What is a Preliminary Economic Assessment?

What is a preliminary economic assessment? Here’s a look at the information they include and their importance to the mining process.

Preliminary economic assessments are critical for determining the economic viability of a resource project.

Mining companies require positive assessments in order to justify investing more capital in moving the project through to development. Knowing what a preliminary economic assessment is will help new market participants better understand the investment value of a mining company and its assets.

Read on for a more in-depth look at the information that preliminary economic assessments include, and why they are a crucial part of the mineral resource exploration and mining process.

What is a preliminary economic assessment?

A preliminary economic assessment, sometimes abbreviated as PEA, is defined as a study that includes an economic analysis of the potential viability of a mining project’s mineral resources.

Also called scoping studies, PEAs helps mining companies understand risks and uncertainties associated with a project.

Before a mineral resource project becomes a mine, several technical studies must be completed on a deposit to ensure its economic viability. Completing a PEA in mining is one of the first steps in the process, with prefeasibility and feasibility studies following.

All of these studies analyze and assess the same geological, engineering and economic factors; however, they include significantly different levels of detail and precision.

For example, unlike a prefeasibility study or feasibility study, PEAs may contain metallurgical testing results based on an inferred mineral resource. That means the mineral resource estimate in a PEA may be based on limited information and sampling of the mineralization compared to the studies that come after.

PEAs must either be presented in the form of a technical report, or supported by a technical report. In some cases, the technical report must be independent.

What’s in a preliminary economic assessment?

Generally, PEAs will include base-case information on the capital costs associated with bringing a project into production, an estimate of how the mine will operate once it is built, how much metal and money it will produce and what operating costs the project will incur.

A preliminary economic assessment should also include a mine plan. More specifically, a PEA tends to have information on pre-production capital costs, life-of-mine sustaining capital, mine life and cash flow, as well as details on processing and production methods and rates.

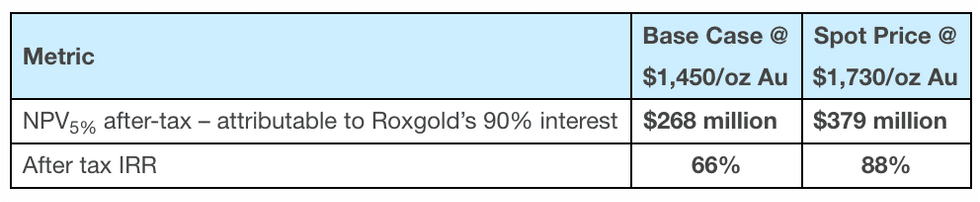

PEAs also include information on project economics at various metal prices. For example, the PEA for the Séguéla gold project in Côte d’Ivoire, then owned by Roxgold and now held by Fortuna Silver Mines (TSX:FVI,NYSE:FSM), outlines how the project will perform before and after tax in two different gold price scenarios:

What comes after a preliminary economic assessment?

After producing a positive PEA, a company can move on to prefeasibility and feasibility studies.

As explained, these studies look at the same geological, engineering and economic factors, but at a higher level of detail and precision. They can help determine factors such as operating costs and potential ounces or metric tons to be mined for commodities such as precious metals and base metals.

Prefeasibility and feasibility studies can also offer insight into the average grade of the resources that will eventually be mined. Additionally, they account for impactful future events, such as community issues, geographic obstacles and permit challenges. They should include multiple options for tackling different issues.

Once a prefeasibility study has been reviewed and approved, companies then move on to complete a feasibility study, which includes fewer assumptions and more hard facts.

Feasibility studies contain similar content, but are much more accurate than prefeasibility studies in their assumptions and require more resources to conduct. These studies are intended to evaluate if a mineral reserve can be mined effectively and if it will be profitable. Detailed mining feasibility studies are also used as the basis for a project’s capital estimates, operating costs and overall economic viability.

To learn more about how issuers determine potential viability for their assets, click here for details on prefeasibility and feasibility studies and here for more on the full lifecycle of mining.

This is an updated version of an article first published by the Investing News Network in 2019.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.