(TheNewswire)

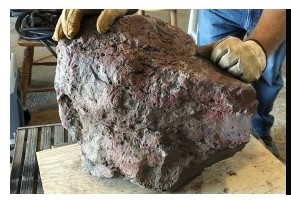

140 kg Boulder Discovered Containing 71.8% Copper, 252 g/t Silver, 3.79 g/t Gold and 6.65 g/t Platinum Group Metals

Noble Mineral Exploration Inc. ( "Noble" or the "Company" ) (TSXV:NOB ) ( FRANKFURT:NB7 ) ( OTC:NLPXF) is pleased to announce that the company has Optioned a 100% interest in 204 claim units by staking to hold in 214 claims in Way Township. The claims extend from about 4 to 15 km southwest of the town of Hearst, Ontario. The staked area is equivalent to approximately 4,500 hectares or 45 km 2

-

Noble has acquired by staking 214 claims (4,500 hectares or 45 sq. km) on the prospective mineral area;

-

The exploration model is the occurrence of a supergene alteration zone of a Volcanogenic Massive Sulphide deposit;

-

A 140 kg boulder found in the area near Jogues about 11 km SW of Hearst Ont. contains significant concentrations of base and precious metals;

-

On analysis the sample was found to contain 71.8% copper, 252 g/t silver, 3.79 g/t gold and 6.65 g/t platinum group metals;

-

There has not been any recent exploration since the 1960's when Algoma explored for iron ore.

A sample of the metalliferous boulder, brought to the Timmins Mining District Regional Resident Geologist in 2019 by a Mr. A. Cousineau, was submitted for chemical analysis to Geolabs in Sudbury to establish its metal and mineralogical makeup. Geolabs determined that the boulder contained: 71.8% copper; 3.5% lead, 1.09% zinc; 252 g/T of silver, 3.79 g/T of gold; 4.43 g/T of palladium; and 2.22 g/T of platinum and consisted primarily of cuprite (van Hees et al., 2020).

The type of copper mineralization found in the boulder is unusual for copper mineralization found in the Superior Province of the Canadian Shield. The primary mineral is cuprite, a soft, heavy, red oxide mineral (Cu 2 O) that is an important ore of copper worldwide.

In 2021, Noble launched an exploration program on the property to in an effort to identify the source of the boulder. Basal till samples collected from two fence lines of hand auger holes, located about 100 m and 1 km north of the boulder location, produced 35 gold grains. These gold grains defined a southeast-northwest trending dispersion train that indicates they were transported southeast by a glacial transport from a source area located to the northwest. The dispersion train appears to begin near a northeast trending magnetic anomaly to the northwest of the property. The gold grains are predominantly reshaped (24) but also include modified (7) and pristine (4), supporting evidence of local source.

Work will continue during the 2022 field season including an airborne survey, glacial till investigations and eventual diamond drilling.

Vance White, President and CEO of Noble, said "this is a very significant discovery of a highly mineralized boulder in an area that has not seen much past exploration. The discovery of the source of the boulder would be an important mineral find. Even a small deposit of this material would be extremely valuable at current metal prices. Noble will continue its exploration program to establish the source of the boulder"

Figure 1: Photo of the Cousineau Boulder

Figure 2: Photo of Cousineau Boulder cut in half

References:

van Hees, E.H., P. Bousquet, J. Suma-Momoh, C.M. Daniels, S.L.K. Hinz, C. Boucher, P. Sword, L. Wang, S.P. Fudge, A. Millette and C. Patterson, 2020. Report of Activities 2019, Resident Geologist Program, Timmins Regional Resident Geologist Report: Timmins and Sault Ste. Marie Districts; Ontario Geological Survey, Open File Report 6366, 160p.

Deal Terms

On signing - 325,000 shs + 325,000 3-year wts exercisable at $0.175

1 st Anniversary - 325,000 shs + 325,000 3-year wts exercisable at $0.175

Expln Spend to earn 50% - $300,000 (including staking costs and ground exploration in the fall 2021)

Expln Spend to earn 100% - $700,000 (earning 10% per $140,000 in expenditures to include airborne and follow up)

2% NSR with buyback as to 50% at $1,000,000 for first five years and at $1,500,000 to end of life.

If the property is dropped, then it is to be returned to vendors with a minimum one year's assessment credits.

The Transaction is subject to the approval of the Board of Directors, as well as to TSX Venture Exchange approval and to compliance with securities and other laws and regulations.

Michael Newbury PEng (ON), a "qualified person" as such term is defined by National Instrument 43-101, has reviewed the data disclosed in this news release, and has otherwise reviewed and approved the technical information in this news release on behalf of Noble.

About Noble Mineral Exploration Inc.:

Noble Mineral Exploration Inc. is a Canadian-based junior exploration company which, in addition to its shareholdings in Canada Nickel Company Inc., Spruce Ridge Resources Ltd. and MacDonald Mines Exploration Ltd., and its interest in the Holdsworth gold exploration property in the area of Wawa, Ontario, will continue to hold ~25,000 hectares of mineral rights in the Timmins-Cochrane areas of Northern Ontario known as Project 81, as well as an additional ~11,000 hectares in the Timmins area and ~14,400 hectares of mining claims in Central Newfoundland. Project 81 hosts diversified drill-ready gold, nickel-cobalt and base metal exploration targets at various stages of exploration. It will also hold its recently acquired ~14,600 hectares in the Nagagami Carbonatite Complex near Hearst, Ontario, as well as ~3,700 hectares in the Buckingham Graphite Property, ~518 hectares in the Laverlochere Nickel, Copper, PGNM property and ~482 hectares in the Cere-Villebon Nickel, Copper, PGM property, all of which are in the province of Quebec. More detailed information is available on the website at www.noblemineralexploration.com .

Noble's common shares trade on the TSX Venture Exchange under the symbol "NOB".

Cautionary Statement:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

The foregoing information may contain forward-looking statements relating to the future performance of Noble Mineral Exploration Inc. Forward-looking statements, specifically those concerning future performance, are subject to certain risks and uncertainties, and actual results may differ materially from the Company's plans and expectations. These plans, expectations, risks and uncertainties are detailed herein and from time to time in the filings made by the Company with the TSX Venture Exchange and securities regulators. Noble Mineral Exploration Inc. does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise .

Contacts:

H. Vance White, President

Phone: 416-214-2250

Fax: 416-367-1954

Email: info@noblemineralexploration.com

Investor Relations

Email: ir@noblemineralexploration.com

Copyright (c) 2022 TheNewswire - All rights reserved.