Overview

Nigeria is the biggest oil producer in Africa. It holds the largest oil and natural gas reserves on the continent and is one of the world's largest exporters of liquefied natural gas (LNG). With crude oil prices rising, this African nation presents investors with world-class investment and production potential in one of the world's most prolific hydrocarbon basins, the Niger Delta.

In 2020, the country announced plans to increase its oil reserves, including condensates, substantially to 40 billion barrels by 2025. With a current uplift in exploration programs from other proven undeveloped marginal fields, getting entry-level access to Nigeria's exploration and unparalleled production potential could mean significant returns for willing investors.

Decklar Resources Inc. (TSXV: DKL,OTCQX: DKLRF) is an independent international oil & gas company focused on low-risk appraisal and development opportunities in the prolific West African region. Decklar is currently focused on its flagship Oza Oil Field in Nigeria.

The Oza Oil Field contains up to 12 zones of conventional stacked sands, allowing for vertical drilling and conventional horizontal development drilling. Leveraging excellent infrastructure in a prolific oil & gas jurisdiction presents excellent production and development opportunities.

Over the next 12 months, Decklar expects extensive well drilling and exciting development activities at the Oza Oil Field. Its two-phase development program in 2021 and into 2022 could lead to production levels as high as between 5,000 and 10,000 barrels per day with high-margin, high-quality oil, according to Decklar Resources CEO, Duncan T. Blount.

In March 2021, the company announced it completed a private placement financing for approximately US$3.7 million. Proceeds were put immediately towards advancing operational activities to re-enter the Oza-1 by contracting a drilling rig. In August 2021, Decklar has advanced its re-entry and development plans where pulling of existing tubing and 5 ½ inch casing from the Oza-1 wellbore has been successfully completed, and the 9 ⅝ inch casing was cleaned out. Surface testing facilities are currently being installed, and it is anticipated that testing activities on the L2.6 zone are expected to commence early next week with the initial perforation and flow operations.

The company operates a tight share structure with a fully-diluted share capital of 110,608,818. Its acquisition of Decklar Petroleum Ltd. in 2020 pushed the company closer to becoming a more dominant player in the oil & gas space with this high-quality development project with near-term production potential.

Decklar Resources is dedicated to oil & gas best practices and supporting local communities through various government initiatives, indigenous partnerships, and sustainable project development. Likewise, its emphasis on local community development manifests in its ability to create opportunities to support the independent indigenous oil & gas sector and ensure stakeholder satisfaction.

The leadership team of Decklar Resources comprises top experts with years of focused experience in all aspects of Nigerian oil & gas development, local community relations, financial management, and capital markets. Combined, they equip the company with a proven team that can deliver excellent growth potential and fast-tracked development and production possibilities.

Company Highlights

- Decklar Resources is an independent international oil & gas company focused on low-risk appraisal and development opportunities in the prolific West African region. The company has its flagship Oza Oil Field prospect in Nigeria.

- In July 2020, the company closed its acquisition of Nigeria-based Decklar Petroleum Limited, which has a Risk Service Agreement with Millenium Oil and Gas Company Limited on the Oza Field.

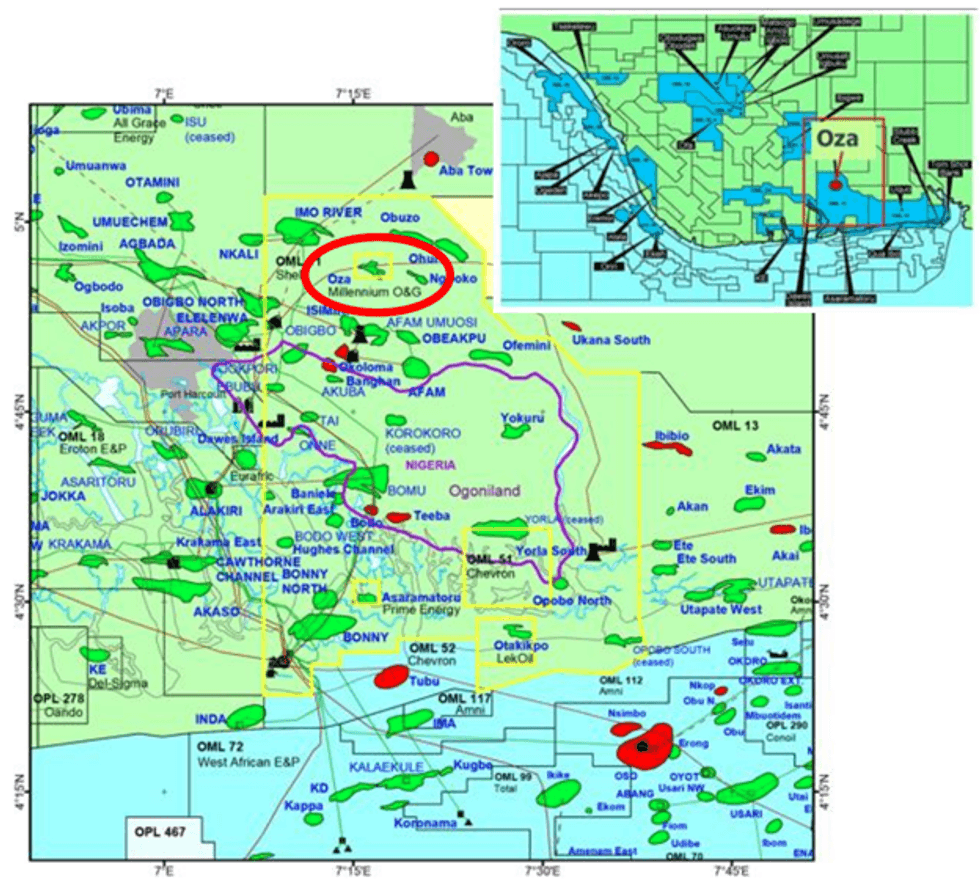

- The Oza Field is located onshore in the northern part of Oil Mining License (OML) 11 in the eastern Niger Delta of Nigeria. The asset leverages excellent infrastructure, including export pipeline access tied into the Trans Niger Pipeline.

- 2021 and early 2022 plans involve involve a two-phase development program, which schedules a rig mobilizing to the Oza Field with re-entry activities estimated to start imminently. The second phase of development involves additional well drilling and well tie-ins to existing infrastructure.

- Its re-entry program presents low-risk development opportunities in proven undeveloped oil fields. The company could see production levels as high as 10,000 barrels per day in the advancement of its development program.

- Decklar announced the commencement of completion operations for the Oza-1 well re-entry.

- Decklar announced the final completion installed in the Oza-1 well composed of a single 2 7/8 inch tubing string, with a selective zone sliding sleeve configuration.

Get access to more exclusive Oil and Gas Investing Stock profiles here