The US Relied 100 Percent on Imports for 21 Minerals in 2017

US Geological Survey reported that in 2017, the US was 100 percent import reliant on 21 minerals, including rare earths, manganese and vanadium.

US mines produced an estimated $75.2 billion of raw mineral materials in 2017, up 6 percent year-on-year.

But according to the US Geological Survey (USGS), the country continues to rely on foreign sources for various raw and processed mineral materials.

In a report released last Wednesday (January 31), the USGS National Minerals Information Center states that the US is still 100 percent important reliant on 21 mineral commodities, including rare earths, manganese, niobium and vanadium. This number has increased from just 11 mineral commodities in 1984.

Thirteen mineral commodities produced in the US were worth more than $1 billion each in 2017. The estimated value of US industrial minerals output was $48.9 billion, 3 percent more than in 2016.

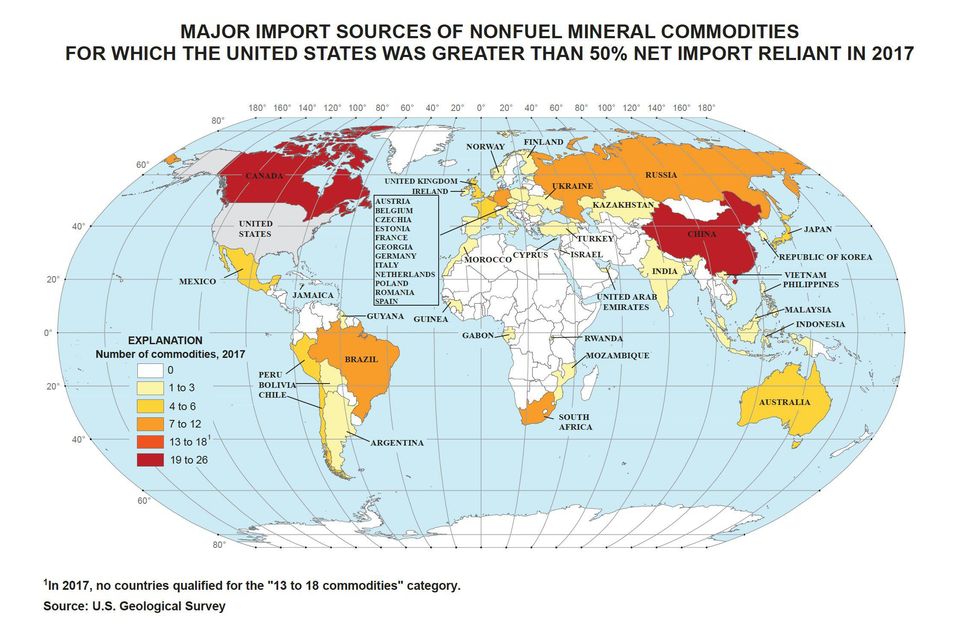

Countries that supply mineral commodities for which the US was more than 50 percent import reliant in 2017. Map via the USGS.

The USGS estimates that US metal mine production in 2017 was $26.3 billion, 12 percent higher than the amount seen in 2016. While most metals experienced higher prices in 2017, domestic production was lower than the previous year.

Other significant findings from the report are as follows:

- Aluminum: Production of primary aluminum decreased for the fifth consecutive year, declining by about 12 percent in 2017 to the lowest level since 1951. US imports of aluminum increased by 16 percent in 2017.

- Rare earths: The suspension of US rare earths mining in late 2015 continued throughout 2017. In Nebraska, one company commissioned an operation that produced separated rare earth oxides from recycled fluorescent light bulbs. The company plans to ramp up production to 18 tons per month using a proprietary technology.

- Gold: Two new gold mines opened in late 2016 and 2017, one in Nevada and one in South Carolina — this was the first gold mine east of the Mississippi River since 1999.

- Cobalt: Average annual cobalt prices more than doubled owing to strong demand from consumers, limited availability of cobalt and an increase in metal purchases by investors.

- Lithium: Strong demand drove the average price of lithium up 61 percent in 2017 vs. 2016.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Nicole Rashotte, hold no direct investment interest in any company mentioned in this article.