (JMT-17); and

- 14m @ 1.1% TREO, from 3m (JMT-07).

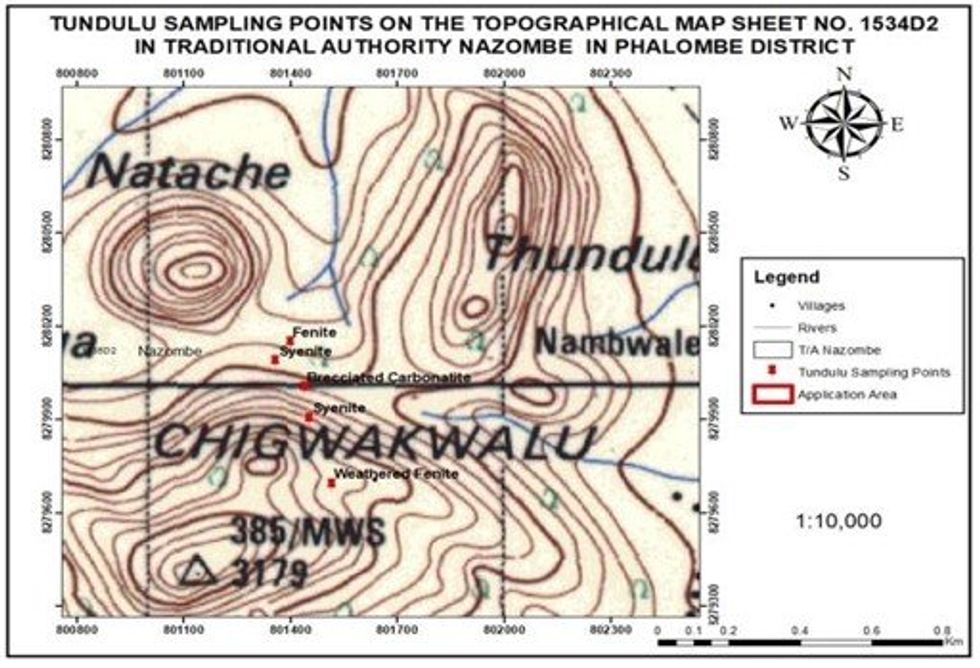

The Company’s geological team recently undertook reconnaissance field visit over parts of the licence application area and samples have been submitted for laboratory analysis in South Africa.

The Company’s CEO, Mr Lloyd Kaiser said:

“We are very excited about this strategic license application in southern Malawi. Tundulu is a known carbonatite ring complex close to our flagship HREE Machinga Project with an interesting profile of bastnaesite and apatite with abundant REE mineralisation, and easily accessible by road. Tundulu will complement our existing REE projects, Machinga and Salambidwe. While the Company waits for the license to be granted, the focus of the exploration team will be on undertaking a detailed geological and geophysical review of this new licence over the coming months.”

Tundulu REE Project

Tundulu is a carbonatite ring complex forming part of the Chilwa Alkaline Province in southern Malawi located approximately 60km south-east of the Company’s flagship HREE, Machinga Project and situated at the southern tip of Lake Chilwa (refer Figure 1). The Project area covers 91.5km2. Previous exploration has identified significant REE mineralisation, mainly in the form of bastnaesite, in addition to substantial amounts of apatite (phosphate).

The geological structure of the Tundulu Ring Complex comprises of three igneous centres. The first comprises a circular aureole of fenitization about a 2 km diameter plug of syenite. The second carbonatite ring structure centred on Nathace Hill has a diameter of 500-600m. Wrench faulting prior to emplacement of the third centre displaced the western half of the Nathace Hill ring structure 250m to the north. The third centre comprises small plugs and thin sheets of meta-nephelinite and beforsite. The main apatite deposit forms an arcuate zone (300m N-S and 50m E-W) around the eastern side of the hill.

Access to the area is relatively straightforward, the east side of the complex and Nathace Hill can be reached via dirt road from nearby village of Nambazo.

Click here for the full ASX Release

This article includes content from DY6 Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

DY6:AU

The Conversation (0)

10 July 2024

DY6 Metals

Developing new sources of critical minerals to power the green energy transition

Developing new sources of critical minerals to power the green energy transition Keep Reading...

24 July 2024

Quarterly Activities Report for the Period Ended 30 June 2024

Heavy rare earths and critical metals explorer DY6 Metals Ltd (ASX: DY6) (“DY6”, “the Company”) is pleased to present its quarterly activities report for the June 2024 quarter. Tundulu (REE)Historical high-grade drill intercepts reported at Tundulu including1:101m @ 1.02% TREO, 3.6% P2O5 from... Keep Reading...

02 July 2024

Reconnaissance Sampling Program Commences at Ngala Hill PGE Project to Follow up Historical Targets

DY6 Metals Ltd (ASX: DY6, “DY6” or the “Company”), a strategic metals explorer targeting Heavy Rare Earths (HREE) and Niobium (Nb) in southern Malawi, is pleased to report it is preparing for commencement of a reconnaissance program at the Company’s highly prospective PGE project at Ngala Hill... Keep Reading...

29 June 2023

Heavy Rare Earths & Niobium Explorer DY6 Metals Lists On ASX Following Successful $7M IPO

Heavy rare earths and niobium explorer DY6 Metals Limited (ASX: DY6) (“DY6”, “the Company”) is pleased to announce that its shares will begin trading on the Australian Securities Exchange at 9am Perth today. $7 million successfully raised via IPO, including $2.5 million from Hong Kong- based... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00