Platinum Price Surges to 11 Year High, Breaks US$1,400

Supply and demand fundamentals and a sliding US dollar pushed the platinum price to its highest level in 11 years.

The platinum price surged above US$1,400 per ounce during Thursday (June 26) morning trading, reaching its highest level in 11 years amid a wave of speculative buying in the US and China.

In the US, industrial demand for the metal is rising as American carmakers scale back their electrification plans. At the same time, new policies are set to walk back consumer subsidies for electric vehicles.

These Trump administration mandates are expected to result in increased demand for traditional internal combustion engines or hybrid vehicles, which require higher platinum loadouts.

Tariff fears have also had an effect, with 500,000 ounces of platinum transferred to US warehouses.

Meanwhile, Chinese jewelry fabricators have been seeking at platinum as they shift away from gold, which continues to trade at record-high prices. In April, platinum imports to China surged to more than 10 metric tons.

Palladium was also up on Thursday, breaking the US$1,100 per ounce mark for the first time in 2025.

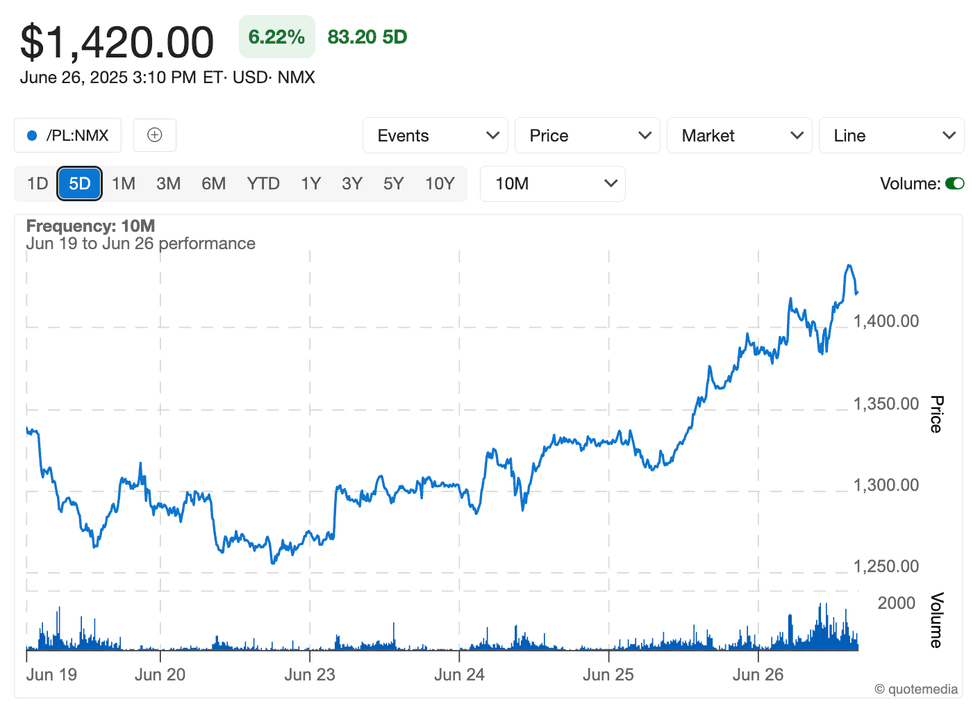

Platinum price, June 19 to June 26, 2025

Chart via the Investing News Network.

In addition to demand factors, platinum supply has been impacted by reduced output at South African mines, which are facing energy disruptions, aging infrastructure and underinvestment in new operations.

The platinum market is expected to record its third consecutive deficit in 2025 at 966,000 ounces.

But it’s not just platinum fundamentals that are impacting the price. Thursday’s gains came alongside a dip in the US dollar index, which sank more than half a percent during the day’s trading session.

The index fell to 97.13, its lowest level since 2022, indicating weaker sentiment for the US dollar, following the release of the US Bureau of Economic Analysis’ third GDP revision revision for the first quarter of 2025.

The data shows that the US economy contracted by 0.5 percent, following a growth rate of 2.4 percent in the final quarter of 2024. The number is significantly different than the 0.3 percent decline reported in the advanced estimate and the 0.2 percent outlined in the second revision. The agency attributes the change to an increase in imports as US businesses increased their inventories to prepare for tariffs proposed by the Trump administration.

The drop in the US dollar index also follows comments made by President Donald Trump this week, indicating that he may look to replace Federal Reserve Chair Jerome Powell as soon as September or October. Powell’s term as head of the central bank is set to expire in May 2026, and his role as governor is due to end in 2028.

Trump has railed against Powell since the start of his term, suggesting the central bank leader has moved too slowly in cutting interest rates. Whether Trump can remove Powell remains to be seen, as the president would need the consent of Congress to carry out such a move.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.