Marble Financial Signs Definitive Agreement to Acquire Score-up, Inc. and Credit Meds Corp.

MLI Marble Lending Inc. (CSE:MRBL, OTCQB:MRBLF) (“Marble” or the “Company”) is pleased to announce that it has entered into a definitive agreement (the “Definitive Agreement”) to acquire Score-Up Inc. (“Score-Up”) (TM: “Score-Up!”), a market leading personal finance and credit management proprietary technology platform, and Credit Meds Corp. (“Credit Meds”), an Ontario-based credit coaching company that offers debt restructuring alternatives by utilizing its proprietary financial wellness diagnostic process.

MLI Marble Lending Inc. (CSE:MRBL, OTCQB:MRBLF) (“Marble” or the “Company”) is pleased to announce that it has entered into a definitive agreement (the “Definitive Agreement”) to acquire Score-Up Inc. (“Score-Up”) (TM: “Score-Up!”), a market leading personal finance and credit management proprietary technology platform, and Credit Meds Corp. (“Credit Meds”), an Ontario-based credit coaching company that offers debt restructuring alternatives by utilizing its proprietary financial wellness diagnostic process.

Under the terms of the Definitive Agreement, the Company is acquiring all the issued and outstanding shares of Score-Up and Credit Meds . The closing of the transaction is subject to certain customary closing conditions. As part of the transaction Patricia Giankas intends to enter into an agreement with Marble to join its management team.

“The acquisition of Score-Up strengthens our portfolio of credit re-building products designed to help underserved Canadians needing tools and guidance to improve their personal finance and creditworthiness,” states Karim Nanji, COO of Marble. “A significant segment of the Canadian population is excluded from mainstream financial services because of poor financial and credit health. Score-Up’s proprietary technology platform allows consumers to leverage artificial intelligence, data and statistics to visualize and control their finances and credit score on the road back to mainstream financial services. We are excited to have Score-Up as part of our product and solution set and elated to have Patricia join us a key addition to our executive team.”

Score-Up is a game-changing proprietary software platform that employs scientific analytical mathematical software based on rigorous credit weight algorithms, analyzing an individual’s credit data, financial information, and behavioral patterns to identify where the greatest positive impact can be achieved on a specific credit file. The software assesses an electronic version of the consumer’s credit report and furnishes specific recommendations to improve credit scores to achieve the desired score needed for credit approval and wellness.

“The acquisition of the Score-Up platform is indeed game-changing as it will provide our Company, referring partners, and their clients the ability to implement specific action plans designed and tailored to achieve a consumer’s unique credit and financial goals and lifestyle,” adds Karim Nanji.

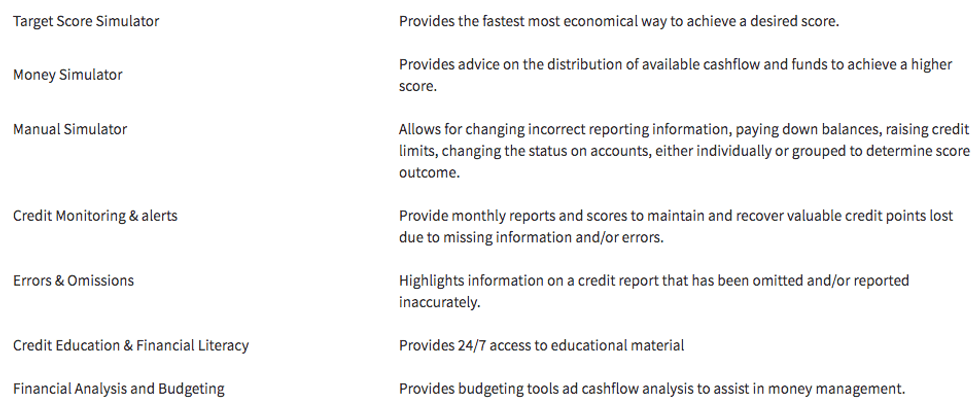

Each Score-Up subscriber will benefit from a custom plan to assist in achieving an optimal credit score using the following key features:

“Equally key in this transaction is Credit Meds. Credit Meds is a front-end diagnostic tool that will allow us to assess the financial health of a consumer and provide the appropriate prescription and recommendations towards financial wellness and recovery,” comments Karim Nanji, COO of Marble. “Together with Score-Up, Marble is now positioned to complement its lending business with software and subscription tools and services to help underserved Canadians re-build their personal finance and credit.”

“I am honoured to be joining Marble and leveraging my 30 years of experience and expertise to continue to help financially distressed Canadians,” states Patricia Giankas, CEO of Score-Up . “With our unique business model, coupled with our digital financial literacy technology, I am confident in our ability to expand our reach in assisting Canadians reach their financial capacity.”

“The acquisition of Score-Up and Credit Meds represents our first entry into additional revenue sources for Marble by expanding our credit wellness offering to the financially underserved in Canada. This B2B and B2B2C opportunity enables Marble to expand its credit rebuilding strategies and products to a far greater Canadian audience that have less than acceptable personal financial credit health,” states Mike Marrandino, CEO of Marble. “These new products will enable the company to aggressively market to the 30% of Canadians with sub-prime or near prime credit that make up $580 billion of the of the $2 trillion consumer credit Industry.” (Fraser Institute – Household Debt and Government. Debt in Canada – 2017)

Patricia Giankas has spent the last 20 years in various roles – notably, she has been a Credit Coach, Bankruptcy Insolvency Counselor, and Mortgage Broker. Prior to this, Patricia had a very successful and accomplished career within the banking industry for nearly 20 years. Along with her vast experience in the financial sector, Patricia is a life skills coach and a minister; she has helped many walk-through life’s challenges and has been of great support and guidance. Committed to financial literacy for all, Patricia has authored The Power of Positive Credit and Great Credit NOW. She has co-authored several other books, and also writes monthly for an online magazine.

ON BEHALF OF THE BOARD OF DIRECTORS,

Mike Marrandino, President & CEO

Score-Up offers exclusive Personal Credit and Financial Wellness programs unique to the individual. As an online Financial and Credit Wellness company, Score-Up maximizes financial and credit worthiness of its clients by making sure that credit reports accurately reflect financial responsibility and educating the consumer about how finance and credit impacts a vast array of today’s decision makers whether they be lenders, employers, insurers or other industry. For further information, please visit the Company’s website at www.score-up.ca

Credit Meds has been in business since 2011, helping Canadians with evaluating their credit challenges. Its proprietary financial diagnostic processes can quickly determine the best course of action to start down the path of debt restructuring and credit wellness.

About MLI Marble Lending Inc.

MLI Marble Lending Inc., dba Marble Financial (CSE: MRBL) (OTCQB: MRBLF) provides Canadians with a second chance to rebuild their credit and to fast track their way back to mainstream lending using socially responsible lending and fintech solutions. Since 2016, the Company’s flagship product has funded in excess of $10 million in loans and helped over 1,100 Canadians rebuild their credit scores. Marble’s proven consumer credit rebuilding strategy accelerates the timeline for its consumers by 50% relative to the current traditional methods available through Consumer Proposals.

For further information, please visit the Company’s website at www.marblefinancial.ca .

Mike Marrandino, CEO, Director

Email: ir@marblefinancial.ca

Forward-Looking Information

All statements in this press release, other than statements of historical fact, may constitute “forward looking information” with respect to Marble within the meaning of applicable securities laws. Forward-looking information is often, but not always, identified by the use of words such as “seek”, “anticipate”, “plan”, “continue”, “planned”, “expect”, “project”, “predict”, “potential”, “targeting”, “intends”, “believe”, “potential”, and similar expressions, or describes a “goal”, or a variation of such words and phrases or state that certain actions, events or results “may”, “should”, “could”, “would”, “might” or “will” be taken, occur or be achieved. This forward-looking information includes statements with respect to, among other things, discussions of future plans and forecasts and statements as to management’s expectations and intentions with respect to the Company’s acquisition of Credit Meds and Score-Up and the expected financial impact of this acquisition.

Forward-looking information is subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those expressed or implied by the forward looking information, including, without limitation, the ability to obtain the consents and approvals and fulfill the conditions required for closing, the Company realizing on the anticipated value of the acquisition of Credit Meds and Score-Up, the ability of the Company to integrate Credit Meds and Score-Up, general economic conditions or conditions in the financial markets and the risks identified in the Company’s Management Discussion & Analysis and other continuous disclosure. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking information. In connection with the forward-looking statements contained in this and subsequent press releases, the Company has made certain assumptions about its business and the industry in which it operates. Although management believes that the assumptions inherent in the forward-looking statements are reasonable as of the date the statements are made, forward-looking statements are not guarantees of future performance and, accordingly, undue reliance should not be put on such statements due to the inherent uncertainty of the statements. The Company’s forward-looking information is based on the beliefs, expectations and opinions of management on the date the statements are made, and the Company does not assume any obligation to update forward-looking information, whether as a result of new information, future events or otherwise, other than as required by applicable law. For the reasons set forth above, readers should not place undue reliance on forward-looking information.

Click here to connect with MLI Marble Lending Inc. (CSE:MRBL) for an Investor Presentation.

Source: www.newsfilecorp.com