South Star Battery Metals Announces Binding Final Agreement for Graphite Project in Coosa County, Alabama

South Star Battery Metals Corp. ("South Star" or the "Company") (TSXV: STS) (OTCQB: STSBF), is pleased to announce that it has entered into a binding Earn-in and Option Agreement ("Agreement") for the Ceylon Graphite Project ("Project") in Alabama with Hexagon Energy Materials Limited ("Hexagon") (ASX: HXG) and U.S. Critical Minerals LLC ("USCM"), a privately-held exploration company incorporated in the United States (see November 3, 2021 press release). Under the terms of the Agreement, South Star will have the right to earn-in to up to 75% of the Project. The transaction is subject to the final approval of the TSX Venture Exchange (the " T SXV").

Richard Pearce , South Star's CEO, said "We continue to execute on creating a multi-asset, diversified battery metals company. Our goals continue to be to get Santa Cruz in production in 2022, and we are excited about bringing on the next scalable critical battery metals project in the pipeline in another important jurisdiction for the sector. The approved Infrastructure Bill in the US will provide a lot of opportunities. We will leverage all our technical and commercial experience from Brazilian graphite and move the Project forward quickly. The Southeast corridor of the US is transforming itself into an electric vehicle, clean-tech and defense hub, and the Project in Coosa County is right in the middle of the action. I would like to thank our partners for getting this done and look forward to working together in the coming years."

Hexagon's Managing Director, Merrill Gray , said: "We are really looking forward to working with the team at South Star under this Agreement on the Ceylon Graphite project, including seeing how South Star creates value for our combined shareholder base in practical, on the ground terms."

CEYLON GRAPHITE PROJECT

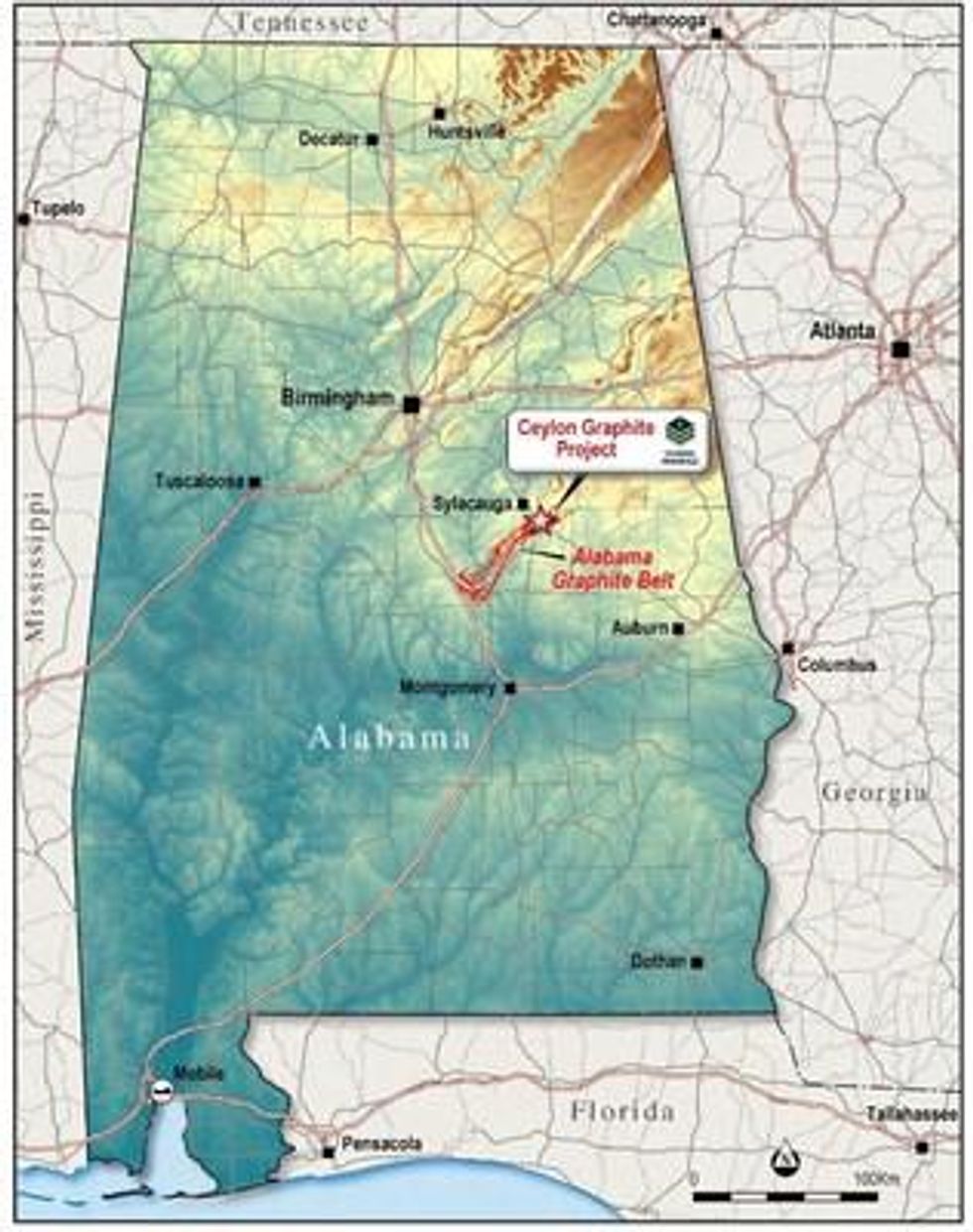

Currently, Hexagon owns 80% of the Project, and USCM with a small group of individuals own the remaining 20% of the Project. The Project is located on the northeast end of the Alabama Graphite Belt and covers approximately 500 acres in Coosa County Alabama . The Project is a historic mine active during World Wars I & II. The Ceylon Graphite mine historically targeted friable outcropping graphite mineralization, averaging approximately 3-5% graphitic carbon. Mineralization is at surface, and the graphitic host rock was mined historically with shovels and excavators with no drilling and blasting required.

A comprehensive preliminary exploration program and bench scale process have been completed. Work completed to date includes:

- Regional scale and local geologic and structural mapping and sampling program.

- 29 trenches totaling 2,769 linear meters were dug to a maximum depth of approximately 2 meters. The trenches were mapped, logged and 765 samples plus standards and duplicates (5 per 100 samples) were analyzed.

- 100 tonnes of bulk ore samples were collected from across the claims, and a bench scale process circuit using 10 representative samples was tested at GIRCU Laboratory in Guangzhou , China. The testing indicated a traditional crush/grind/flotation concentration circuit achieved grades of approximately 96-97% with approximately 86% recoveries. In general, approximately 75-80% of the ore concentrates (by mass) is -80 mesh material and the balance being +80 mesh material. The ore was described as well liberated and easy to process.

FINAL EARN-IN TERMS

To satisfy the terms of the Agreement, South Star must complete the following:

- The drilling, resource estimation and analysis needed to produce a NI 43-101 compliant Preliminary Economic Analysis (PEA) within three years.

- Fund an annual minimum expenditure of C$250,000 ( C$750,000 total) to earn 75% of the project.

- Extend or renew, as needed, the currently existing mineral leases and surface agreements on the Project to ensure they are valid for a period of a minimum of 12 months beyond the three-year term of the definitive earn-in period.

- Upon satisfaction of the first three items listed above, South Star shall have the right, but not the obligation, to acquire 75% of the Project.

- For a period of six months following the exercise of the 75% earn-in option ("Option Period"), Hexagon and USCM individually have the right, but not the obligation, to sell their remaining interest in the Project by selling for a payment of C$250,000 in South Star shares for the remaining 25% of Project.

- During the Option Period, and expenditures will be shared pro rata. Failure by any party to pay their share shall result in a proportional dilution of interest in the Project.

- Should South Star's interest in the Project increase to 90% or greater, STS shall have the right, but not the obligation, to purchase the entire remaining interest not owned or under its control.

- Within six months of the Ceylon Graphite Project achieving Commercial Production ("Production Bonus"), STS shall make a payment of C$250,000 in STS shares. The Production Bonus shall be proportionately reduced to reflect any reduction in the remaining 25% interest held by the parties.

NEXT STEPS

South Star is currently developing plans and making preparations for the Phase 1 exploration program at the Project. This initial work will include RC drilling to further define the extent and structure of the deposit and will be combined with additional field mapping and surface sampling. This first phase is tentatively scheduled to begin early in 2022. Subsequent phases will include diamond core drilling, bench and pilot scale metallurgy, preliminary resource estimation and engineering. South Star will also continue to expand and develop the excellent relationships with the community, as well as with local, state and federal agencies, originally established by the Charge Minerals' team.

ABOUT South Star Battery Metals CORP

South Star Battery Metals Corp. is a Canadian battery metals project developer focused on the selective acquisition and development of near-term production projects in the Americas. South Star's Santa Cruz Graphite Project, located in Southern Bahia, Brazil is the first of a series of industrial and battery metals projects that will be put into production. Brazil is the second-largest graphite-producing region in the world with more than 80 years of continuous mining. Santa Cruz has at-surface mineralization in friable materials, and successful large-scale pilot-plant testing (>30t) has been completed. The results of the testing show that approximately 65% of Cg concentrate is +80 mesh with good recoveries and 95-99% Cg. With excellent infrastructure and logistics, South Star is carrying its development plan towards Phase 1 production projected in Q4 2022, pending financing. South Star trades on the TSX Venture Exchange under the symbol STS, and on the OTCQB under the symbol STSBF.

South Star is committed to a corporate culture, project execution plan and safe operations that embrace the highest standards of ESG principles based on transparency, stakeholder engagement, ongoing education and stewardship. To learn more, please visit the Company website at https://www.southstarbatterymetals.com .

This news release has been reviewed and approved by Richard Pearce, P.E., a "Qualified Person" under National Instrument 43-101 and President and CEO of South Star Battery Metals.

On behalf of the Board,

Mr. Richard Pearce

Chief Executive Officer

For additional information, please contact:

CHF Capital Markets (IR Canada)

Cathy Hume , CEO

Phone: +1 416-868-1079 x251

Email: Cathy@chfir.com

RBMG – RB Milestone Group LLC (IR US)

Trevor Brucato , Managing Director

Email: southstar@rbmilestone.com

Mr. Dave McMillan

Chairman

Email: davemc@telus.net

Twitter: https://twitter.com/southstarbm

Facebook: https://www.facebook.com/southstarbatterymetals

LinkedIn: https://www.linkedin.com/company/southstarbatterymetals/

YouTube: South Star Battery Metals - YouTube

CAUTIONARY STATEMENT

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

This news release and the Updated Technical Report contain references to inferred resources. The Report is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves.

FORWARD-LOOKING INFORMATION

The information contained herein contains "forward-looking statements" within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements".

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in the Company's disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Company's expectations or projections.

SOURCE South Star Battery Metals Corp.

News Provided by Canada Newswire via QuoteMedia