Solution Financial Inc. (TSXV:SFI), today announced its financial results for the quarter ending July 31, 2019.

Solution Financial Inc. (TSXV:SFI) (the “Company”) a leading provider of luxury automotive and yacht leasing in British Columbia, today announced its financial results for the quarter ending July 31, 2019.

Earning Highlights for the Quarter

- Net income increased to $98,565 and Adjusted net income(1) increased to $228,261

- Net revenue increased 12% over the prior quarter to $1,904,391

- Gross in-house leasing, brokering and sales transactions increased to $8.8 Million

- Dividend initiated at $0.001 per common share per quarter with the first payment made on September 15, 2019.

“Our one-year anniversary as a public company marked an impressive achievement with over 100% growth in our operating lease portfolio by July 31, 2019,” said Bryan Pang, Solution’s CEO. “After a year, we’ve now settled in as a public company and are focused on growth and improving our bottom line. Fiscal Q3’s increase in business volume and our subsequent months performance led us to hit our target $20 million of operating lease assets ahead of our original year end target. Having completed this milestone and coupled with strong cash flows from operations, our board approved a quarterly $0.001 dividend to our common shareholders which commenced on September 15, 2019. This dividend represents a more tax advantageous management compensation strategy that will further improve our profitability as well as provide a direct return to our existing and new investors who are looking for a growth-oriented investment with a cash dividend,” concluded Bryan Pang.

Financial Results

Solution is reporting a net income of $98,565, or $0.001, per share for the third quarter of 2019. This compares to a net loss of $2,026,444, or $0.032 per share for the same period in 2018.

Adjusted net income for the quarter ended July 31, 2019 was $228,261(1) or $0.003 per share compared to $103,127 or $0.002 per share for the same period in 2018. Adjusted net income excludes the accretion expense related to convertible debentures of $46,827, share-based compensation expense of $24,904 for stock compensation, income tax expense of $49,364 and amortization expense of $8,601.

Our operating cash flow for the quarter ended July 31, 2019 increased to $1,228,668 compared to $1,117,265 for the second quarter ended April 30, 2019.

Lease Portfolio

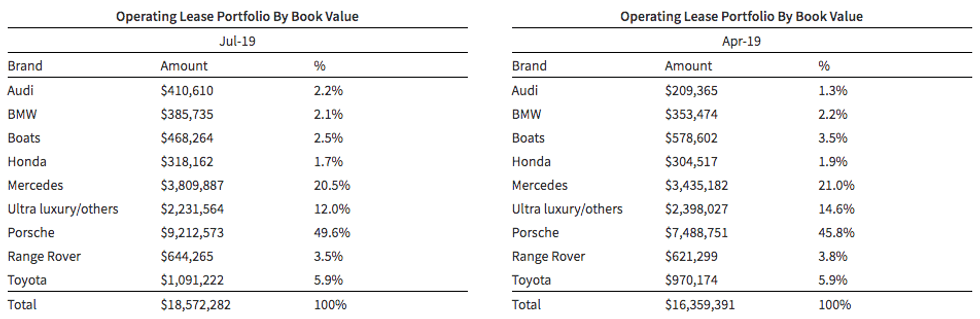

At July 31, 2019, Solution had 266 vehicles on lease, a net increase of 21 vehicles and $2.12 Million for the three-month period ending July 31, 2019 and a net increase of 59 vehicles and $6.30 Million for the nine month period ending July 31, 2019 to bring the total operating lease portfolio to $18.6 Million.

At July 31, 2019, the average remaining lease term for the portfolio dropped to 2.16 years, weighted by net book value for each vehicle. At July 31, 2019, Solutions’ 266 leases were generating annualized rental revenue of approximately $4.3 Million, a 11.91% increase during the quarter.

About Solution

Solution Financial commenced operations in 2004 and specializes in sourcing and leasing luxury and exotic vehicles, yachts and other high value assets. Solution works with a select group of automotive and marine dealerships providing lending solutions to clients who cannot obtain leasing terms with traditional Canadian financial institutions or other sub-prime lenders. Typical customers include new immigrants, business owners and international students. Solution Auto provides a unique leasing experience whereby it partners with its clients to help them navigate the challenges of acquiring, insuring, maintaining and upgrading vehicles and luxury assets in Canada.

No securities of the Company (including, for greater certainty, the Shares issued to the former Solution shareholder, on conversion of the Subscription Receipts or pursuant to the Non-Brokered Placement) have been or will be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or the securities laws of any state, district or commonwealth of the United States (as defined in Regulation S under the U.S. Securities Act). Accordingly, these securities may not be offered or sold, directly or indirectly, within the United States or to or for the account or benefit of any “U.S. Person” (as defined in Regulation S under the U.S. Securities Act), absent an exemption from the registration requirements of the U.S. Securities Act and applicable state securities laws. This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described in this news release in the United States or any jurisdiction where such offer or sale would be unlawful, or for the account or benefit of any U.S. Person or person within the United States.

Note 1- Non-IFRS Financial Metrics

Solution provides all financial information in accordance with International Financial Reporting Standards (“IFRS”). To supplement our consolidated financial statements presented in accordance with IFRS, we are also providing with this press release, certain non-IFRS financial measures, including Adjusted Net Income. In calculating these non-IFRS financial measures, we have excluded certain transactions that are not necessarily indicative of our ongoing operations or do not impact cash flows.

Cautionary Statement Regarding Forward- Looking Statements

This press release contains “forward-looking information” as defined under applicable Canadian securities laws. This information includes, but is not limited to, statements concerning our objectives, our strategies to achieve those objectives, as well as statements made with respect to management’s beliefs, plans, estimates, projections and intentions, and similar statements concerning anticipated future events, results, circumstances, performance or expectations that are not historical facts. Forward-looking information generally can be identified by the use of forward-looking terminology such as “outlook”, “objective”, “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “should”, “plans” or “continue”, or similar expressions suggesting future outcomes or events. Such forward-looking information reflects management’s current beliefs and is based on information currently available to management. Forward-looking information is not a guarantee of future performance and is subject to numerous risks and uncertainties, including those described in this press release. Solution’s primary business activities are both competitive and subject to various risks. These risks include market, credit, liquidity, operational and legal and regulatory risks and other risk factors including, without limitation: volume of new financings and mergers and acquisitions, dependence on key personnel and sustainability of fees. Other factors, such as general economic conditions, including interest rate fluctuations, may also have an effect on Solution’s results of operations. Many of these risks and uncertainties can affect Solution’s actual results and could cause its actual results to materially differ from those expressed or implied in any forward-looking information disclosed by management or on its behalf. For a description of additional risks that could cause our actual results to materially differ from our current expectations, see “Risk Management” and “Risk Factors” in the Third Quarter 2019 MD&A and “Risk Factors”. These risks and uncertainties are not the only ones facing Solution. Additional risks and uncertainties not currently known to us or that we currently consider immaterial may also impair the operations of the Solution.

Material assumptions or factors underlying the forward-looking information contained in this press release include, but are not limited to, “Third Quarter 2019 Financial Highlights” and “Liquidity and Capital Resources” sections of the Third Quarter 2019 MD&A. Although forward-looking information contained in this press release is based upon what management believes are reasonable assumptions, there can be no assurance that actual results will be consistent with this forward-looking information. Certain statements included in this press release may be considered a “financial outlook” for purposes of applicable Canadian securities laws, and as such the financial outlook may not be appropriate for purposes other than this press release.

The forward-looking information contained in this press release is made as of the date of this press release and should not be relied upon as representing Solution’s views as of any date subsequent to the date of this press release. Except as required by applicable law, management and Solution’s Board of Directors undertake no obligation to publicly update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

For further information please contact Sean Hodgins at (778) 318-1514.

ON BEHALF OF THE BOARD

(signed) “Bryan Pang”

Brian Pang

President, CEO and Director

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release does not constitute an offer to sell or a solicitation of an offer to sell any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

Click here to connect with Solution Financial Inc. (TSXV:SFI) for an Investor Presentation