South Star Battery Metals Announces Proposed Earn-in for Graphite Project in Alabama, Joins the Critical Metals Institute and Retains Market Digital

South Star Battery Metals Corp. ("South Star" or the "Company") (TSXV: STS) (OTCQB: STSBF), today announces that it has agreed to the key terms of a proposed earn-in to the Ceylon Graphite Project ("Project") in Alabama with Hexagon Energy Materials Limited ("Hexagon") (ASX: HXG) and U.S. Critical Minerals LLC ("USCM"), a privately-held exploration company incorporated in the United States . South Star and the vendors intend to negotiate the terms of a formal agreement which will allow South Star to earn-in up to 75% of the Project. The transaction is subject to customary conditions, including preparation, finalisation and execution of formal agreements and the receipt of all necessary approvals, including the approval of the TSX Venture Exchange (the "TSXV").

Richard Pearce , South Star's CEO, said: "This is another important step towards creating a multi-asset, diversified battery metals company. We are potentially bringing on the next project in the pipeline in another important jurisdiction for the sector. The geology and processing flow sheets are very similar to our Brazil graphite asset, and we believe we can leverage our commercial relationships and technical experience to scale the project into near-term production. The infrastructure is excellent with access, energy, and the Mobile port facility near-by. The Southeast corridor of the US is transforming itself into an electric vehicle hub, and the Project in Coosa County is right in the middle of the action. The Project is on private land, and we believe the permitting and licensing efforts should be fairly straight-forward. I am very excited to be working with our partners on moving this Project forward in the coming years."

Hexagon's Managing Director Merrill Gray said: "South Star is an experienced graphite project developer and operator with significant technical resources and the ambition to move this expertise into North America. This earn-in deal could accelerate the Ceylon Graphite project's development, unlocking value for Hexagon and allowing the company to focus on the progression of our core Australian projects, in Hydrogen and Nickel, growing our energy materials portfolio beyond Ceylon Graphite."

CEYLON GRAPHITE PROJECT IN ALABAMA

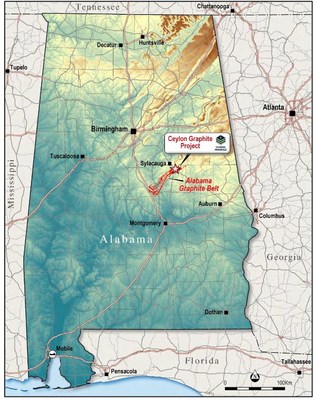

Currently, Hexagon owns 80% of the Project, and USCM with a small group of individuals owning the remaining 20% of the Project. The Project is located on the northeast end of the Alabama Graphite Belt and covers approximately 500 acres in Coosa County, Alabama . The Project is an historic mine active during World Wars I & II. The Ceylon Graphite mine historically targeted friable outcropping graphite mineralization, averaging approximately 3%-5% graphitic carbon. Mineralization is at surface, and the graphitic host rock was mined historically with shovels and excavators with no drilling and blasting required.

A comprehensive preliminary exploration program and bench-scale process have been completed by Hexagon. Work completed to date includes:

- Regional scale and local geologic and structural mapping and sampling program.

- 29 trenches totaling 2,769 linear metres were dug to a maximum depth of approximately 2 metres. The trenches were mapped, logged and 765 samples plus standards and duplicates (5 per 100 samples) were analyzed.

- 100 tonnes of bulk ore samples were collected from across the claims, and a bench-scale process circuit using ten (10) representative samples was tested at GIRCU Laboratory in Guangzhou, China . The testing indicated a traditional crush/grind/floatation concentration circuit achieved grades of approximately 96%-97% with approximately 86% recoveries. In general, approximately 75%-80% of the ore concentrates (by mass) is -80 mesh material and the balance being +80 mesh material. The ore was described as well-liberated and easy to process.

PROPOSED EARN-IN TERMS

The following is a summary of the key terms of the proposed earn-in:

- South Star to complete drilling, resource estimation, and analysis needed to produce a NI 43-101 compliant Preliminary Economic Assessment (PEA) within three years from the signing of the final agreements ("Earn-in Period").

- South Star to fund an annual minimum expenditure of CAD$250,000 ( CAD$750,000 total minimum) during the Earn-in Period to earn 75% of the Project.

- South Star to extend or renew, as needed, and as part of the earn-in expenditure, the existing mineral leases and surface agreements on the Project to ensure they are valid for a period of a minimum of 12 months beyond the Earn-in Period.

- Upon satisfaction of the first three items listed above, South Star shall have the right, but not the obligation, exercisable within an agreed period, to acquire 75% of the Project, following which (subject to the put option described below) the parties would operate the Project as a joint venture.

- For a period of six months following the exercise of the 75% earn-in option ("Option Period"), Hexagon and USCM individually have the right, but not the obligation, to sell their remaining 25% interest in the Project for an aggregate payment of CAD$250,000 in South Star shares ("Put Option").

- During the Option Period, any expenditures will be shared pro rata. Failure by any party to pay their share shall result in a proportional dilution of interest in the Project.

- Should South Star's interest in the Project increase to 90% or greater, South Star shall have the right, but not the obligation, to purchase the entire remaining interest not owned or under its control on a basis proportional to the Put Option.

- Within six months of the Ceylon Graphite Project achieving commercial production, South Star shall make a payment of CAD$250,000 in South Star shares ("Production Bonus"). The Production Bonus shall be proportionately reduced to reflect any reduction in the remaining 25% interest held by the parties .

Hexagon, USCM and South Star are currently negotiating the proposed formal agreements to reflect the above terms, with the intention of finalising and executing those agreements (if final terms are agreed) during November 2021 .

CRITICAL MATERIALS INSTITUTE

South Star is pleased to announce that it joined the Critical Materials Institute ("CMI") as an affiliate member. CMI is a U.S. Department of Energy ("DOE") - Energy Innovation Hub that seeks to accelerate innovative scientific and technological solutions to develop resilient and secure supply chains for rare-earth metals and other materials critical to the success of clean-energy technologies. Ames Laboratory leads the CMI team, which includes partners from other national laboratories, universities, and industry. CMI research works in four ways:

- Diversifying Supply;

- Developing Substitutes;

- Driving Reuse and Recycling; and

- Crosscutting Research.

MARKET DIGITAL

South Star has retained Market Digital ("MD"), a leading provider of marketing services ("Services"), to heighten and broaden our brand awareness within the investment community. Market Digital shall comply with all applicable security laws and policies of the TSX Venture Exchange ("TSXV") in providing the Services. MD has been retained for a period of 3 months starting November 01, 2021 and will be paid a monthly fee of C$100,000 investor for the Services. The engagement is subject to TSXV approval.

ABOUT South Star Battery Metals CORP.

South Star Battery Metals Corp. is Canadian battery metals project developer focused on the selective acquisition and development of near-term production projects in the Americas. South Star's Santa Cruz Graphite Project, located in Southern Bahia, Brazil is the first of a series of industrial and battery metals projects that will be put into production. Brazil is the second-largest graphite-producing region in the world with more than 80 years of continuous mining. Santa Cruz has at-surface mineralization in friable materials, and successful large-scale pilot-plant testing (>30t) has been completed. The results of the testing show that approximately 65% of Cg concentrate is +80 mesh with good recoveries and 95%-99% Cg. With excellent infrastructure and logistics, South Star is carrying its development plan towards Phase 1 production projected in Q4 2022, pending financing. South Star trades on the TSX Venture Exchange under the symbol STS, and on the OTCQB under the symbol STSBF.

South Star is committed to a corporate culture, project execution plan and safe operations that embrace the highest standards of ESG principles based on transparency, stakeholder engagement, ongoing education, and stewardship. To learn more, please visit the Company website at https://www.southstarbatterymetals.com .

This news release has been reviewed and approved by Richard Pearce, P.E., a "Qualified Person" under National Instrument 43-101 and President and CEO of South Star Battery Metals Corp.

On behalf of the Board,

Mr. Richard Pearce

Chief Executive Officer

Twitter: https://twitter.com/southstarbm

Facebook: https://www.facebook.com/southstarbatterymetals

LinkedIn: https://www.linkedin.com/company/southstarbatterymetals/

YouTube: South Star Battery Metals - YouTube

CAUTIONARY STATEMENT

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

This news release and the Updated Technical Report contain references to inferred resources. The Report is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves.

FORWARD-LOOKING INFORMATION

The information contained herein contains "forward-looking statements" within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements".

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in the Company's disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Company's expectations or projections.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/south-star-battery-metals-announces-proposed-earn-in-for-graphite-project-in-alabama-joins-the-critical-metals-institute-and-retains-market-digital-301415280.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/south-star-battery-metals-announces-proposed-earn-in-for-graphite-project-in-alabama-joins-the-critical-metals-institute-and-retains-market-digital-301415280.html

SOURCE South Star Battery Metals Corp.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/November2021/03/c2963.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/November2021/03/c2963.html

News Provided by Canada Newswire via QuoteMedia