Gold Price Steady After Macron's French Election Win

Centrist candidate Emmanuel Macron took 66 percent of the vote compared to far-right candidate Marine Le Pen’s 34 percent.

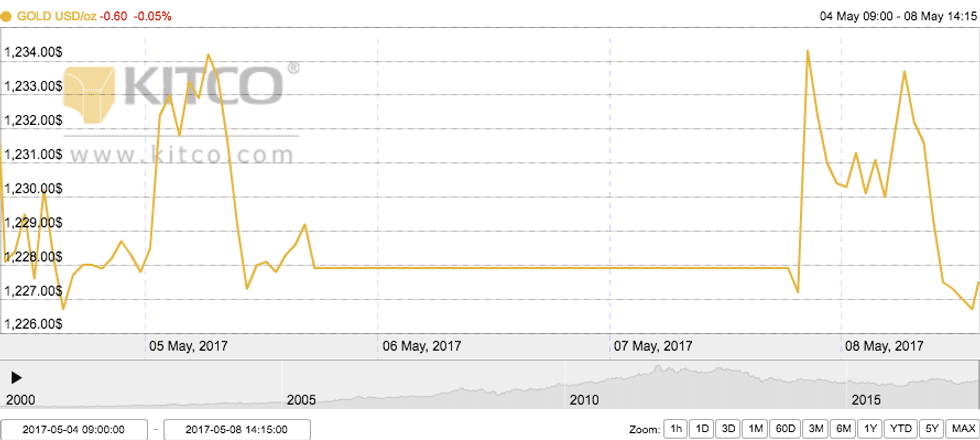

The French presidential election had some gold-focused investors worried, but as of Monday (May 8) at 2:00 p.m. EST, the yellow metal was changing hands at $1,227.50 per ounce.

That’s about where it was sitting at close of day Friday (May 5), and market watchers seem to agree that the lack of change means centrist candidate Emmanuel Macron’s victory this past weekend was largely priced into the market.

“What we’re seeing this morning is a classic case of the rumor — or the expected result in this case — being bought and the fact being sold,” Craig Erlam, a currency strategist at Oanda, explained to MarketWatch. “The [broad market] gains over the last couple of weeks since Macron’s first round victory have been substantial and it would appear the trade has exhausted itself.”

Similarly, ANZ analyst Daniel Hynes told Reuters, “[l]eading into the election, with many polls predicting Macron’s victory, we saw safe-haven buying easing into end of last week. Confirmation that he is victorious has not resulted in any additional selling.”

The silver price also gained some traction on Monday, and was trading at $16.27 per ounce as of 2:00 p.m. EST.

Chart via Kitco: Gold’s price movement between May 4 at 9:00 a.m. EST and May 8 at 2:15 p.m. EST.

All that said, it’s worth noting that gold suffered its largest weekly loss of the year last week, and closed Friday at its lowest settlement price since mid-March. The yellow metal was buffeted by a US Federal Open Market Committee (FOMC) meeting and by stronger-than-expected US jobs data.

The FOMC meeting did not contain any concrete news about when the Federal Reserve’s next interest rate hike may be. However, the consensus seems to be that the the jobs report, which indicates that the unemployment rate was near a 10-year low in April, “likely seals the case for an interest rate increase next month despite moderate wage growth.”

Precious metals like gold and silver tend to fare better when interest rates are low and often struggles when interest rates are higher.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.