Disrupting China’s Hard-rock Lithium Conversion Dominance

China is a dominant player in hard-rock lithium conversion, but other countries and companies are working on getting their supply chains up to speed.

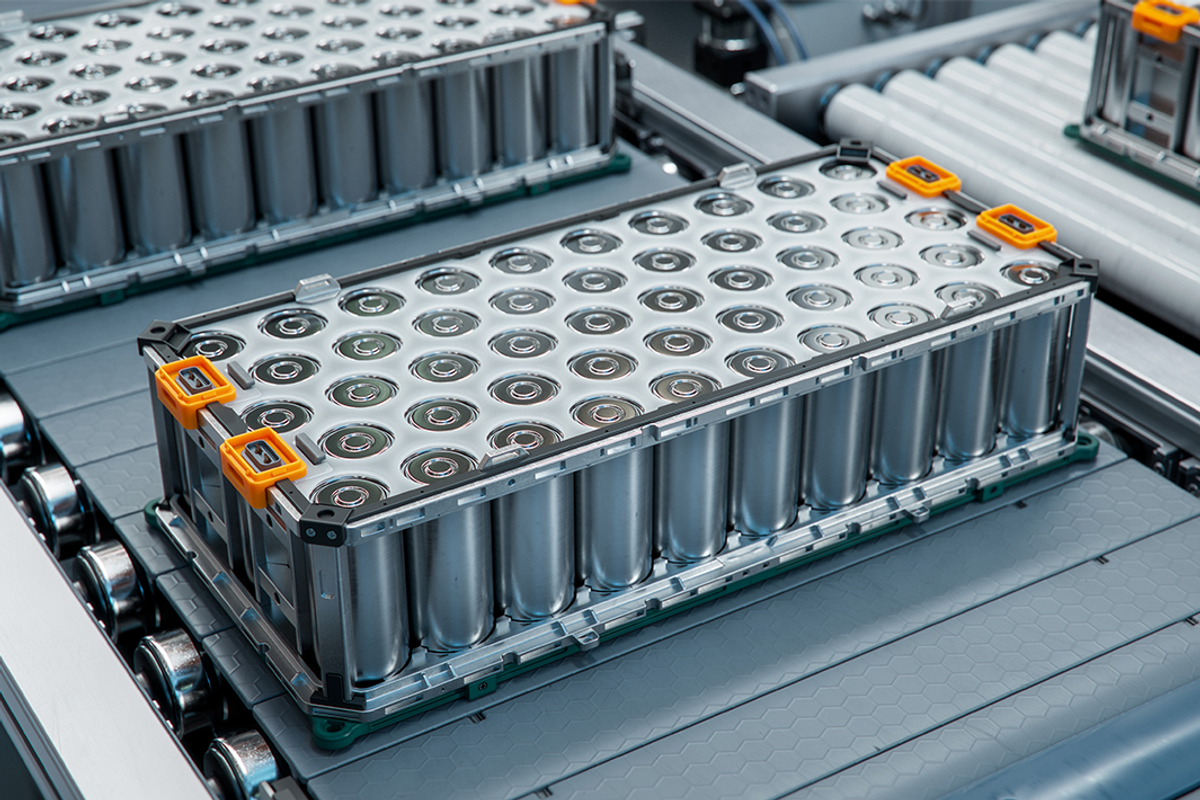

You can’t make lithium-ion batteries, a critical component of electric vehicles (EVs) and other devices of the new green economy, without lithium. But securing a stable, secure and politically neutral supply chain for so-called white gold is a challenge.

China currently controls 80 percent of global lithium chemical production — despite having less than 7 percent of lithium reserves. China has successfully created the infrastructure and financial incentives for an interdependent supply chain that integrates mines, processing factories and electric battery manufacturers; it controls 70 percent of cell manufacturing for the EV industry.

Hard-rock lithium conversion entails converting mined lithium spodumene ore into lithium sulfate, then battery-grade lithium carbonate or lithium hydroxide.

Having access to facilities undertaking this process is just as important as having access to lithium mines. Many countries understand this and endeavour to improve their lithium supply chains. The goal is to establish facilities where geopolitical wrangling is not a concern, that are closer to home and take environmental values into account — hard-rock lithium conversion can be environmentally intense, especially in jurisdictions with looser environmental controls. Concerns range from water use to consumption of electricity in jurisdictions where fossil fuels power the electricity grid.

On top of that, many nations seek to ensure the price of lithium stays stable, as so much of the green economy is reliant on it.

The market overall is worth developing and protecting: lithium demand has tripled since 2017 and is set to grow tenfold by 2050.

The hard-rock situation

Hard-rock sources of lithium make up 60 percent of globally mined supply — that’s forecast to continue through to 2030 — while brine sources comprise the rest.

China controls 65 percent of hard-rock lithium processes, while Chile, at a distant second, takes care of 29 percent. While other countries are attempting to ramp up production, China is expected to more than triple its processing capacity in the coming years.

It’s already taken a firm hold of the raw resource market by investing heavily in the so-called Lithium Triangle made up of Argentina, Chile and Bolivia, plus it’s made forays into Afghanistan. China uses off-take contracts, which guarantees a mine or processor a certain amount of product purchased at an agreed price, which helps fund its operations and cements a long-term relationship.

It also has a strong domestic supply chain while Chinese companies have bought up many key players in the industry, including lithium mines, around the world. It’s now investing heavily in mines in Africa — the continent is home to just one percent of world lithium production, but that is predicted to rise to 12 percent in the coming years.

China consequences

There are a number of concerns regarding China’s de facto monopoly on hard-rock lithium conversion. There are risks it could exert too much control over its partners, even lead to possibly bullying over prices and market access. It would dominate any negotiations around international policies related to lithium supply chains.

Meanwhile, other players in the market do not have much in the way of bargaining power in this uneven market, making it increasingly difficult for newcomers to gain a foothold — a situation that could worsen if China’s dominance were to grow further, causing a snowball effect.

International efforts

Concerns about the international lithium-processing market are well known, and many nations are making federal-level efforts to encourage a more diverse industry and to secure their own supply chains.

In 2021, the US released the National Blueprint for Lithium Batteries, declaring it would establish a stable supply chain for battery materials by 2030. A year later, it introduced the Inflation Reduction Act, which offers tax breaks for the domestic green energy sector worth tens of billions of dollars. Lithium producers gained access to production tax credits equalling 10 percent of their operating costs.

Similarly, in 2022 Canada created a 30 percent Critical Mineral Exploration Tax Credit — it was set to expire in 2024 but has now been extended an additional year. The government estimates it will be worth C$65 million, offering a tax break to junior mineral exploration companies and for investors in the sector as well.

The European Union has introduced a host of acts to support lithium mining and processing, including the Critical Raw Materials Act, which lists lithium as one of 34 critical raw materials. The act urges member nations to begin mining 10 percent of the materials the EU needs, lithium included, and increase processing to 40 percent of the EU's needs by 2030. The Net-Zero Industry Act furthers these goals.

Collaborations between nations have also been underway to support new lithium opportunities. Chile has already secured tax breaks through the US Inflation Reduction Act, and the EU has tried to pen a similar arrangement.

As well, in 2023, a panel that took place in Mexico discussed the idea of creating an international organization to guide the production and exportation of lithium — the hope being such a group could encourage an environmentally responsible worldwide supply chain based on cooperation, no coercion.

Projects with promise

Currently, many countries who seek to become more self-sufficient in lithium production, in fact, have very little underway. Europe has one operational lithium mine in Portugal that produces low-grade ore while the US has Albemarle’s Silver Peak mine in Nevada.

New processing endeavours include Full Circle Lithium’s (TSXV:FCLI,OTCQB:FCLIF) lithium carbonate facility in Georgia, which just closed $1.5 million in private placement financing, and has completed a modular demonstration plant that will scale to full commercial production.

Lithium Americas (TSX:LAC,NYSE:LAC) is set to take advantage of lithium deposit in Thacker Pass in Nevada, and create battery-quality lithium carbonate in a continuous production process. The project has $650 million in backing from General Motors and is set to produce 40 kilotonnes of lithium carbonate in phase one.

With proven expertise having built spodumene mines and lithium refineries before, Lithium Universe (ASX:LU7) is focused on closing the lithium conversion gap in North America. In line with this, the company is building the Bécancour Lithium Carbonate Refinery in Quebec, Canada, which aims to serve the North American and European markets with battery-grade lithium carbonate.

Led by lithium mining pioneer Iggy Tan, the company has assembled a ‘dream team’ that is moving the company toward its goal of becoming a key player in the critical minerals and battery supply chain, a statement from Lithium Universe’s website says. The Bécancour Lithium Carbonate Refinery is part of Lithium Universe’s Québec lithium processing hub strategy, which also includes a stand-alone spodumene concentrator.

In a similar model, Frontier Lithium (TSX:FL,OTCQX:LITOF) aims to mine and process a fully integrated lithium operation in Ontario, Canada. It’s a joint venture with Mitsubishi (TSE:8058) via an initial deal of acquiring 7.5 percent in the venture for C$25 million.

Lithium-rich Australia is now expanding some of its mining operations to include conversation capabilities. That includes the Kemerton plant, run by Albemarle, which is slated to produce 100,000 tonnes of lithium hydroxide upon completion.

Investor takeaway

Lithium conversion facilities are becoming an attractive investment opportunity across the globe as nations vie to secure supply chains by offering incentives for projects and investors. With lithium-ion batteries a key component for a myriad of green products, this once underdeveloped industry — at least outside of China — is set to transform.

This INNSpired article was written as part of an advertising campaign for a company that is no longer a client of INN. This INNSpired article provides information which was sourced by INN, written according to INN's editorial standards, in order to help investors learn more about the company. The company’s campaign fees paid for INN to create and update this INNSpired article. INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled. If your company would benefit from being associated with INN's trusted news and education for investors, please contact us.