March 01, 2023

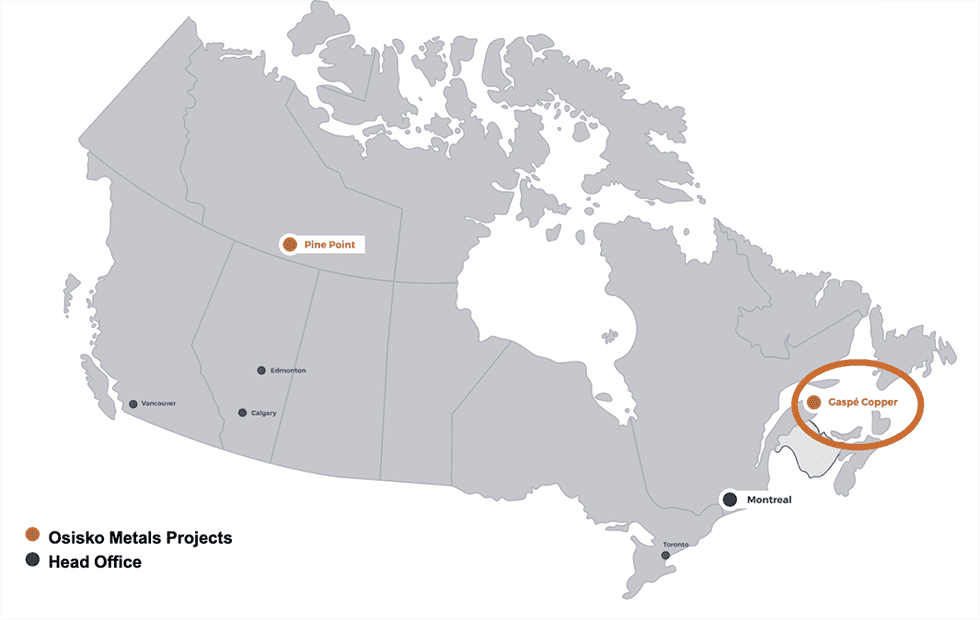

Osisko Metals (TSXV:OM)) focuses on two base metal assets in Canada as the demand for base metals is expected to continue to increase. The company's Gaspé Copper and Pine Point projects target copper and zinc, both critical minerals necessary for the global transition to clean energy. Both company assets are past-producing, brownfield assets that provide significant potential for future production.

The Gaspé Copper project in Quebec has a rapid development plan to begin mining the inferred 456 million tonnes of ore at 0.31 percent sulfide copper. As the gap between available copper supply and growing demand widens, Osisko Metals is well-positioned to help create and strengthen a domestic supply chain for the North American market.

The Pine Point Zinc-Lead project in the Northwest Territories, on the other hand, contains a mineral resource estimate of 15.8 million tonnes at 4.2 percent zinc and 1.5 percent lead, in addition to significant inferred resources.

This Osisko Metals profile is part of a paid investor education campaign.*

Click here to connect with Osisko Metals (TSXV:OM) to receive an Investor Presentation

OM:CA

Sign up to get your FREE

Osisko Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

06 January

Osisko Metals

Developing high-grade base metal assets in Canada to meet future demand

Developing high-grade base metal assets in Canada to meet future demand Keep Reading...

9h

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

12h

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

30 January

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

30 January

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

23 January

Freeport-McMoRan Plans 2026 Grasberg Restart After Deadly Mud Rush

Freeport-McMoRan (NYSE:FCX) is preparing to bring one of the world’s most important copper assets back online, laying out plans for a phased restart of the Grasberg mine in Indonesia following a deadly mud rush that halted operations late last year.The Arizona-based miner said remediation and... Keep Reading...

Latest News

Sign up to get your FREE

Osisko Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00