The Conversation (0)

On Friday, the much-anticipated ETF was rejected by the US Securities and Exchange Commission.

There goes the Winklevoss Bitcoin ETF. On Friday, the much-anticipated ETF was rejected by the US Securities and Exchange Commission.

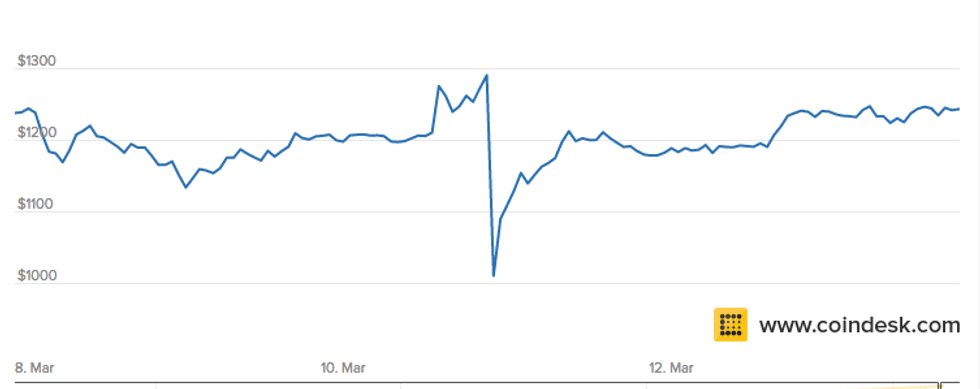

On Friday morning, the cryptocurrency traded to $1,206.10 and plunged to a low of $1,010.00 by Friday night. However, Bitcoin slowly recovered and opened at $1,229.51 on Monday.

In a public statement, the US SEC stated that the rejection was due to the trading risks involved, specifically in preventing, “fraudulent and manipulative acts and practices.”

The agency further stated, “First, the exchange must have surveillance-sharing agreements with significant markets for trading the underlying commodity or derivatives on that commodity. And second, those markets must be regulated.”

According to a statement on CoinDesk, Tyler Winklevoss is still optimistic in bringing the ETF to market, saying, “[W]e began this journey almost four years ago, and are determined to see it through. We agree with the SEC that regulation and oversight are important to the health of any marketplace and the safety of all investors.”

Corey Johnson of Bloomberg said, “There was hope that this Bitcoin ETF would provide more liquidity in the marketplace to make it less volatile. The SEC didn’t see it that way and decided to pull out of it.” He also suggested that trading in China may actually be the reason of Bitcoin’s move in price.

Johson’s statement is something INN has heard before. In a previous article, Kevin Hobbs of Vanbex Group said that he believes Bitcoin already has a solid base and that if the ETF is rejected, a slight decline in the price is expected–which was evident on Friday’s charts. Hobbs told INN at the time that, “I think it will regain its steam and stay on course to hit about $2,000 USD by year’s end.”

Kraken CEO, Jesse Powell, also told INN that Bitcoin’s fundamentals — growing demand and limited supply — are the reasons behind Bitcoin’s steady rise in price. Although, Powell said that, “a publicly traded ETF in the US makes bitcoin more accessible to a greater number of people and financial entities.”

The Winklevoss Bitcoin Trust may not have seen the light of day for now, but as cryptocurrencies are in its early days, things will continue to evolve. As Bloomberg wrote, “Friday’s decision doesn’t close the door on a possible future exchange-traded fund based on bitcoin, but it makes the path more complicated.”

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Pia Rivera, hold no direct investment interest in any company mentioned in this article.