May 17, 2023

Noble Mineral Exploration Inc. ( “Noble” or the “Company” ) (TSX V :NOB ) ( FRANKFURT:NB7 ) ( OTC:NLPXF) is pleased to report on several active exploration projects in Ontario and Quebec.

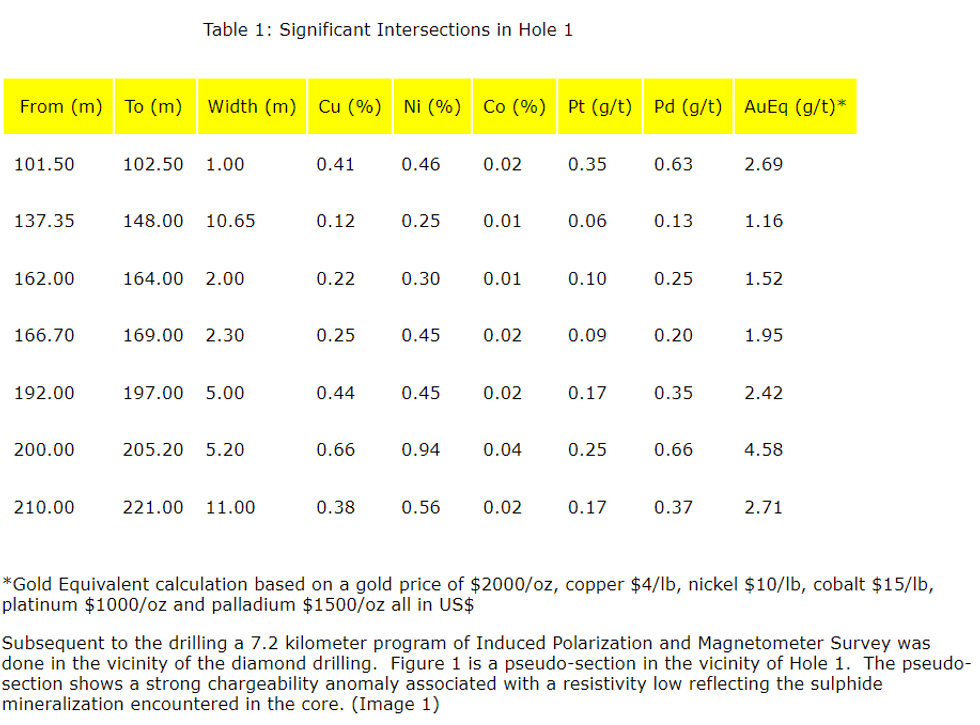

- Cere Villebon Project - Initial sampling from the Cere Villebon drill program indicates 5.2 meters of 0.66% copper, 0.94% nickel, 0.04% cobalt, 0.25 g/t platinum and 0.66% palladium within 40 meter wide mineralized zone (true width not known at this time). Additional sampling within this zone is pending with analyses expected by the end of June.

- Nagagami Project - Sampling of the core in hole NG-22-02 has identified a 61.0 metre* long mineralized zone on the Nagagami Project in Ontario. The mineralized zone grades 0.554% Total Rare Earth Oxide (TREO) and 0.098% Nd 3. Airborne survey is planned to help define the size of the mineralized zone.

- Boulder Project - Electromagnetic targets will be followed up on the ground this Spring with drill targets to follow on the Boulder Project near Hearst, Ontario.

- Kidd Project - A line-cutting and geophysical program has been completed on the Kidd Project. Drill targets are being generated in preparation for drilling in the early summer.

- Buckingham Project - Isabelle Robillard P.Geo. (OGQ) has completed an update to the 43-101 report on the Buckingham Graphite Project.

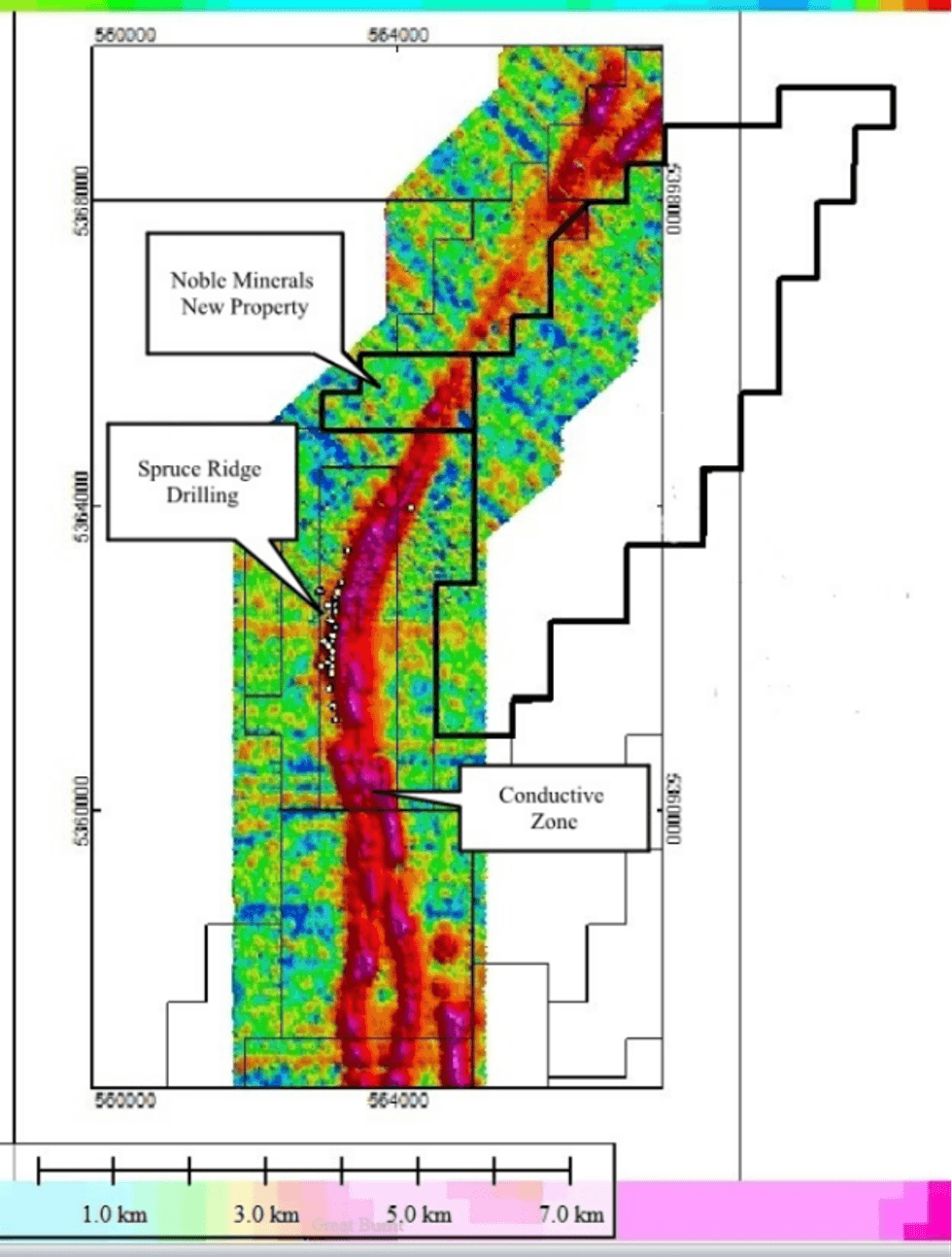

- Newfoundland Project - The Newfoundland Project covers the northern extension of the Spruce Ridge Property where recent drilling intersected 51.00 metres averaging 1.69 grams of gold per tonne (g/t Au) in hole SP21-01, 15.00 metres of 2.36 g/t Au (including 4.00 metres of 5.29 g/t Au) in SP21-03, 21.20 metres of 1.75 g/t Au in SP21-08, 17.60 metres of 1.34 g/t Au in SP21-11 and 21.00 metres of 2.06 g/t Au in SP21-14

- Canadian Mining Expo - Wayne Holmstead and Ed van Hees will be presenting at the Canadian Mining Expo in Timmins, Ontario. Topics will include a discussion of the Kidd Creek Project, the Boulder Project and the Nagagami Project.

( https://virtex.canadianminingexpo.com/)

Cere Villebon Project:

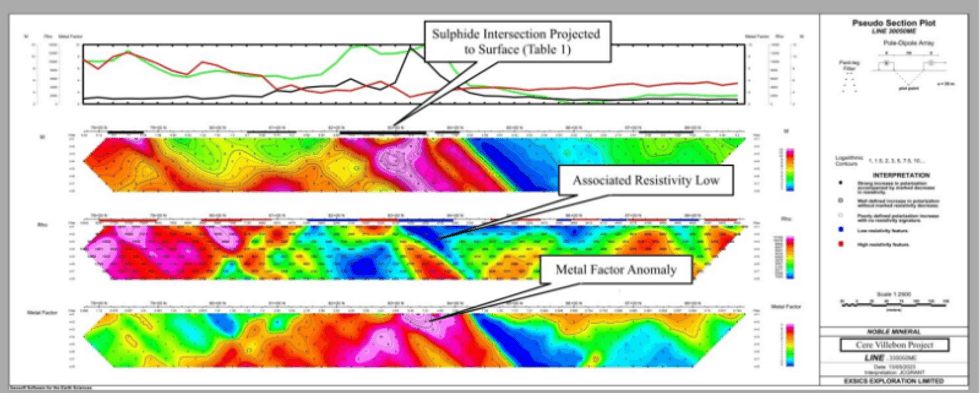

A drill program and geophysical surveys has been completed on the Cere Villebon Project southeast of Val d’Or, Quebec. The program included 7 diamond drill holes for a total of 1,955 meters. Significant mineralization was encountered in holes 1 and 5. Analysis results of samples taken have been received for Hole 1.

H istoric drilling and resource estimates done by the Groupe La Fosse Platinum Inc on the North Zone (1987) evaluated a historical resource of 421,840 tonnes grading 0.52% copper, 0.72 % nickel and 1.08 g/t combined platinum-palladium (Groupe La Fosse Platinum Inc., 1987 Annual Report).

This estimate is historical in nature, non-compliant to NI 43-101 Mineral Resources and Mineral Reserves standards, and therefore should not be relied upon. A Qualified Person has not done sufficient work to classify the historical estimate as current mineral resources, and these estimates should only be considered has an indication of the mineral potential of the Property.

Significant mineralized sections from the current drill program are included in Table 1. The intermediate sections not initially sampled have been sampled and sent for analysis. Portable XRF readings have indicated similar mineralization from 188 to 228 meters downhole.

Nagagami Project:

A 61 metre* long mineralized intercept from Hole NG-22-02 contains an average of 0.554% Total Rare Earth Oxide (TREO) and 0.098% Nd 2 O 3 . The 61 metre* zone includes a 17 metre* long zone that has average TREO and Nd 2 O 3 grades of 0.665% and 0.118%, respectively. These grades are 20% higher than those of the 61 metre* intercept.

- 61.0 metre* intercept (between 373 and 434m) contains 0.554% Total Rare Earth Oxides and 0.098% Nd

- Above intercept includes 17.0 metres* (between 380 and 397m) containing 0.665% TREO and 0.118% Nd

- Two smaller intercepts contain 0.573 % TREO and 0.105% Nd over 4 metres* (between 528 and 532m) and 0.605 % TREO and 0.119% Nd over 7 metres (between 538 and 545m).

- A slightly longer mineralized intercept also contains 0.24% Ce over 89 metres* (345 to 434m).

The average Dy 2 O 3 , Nd 2 O 3, Pr 2 O 3 , and Tb 2 O 3 content of the 61 metre intercept is equivalent to 3.25 g/t of gold. ( This calculation was done with a gold price of US$ 2000/ounce.)

Additional work being undertaken on the Nagagami project include; geophysical surveys to identify the rock units in the core of the carbonatite complex; studying the area around the property to identify a possible location f(or a new road to facilitate mobilizing a diamond drill onto the property via ground rather than using a helicopter; meetings in communities near Hearst to share Noble’s planned exploration program with the public; and lithogeochemical and mineralogical studies to characterize the wallrocks that host the mineralized zone(s) and identify the TREO-bearing minerals .

Total Rare Earth Oxides = Ce 2 O 3 +Dy 2 O 3 +Er 2 O 3 +Eu 2 O 3 +Gd 2 O 3 +Ho 2 O 3 +La 2 O 3 +Lu 2 O 3 +Nd 2 O 3 +Pr 2 O 3 +Sc 2 O 3 +Sm 2 O 3 +Tb 2 O 3 +Tm 2 O 3 +Yb 2 O 3 +Y 2 O 3

*True width not known at this time.

For a video on the Nagagami drill project, please see:

https://www.youtube.com/watch?v=K69UH7RT9MY

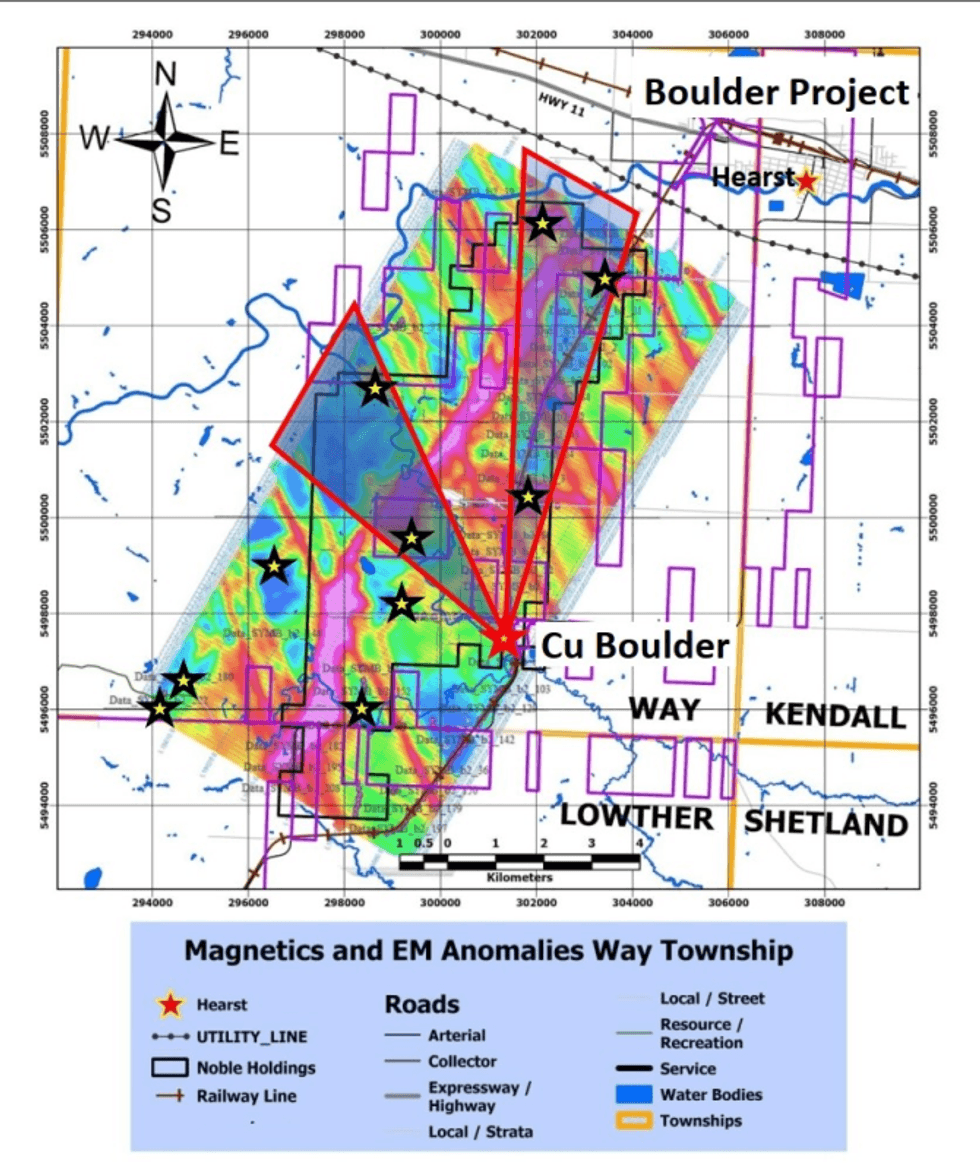

Boulder Project:

Noble Minerals has Identified several exploration targets using the recently completed magnetic and electromagnetic airborne survey. (See figure 2 below).

Steps being taken to prepare for exploration on the Noble Minerals’ Boulder Project property include:

- submitting an exploration permit application to MLAS for the planned diamond drilling program;

- multiple targets identified from Airborne Geophysics. (See figure 2 below);

- organizing a prospecting program to explore for outcrop/boulders that could explain the targets;

- follow up talks with surface rights owners above Noble’s mining claims to arrange access for drill rigs to the exploration targets located on or near their properties;

- and meetings in the communities near Hearst to open dialogue on the project.

Buckingham Graphite Property:

The following was adapted from the April 11, 2023, report titled, Technical Report on the Buckingham Graphite Project, Buckingham Township, Quebec, Canada by Isabelle Robillard P,Geo, OGQ

The Buckingham Graphite Property of Noble Mineral Exploration fully deserves further investigation as several mineralized intersections were drilled over historical conductors. Three zones of interest were identified as follows:

- Zone 1 as the Northeast end of the 1.3 km long conductor in the West Claim Block;

- Zone 2 as the two conductors in the East Claim Block that underwent exploration works in the eighties and

- Zone 3 a and b, respectively corresponding to a short conductor in the NE portion of the East Claim block and the Robidoux Graphite Prospect.

A three phase work program is proposed:

- A first, non-contingent phase of C$526,000 includes additional drilling and metallurgical testing in Zone 1, along with prospecting works in Zones 2 and 3.

- A contingent second phase totalling 700,000 CAD$ is recommended and consists of a detailed drilling program in Zone 1 and a ground geophysical survey in Zones 2 and 3, if supported by the results obtained from Phase 1.

- Phase 1 and Phase 2 programs would total 1,226,000CAD$. Based on the positive results of the detailed drilling program of Phase 2,

- A third drilling phase of 700,000CAD$ could be added for Zone 1, in order to complete a first calculation of the mineral resources.

- This third phase would bring the total to 1,926,000CAD$ for the exploration work on Buckingham Property.

The NI 43 101 Report will be posted on the Company’s website within the next 30 days.

Newfoundland Project:

The Newfoundland property covers the northern extension of the Spruce Ridge Property where recent drilling intersected 51.00 metres averaging 1.69 grams of gold per tonne (g/t Au) in hole SP21-01, 15.00 metres of 2.36 g/t Au (including 4.00 metres of 5.29 g/t Au) in SP21-03, 21.20 metres of 1.75 g/t Au in SP21-08, 17.60 metres of 1.34 g/t Au in SP21-11 and 21.00 metres of 2.06 g/t Au in SP21-14.

Michael Newbury P.Eng. (ON), a “qualified person” as such term is defined by National Instrument 43-101, has reviewed the Ontario data disclosed in this news release, and has otherwise reviewed and approved the technical information in this news release on behalf of Noble.

Mitch Lavery (OGQ), a “qualified person” as such term is defined by National Instrument 43-101, has reviewed the Cere Villebon data disclosed in this news release, and has otherwise reviewed and approved this technical information in this news release on behalf of Noble.

Isabelle Robillard (OGQ) a “qualified person” as such term is defined by National Instrument 43-101, has reviewed the Buckingham Graphite data disclosed in this news release, and has otherwise reviewed and approved this technical information in this news release on behalf of Noble.

About Noble Mineral Exploration Inc.:

Noble Mineral Exploration Inc. is a Canadian-based junior exploration company which, in addition to its shareholdings in Canada Nickel Company Inc., Spruce Ridge Resources Ltd., Go Metals Corp. and MacDonald Mines Exploration Ltd., and its interest in the Holdsworth gold exploration property in the area of Wawa, Ontario, will continue to hold ~25,000 hectares of mineral rights in the Timmins-Cochrane areas of Northern Ontario known as Project 81, as well as an additional ~11,000 hectares in the Timmins area and ~14,400 hectares of mining claims in Central Newfoundland. Project 81 hosts diversified drill-ready gold, nickel-cobalt and base metal exploration targets at various stages of exploration. It will also hold its ~14,600 hectares in the Nagagami Carbonatite Complex and its ~4,600 hectares in the Boulder Project both near Hearst, Ontario, as well as its ~482 hectares in the Cere-Villebon Nickel, Copper, PGM property, its ~3,700 hectares in the Buckingham Graphite Property, its ~10,152 hectares in the Havre St Pierre Nickel, Copper, PGM property, its ~518 hectares in the Laverlochere Nickel, Copper, PGM property, all of which are in the Province of Quebec. More detailed information is available on the website at: https://www.noblemineralexploration.com

Noble’s common shares trade on the TSX Venture Exchange under the symbol “NOB”.

Cautionary Statement:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

The foregoing information may contain forward-looking statements relating to the future performance of Noble Mineral Exploration Inc. Forward-looking statements, specifically those concerning future performance, are subject to certain risks and uncertainties, and actual results may differ materially from the Company’s plans and expectations. These plans, expectations, risks and uncertainties are detailed herein and from time to time in the filings made by the Company with the TSX Venture Exchange and securities regulators. Noble Mineral Exploration Inc. does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise.

Contacts

H. Vance White, President

Phone: 416-214-2250

Fax: 416-367-1954

Email: info@noblemineralexploration.com

Investor Relations: ir@noblemineralexploration.com

NOB:CA

The Conversation (0)

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00