TriStar Gold (TSXV:TSG,OTCQX:TSGZF) has launched its campaign on the Investing News Network.

TriStar Gold (TSXV:TSG,OTCQX:TSGZF) has launched its campaign on the Investing News Network. The company recently completed a US$8 million agreement with Royal Gold (NASDAQ:RGLD) regarding its acquisition of a 1.5 percent net smelter royalty (NSR) on TriStar’s Castelo de Sonhos property. TriStar Gold is a fully funded gold exploration and development company focused on expanding its resources in Brazil.

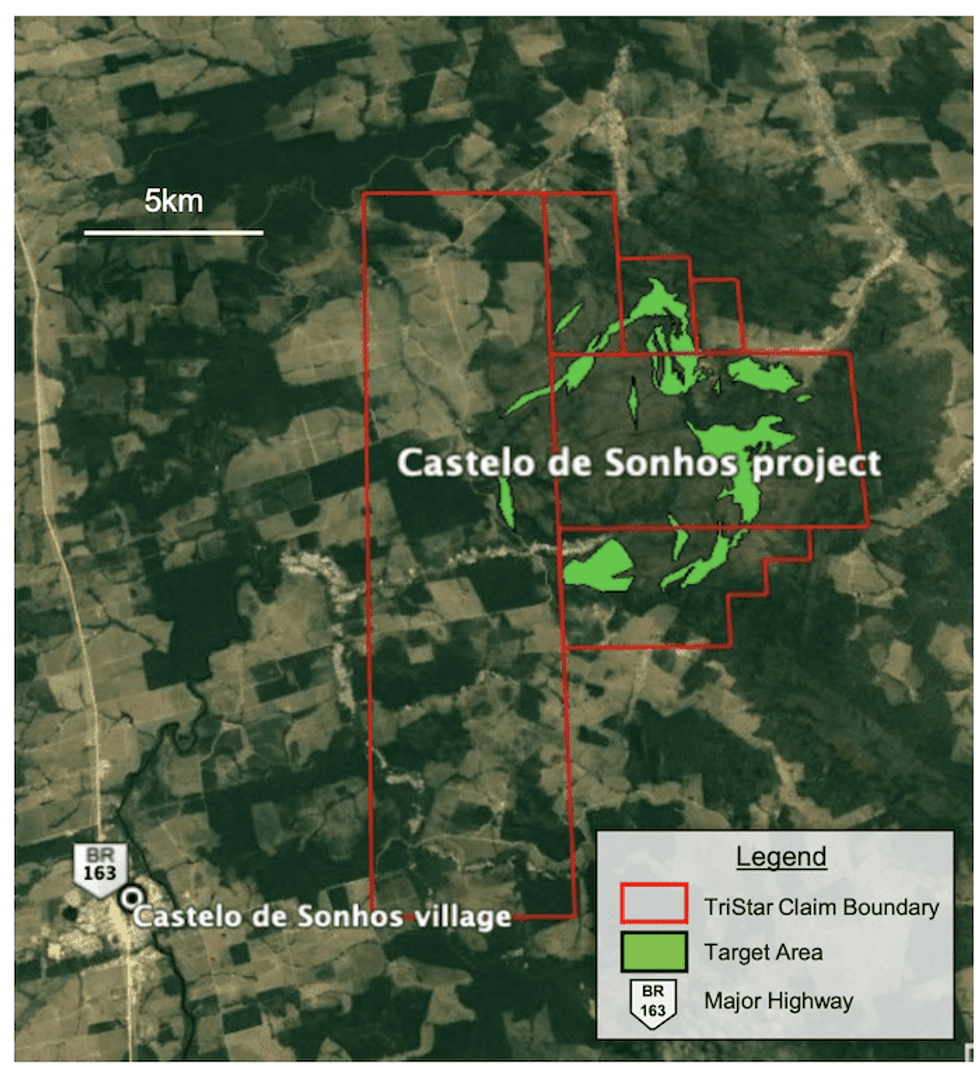

TriStar Gold’s Castelo de Sonhos project has a combined total 2-million-ounce National Instrument 43-101 resource estimate of 17.7 million tonnes of gold in the indicated category at 1.2 grams per tonne (g/t), totaling 0.7 million ounces of gold. In the Inferred category, the estimate highlights 39.8 million tons at 1 g/t. A preliminary economic assessment (PEA) conducted in November 2018 indicates a pre-tax internal rate of return (IRR) of 51 percent at a gold price of US$1,250, a pre-tax net present value (NPV) of US$319 million and a post-tax NPV of US$264 million. At $1,750 gold and 5:1 exchange rate pre-tax IRR is 100% and NPV is US$730 million. The company has initiated a prefeasibility study (PFS) with results aimed for the second quarter of 2021.

TriStar Gold’s Company Highlights

- TriStar Gold is a fully funded gold exploration development company with a wholly owned 17,177 property in Pará, one of Brazil’s major mining jurisdictions.

- The company completed a US$8 million agreement with Royal Gold for an acquisition of 1.5 percent NSR on TriStar’s flagship Castelo de Sonhos project.

- The Castelo de Sonhos project has a combined total 2-million-ounce NI 43-101 resource estimate of

- 17.7 million tonnes of gold at 1.2 g/t and 0.7 million ounces of gold in the Indicated category and

- 39.8 million tonnes at 1 g/t containing 1.3 million ounces gold in the Inferred category.

- The company has completed a PEA indicating:

- pre-tax IRR of 51 percent at a gold price of US$1,250

- 100% at US$1,750 and current exchange rate

- pre-tax NPV 5% of US$319 million and a post-tax NPV 5% of US$264 million

- US$730 million at US$1,750 and current exchange rate

- pre-tax IRR of 51 percent at a gold price of US$1,250

- A PFS is close to being complete, with results expected to increase valuations.

- The project benefits from significant exploration upside potential.