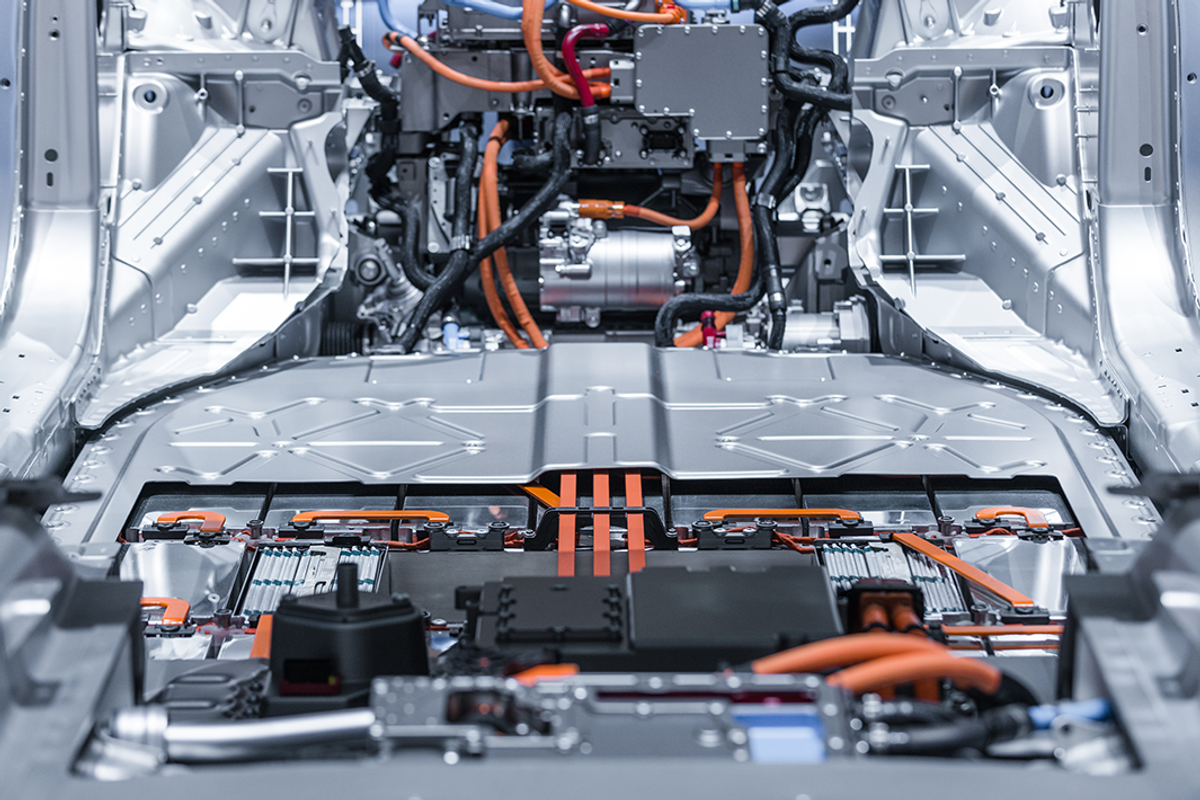

As the supply crunch for EV battery metals intensifies, car manufacturers are increasingly taking charge of their own supply chains.

As government mandates and policies move toward a gradual phase out of combustion engines in favor of electric and hybrid vehicles, supplies of critical materials remain insufficient to meet demand. Global automakers have begun rethinking their supply chains, with one prevailing strategy of forging partnerships with mineral exploration companies.

These supply agreements represent a compelling opportunity for junior explorers with promising assets. Companies that take advantage of this trend have the potential to become a stable supply of critical minerals, greatly enhancing shareholder value in the process.

Understanding the supply and demand dynamic from partnerships between original equipment manufacturers and mining companies is critical in identifying the right investment opportunities.

Committing to a sustainable future

In 2014, the EU committed to cutting carbon emissions by 40 percent by 2030. In the years that followed, it has expanded considerably on that commitment, announcing an ambitious long-term strategy to become fully climate neutral by 2050. The EU has also taken steps to both shore up critical mineral supply chains and support the development of clean technology and green industry.

While the EU was the first to set a framework for decarbonization and electrification, it was far from the last. In the years since 2014, many others have followed Europe's lead.

In Canada, for instance, there are multiple government-led decarbonization policies. The Canadian federal government has announced plans to replace combustion engines and require 100 percent of car and passenger truck sales in 2035 to be zero emission. It will require all new vehicle sales to be zero emission by 2040. Electric Mobility Canada, an industry initiative, aims to help the country reach 100 percent electric passenger vehicle sales by 2030.

At the province level, governments have instituted programs that will help reach environmental goals, such as British Columbia's CleanBC Industrial Incentive Program and Alberta's Carbon Competitiveness Incentive.

Governments are moving toward a gradual phase out of gas vehicles in favor of electric cars.

The US, for its part, launched the Inflation Reduction Act of 2022. Though primarily a means to reduce the national deficit and curb inflation, the act also introduced several clauses geared towards sustainability, including a goal of a 40 percent reduction in emissions by 2030, investment into domestic manufacturing and energy production, and expanded tax credits for the purchase and sale of electric vehicles (EVs).

These measures will, according to a press release from the White House, serve a few purposes. First, the Act's incentives will reduce the cost of both EVs and EV charging infrastructure. Incentivization is also expected to drive competition and consumer demand while accelerating the growth of the EV market. Lastly, the government intends to promote private sector investment and establish a stable domestic supply chain for critical minerals.

China, the country with the world's fastest-growing EV market, has also established multiple sustainability-focused initiatives. The Chinese government is investing heavily in EVs, with plans to build charging stations for 20 million EVs by 2025 while also constructing a fully electrified public transit system. These measures represent a cornerstone of China's carbon neutrality plan, which it hopes to achieve by 2060.

Other countries are also on board with the EV industry.

Indonesia plans to have 13 million electric motorbikes and 2.2 million electric cars on the road by 2030. The United Kingdom intends for all new cars and vans sold in the country to be zero emission by 2035. The Government of Japan announced similar plans for what it refers to as clean energy vehicles.

In search of adequate supply

The response from automakers to EV initiatives has been largely positive, with the majority of industry leaders embracing electrification. This is most evident from the heavy investment that companies like Tesla (NASDAQ:TSLA) and General Motors (NYSE:GM) have directed toward manufacturing infrastructure. For example, the US hosts nearly 30 EV factories and gigafactories in various stages of construction, with even more facilities dedicated to battery manufacturing.

Tesla alone currently operates five gigafactories worldwide, with plans to eventually increase that number to twelve.

Yet manufacturing is only half the equation; the other half is in the supply of raw materials that will feed it. Given the current rate of production, there is a looming global shortage of multiple materials crucial to EV production, including but not limited to lithium, graphite and copper.

While mining and exploration companies working together with governments have made great strides in addressing these deficits and establishing a stable domestic supply chain, it's still not enough. There are simply too many stalled, incomplete and slow-to-start projects. In light of this, EV manufacturers are increasingly taking matters into their own hands by establishing supply partnerships with junior mining and exploration companies.

These partnerships will impact the market for both critical minerals and battery metals, potentially causing further price spikes as manufacturers stake their claim on already limited supply. Moving forward, agreements between automakers and mineral producers could become standard practice — and even required to remain competitive in the EV market. The upside for exploration companies and their investors: these deals have the potential for considerable returns.

Paving the way to electrification

So why are EV manufacturers targeting exploration companies specifically?

As noted by the New York Times, established mining companies cannot meet the needs of the EV industry. Throwing in their lot with exploration companies gives automakers the opportunity to completely sidestep existing supply chains and gain exclusive access to the materials their factories require. These agreements represent something of a return to the automotive sector's roots, hearkening back to the days of Ford's (NYSE:F) Brazilian rubber plantations.

"We quickly realized there wasn't an established value chain that would support our ambitions for the next 10 years," Sham Kunjur, executive director of General Motors' EV Raw Materials Center of Excellence, told the New York Times. "It almost seems like 100 years later, we're back (to the early days of the industry)."

The majority of industry partnerships are focused on securing a supply of lithium, although other metals such as nickel, cobalt and manganese may also become targets in the near future.

There have been several prominent recent partnership deals, one of which is Liontown Resources’ (ASX:LTR) February 2022 deal with Tesla. Contingent on the company starting commercial production in 2025, the supply agreement promises roughly a third of the company's production capacity to the EV manufacturer. Liontown has also signed offtake agreements with Ford and LG Energy Solution (KRX:373220), with all three deals accounting for roughly 450,000 dry metric tons of lithium per year.

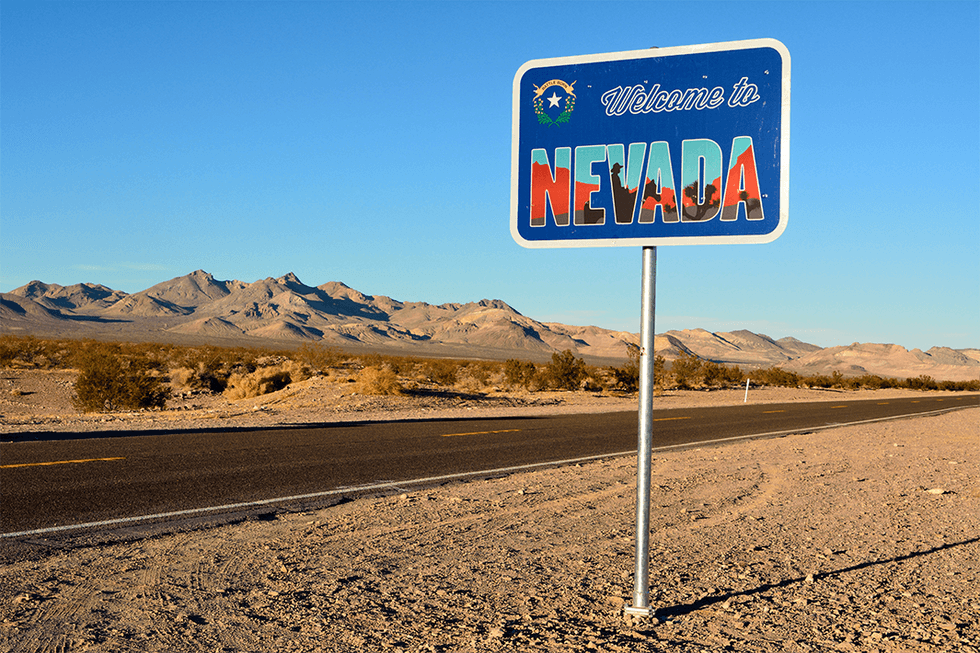

Nevada is emerging as a new lithium frontier with several promising projects underway.

In 2023, Lithium Americas (NYSE:LAC) signed a US$650 million equity investment deal with General Motors to develop the mining company's Thacker Pass project in Nevada. This deal represents the largest investment in raw battery materials by an automaker to date.

In Europe, Vulcan Energy Resources (ASX:VUL), which controls license areas in both Italy and the Upper Rhine Valley in Germany, currently maintains lithium supply agreements with Stellantis (NYSE:STLA), Renault (EPA:RNO) and Volkswagen (OTC Pink:VLKAF,FWB:VOW). It also has offtake agreements with LG Energy Solutions as well as battery materials producer Umicore (EBR:UMI).

Significant though they are, these agreements represent only a drop in the bucket. There are many other junior exploration companies that could serve as promising suppliers for automakers, including Grid Battery Metals (TSXV:CELL,OTCQB:EVKRF). In addition to several lithium development projects in Nevada, the company has discovered a promising nickel exploration region situated in Central British Columbia.

Each of the company's four projects is situated near extensive pre-existing infrastructure, ensuring that Grid Battery Metals can ramp up production in the short term with minimal capital investment cost. The Canadian exploration company also raised in excess of C$5 million in 2023 and has approximately C$9 million in working capital on its balance sheet.

Investor takeaway

With supply deficits growing progressively more severe, EV manufacturers have begun to take matters into their own hands, signing agreements with junior exploration companies to gain exclusive access to critical materials. This has resulted in significant returns for those companies and their investors — with more opportunities likely to come in the near future.

This INNSpired article was written as part of an advertising campaign for a company that is no longer a client of INN. This INNSpired article provides information which was sourced by INN, written according to INN's editorial standards, in order to help investors learn more about the company. The company’s campaign fees paid for INN to create and update this INNSpired article. INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled. If your company would benefit from being associated with INN's trusted news and education for investors, please contact us.