Potash Outlook 2022: Supply Disruptions Push Prices to 13 Year High

Rising global demand paired with myriad supply constraints pushed potash prices higher in 2021. Will this trend continue in 2022?

Click here to read the previous potash outlook.

Logistical woes and US sanctions against Belarus added major tailwinds to the potash market in 2021 as prices for the valuable fertilizer component soared to US$650 per tonne for the first time since 2008.

With shipments stymied as a residual result of pandemic-related disruptions, downstream costs for potash spiked to a 13 year high during the second half of the year and remain elevated.

The potash market relies heavily on rail and sea transport, so continued disturbances due to COVID-19 were only exacerbated as flooding in BC, Canada ― the leading potash-producing country ― impacted freight movement.

2021 was especially beneficial for muriate of potash (MOP), the more commonly used of the two potash types. As Andy Hemphill, ICIS Fertilizers’ senior markets editor, explained, high energy prices, limited supply and strong demand throughout the year aided in price growth.

“Specifically for potash, unlike many other industries ― and indeed, rival fertilizers ― MOP offers were firm throughout 2021, and the necessity of food production insulated the industry from the worst ravages of coronavirus-related lockdowns and logistical mayhem,” he said. “Added to this is concern for supply stemming from sanctions on key supplier Belarus’ potash exports via Lithuania, which is still unresolved as of early 2022.”

Potash outlook 2022: Potential supply challenges ahead

Mounting sanctions against Belarus specifically targeting the nation’s potash sector added uncertainty to the space in Q2 of last year and continue to motivate price activity.

The European country ranked third in potash production in 2020, with output totaling 7.3 million metric tonnes (MT). It is estimated that global demand for MOP rose to 56 million MT in 2020, up from 2019’s 49 million MT.

In June, the European Union (EU) began levying sanctions on Belarus in response to Belarusian President Alexander Lukashenko’s mounting human rights abuses.

“By late June 2021, rumours and speculation indicated Belarus’ prized money-spinning MOP export operation would soon be subject to sanctions, following the forced grounding of a passenger airliner by Belarusian authorities and the removal of activist and journalist Roman Protasevich from a Ryanair (NASDAQ:RYAAY) flight,” said Hemphill, noting that the activist remains in detention.

“Four days later, the speculation was proven true, as the European Council slapped sanctions on 78 individuals and eight entities, including a ban on travel to the EU and the freezing of assets.”

The legislation, which passed on June 24, states, “It shall be prohibited to import, purchase or transfer, directly or indirectly, potassium chloride (potash) products listed in Annex VIII from Belarus, whether or not originating in Belarus.” The sanctions target an estimated 15 to 20 percent of the potash exported by Belarus.

The move drove potash prices higher over the second half of the year, and was exacerbated when the US levied its own sanctions against Belarus and the Lukashenka regime at the end of the year.

“Then, compounding the issue, MOP marketing arm Belarusian Potash Company (BPC) itself ― which previously dodged the majority of the sanctions, which were instead placed on Belaruskali, the country’s state-run mining arm ― was sanctioned by the US in early December,” Hemphill said.

Potash prices responded with a dramatic spike, reaching the the US$650 range.

The US penalties on Belarusian potash will come into full effect in April 2022, the deadline Washington gave BPC’s clients ― including India, China and Brazil ― to wind down business. Additionally, American sanctions will inhibit BPC’s ability to access dollar-based financial services, impeding trade on international markets.

“This is set to upend global MOP trade flows, especially if Lithuania blocks the transit of potash via Klaipeda port,” Chris Lawson, head of fertilizers at CRU Group, wrote in a market overview. “However, we do not expect a complete halt of exports from Belarus.”

For Hemphill, the situation “leaves BPC’s buyers with some questions, and so far no accompanying answers.”

Several questions the senior markets editor mentioned include:

- If Lithuania's port becomes unavailable, can Lukashenko thrash out an agreement to transport tonnes via train to Russian ports for export?

- Would such a route offer the security of supply MOP buyers demand in a market witnessing decade-high prices?

- Would a jaunt across Russia increase logistics costs so much that rival MOP majors’ tonnes will appear more agreeably priced for buyers?

For now, with prices sitting at a decade high and supply from the market’s third largest producer facing global sanctions, the future is full of uncertainty. Add to that strong grower economics and historically low grain and grape seed inventories, and potash prices could continue their upward trend well into the new year.

Potash outlook 2022: Miners benefit amid market volatility

As pressure mounts against Belarus’ potash sector, production in Canada has become increasingly important.

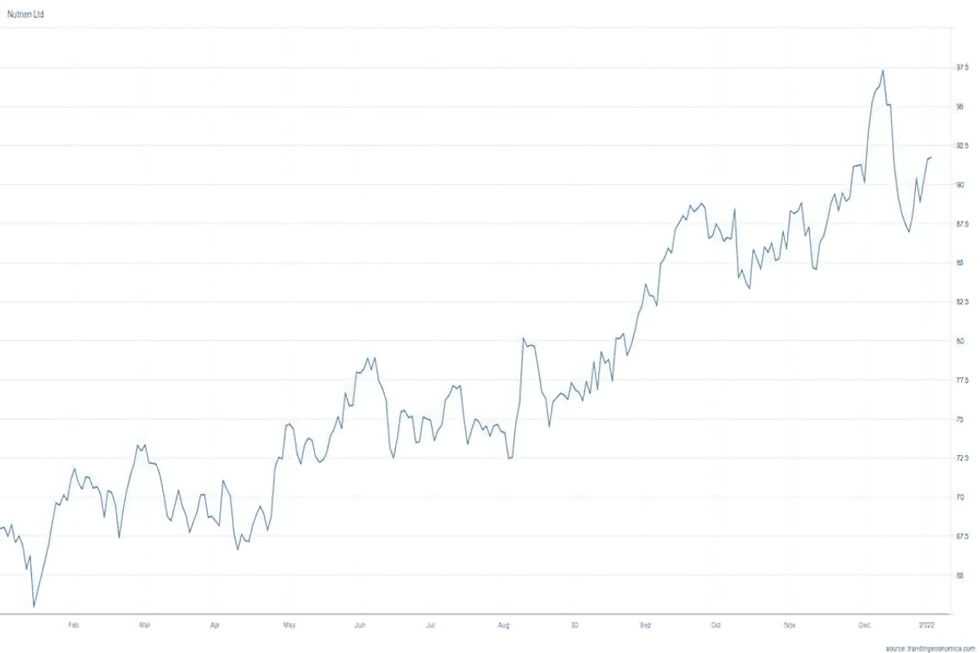

Shares of leading producer Nutrien (TSX:NTR,NYSE:NTR) have climbed 38 percent over the last 12 months.

In its Q3 earnings report, the Canadian miner credits “decisive actions we made across our business units and leveraging our competitive advantages to benefit from strong market fundamentals” as factors that aided growth.

Nutrien's 2021 share price performance.

Chart via Trading Economics.

Over the first nine months of 2021, Nutrien reported record adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) of US$4.7 billion.

Additionally, the Canadian company, which has six potash mines in Saskatchewan, achieved record production and sales volumes of nearly 7 million MT during the first six months of 2021.

Demand is forecast to continue trending up this year amid positive market fundamentals. “We expect growers to maximize planted acreage and yields in 2022 as projected US grower corn and soybean margins are approximately 60 percent and 35 percent, respectively, above 10-year average levels,” Nutrien’s Q3 statement notes.

In South America, Brazilian growers were anticipated to increase total plantings by 5 million to 7 million acres amid record grower profitability and supportive rainfall.

However, Brazil has seen spot MOP prices skyrocket to the US$800 range since December, potentially impacting soybean crops. Some analysts are speculating that prices could move as high as US$900 to US$950 in Brazil in Q1.

Potash outlook 2022: Potential price motivators

While some of the factors that impacted the potash market in 2021 will remain relevant as 2022 carries on, CRU sees various more prevalent issues easing, helping to alleviate upward price pressure.

By the end of the Q1 2022, the business intelligence company sees 2021’s freight challenges subsiding following a year that saw freight rates on the main dry bulk trade routes rise between 33 and 120 percent.

“Rates have recently declined, and we anticipate this trend to continue,” the firm's January fertilizer overview reads. “Bulk freights are anticipated to be close to historical norms by the end of Q1.”

While growers will get some relief in terms of downstream freight costs, gas prices are expected to remain elevated, which will add to production and transport overhead.

Longer term, the continued impact of climate change ― which among other things is making crop growth more difficult ― will also have an effect on the potash market.

“It’s certainly a factor to consider, but the growing global population is by far the bigger influence on supply/demand dynamics,” Hemphill said. “People have to eat, and fertilizers are the key to meeting that demand. Potash supply and demand will continue to increase over the next 10 years.”

Crop growth challenges are only one of the potential effects climate change may have on the potash market.

In a September report, Fertilizer Canada responded to the Canadian government's proposal to reduce on-farm emissions by 30 percent. The agricultural group, which represents manufacturers, wholesalers and retail distributors, estimates that cutting fertilizer use to reduce on-farm emissions could cost growers nearly C$48 billion over the next eight years.

“If Canada adopted the EU model, the potential economic impact of reduced fertilizer use would be devastating to Canadian farmers,” the report reads. “To avoid this, any plan to reduce greenhouse gas emissions must be done through sustainable agricultural intensification; an approach that allows for significant reductions in agricultural emissions without risking Canada’s contribution to global supply of food or economic growth within the sector.”

South of the border, US farmers are demanding an investigation into the broad fertilizer industry.

In December, US agricultural research and policy non-profit Family Farm Action Alliance (FFAA) called on the Department of Justice to launch an antitrust investigation into high fertilizer prices.

The FFAA called fertilizer producers a “monopoly power” that is using unfair pricing tactics. While the US government decides whether to investigate, there are still the sanctions on Belarusian potash.

“Despite the bluster and political maneuvering, the lack of official comment from the Belarusian government and its state-run potash firms on the plans for future potash exports has left buyers ― which need to secure tonnes early due to a month or more lead times from mine to field ― deeply concerned," Hemphill said. “Some speculate BPC is keeping its cards close on the possibility of exporting via Russia, while investors are buying into rival majors, and in some cases, throwing their lot in with smaller, upcoming players.”

For Hemphill, the question is whether buyers are willing to purchase tonnes at these high rates forever, move away to a different fertilizer or simply buy lower-quality blends or mixed tonnes instead.

As 2022 progresses, CRU sees prices trending lower despite the market uncertainty.

“We forecast a correction in prices, but not immediately. Gas/coal prices remain high, and supply is tight. Prices are expected to hold at high levels over Q1. Declines will begin in Q2, with more stark corrections in H2," said the firm.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- 10 Top Potash Countries by Production | INN ›

- TSX- and TSXV-Listed Potash Companies | INN ›

- Potash Fertilizers: What's the Difference Between SOP and MOP ... ›

- Ways to Invest in Potash | INN ›

- 5 Top Weekly TSXV Performers: Potential Potash Problems Push Encanto Higher | INN ›

- 5 Top Weekly TSX Performers: Karnalyte Up as Potash Prices Continue to Rally | INN ›

- Josh Linville: Fertilizer Market in Uncharted Waters as Prices Soar | INN ›

- Fertilizers: The Difference Between Potash and Phosphate ›

- Potash and Phosphate Price Update: H1 2022 in Review ›