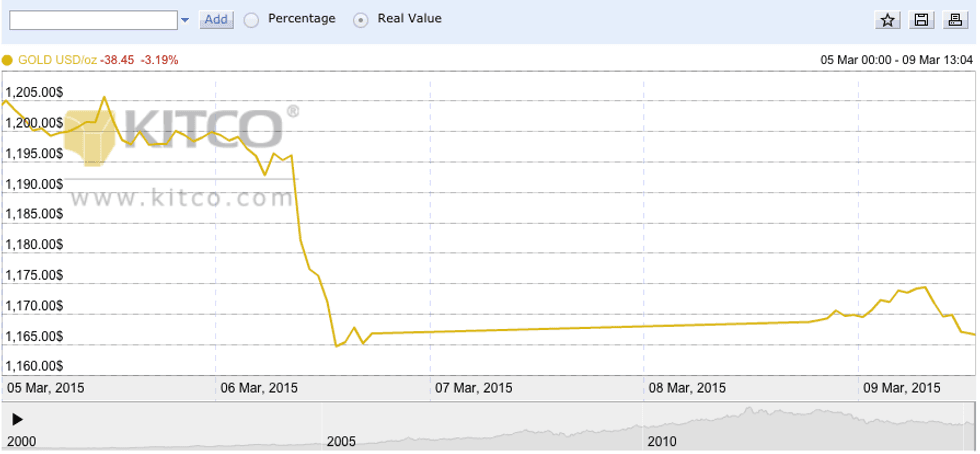

Following a precipitous drop in the gold price on Friday, UBS has lowered its price target for the yellow metal, and it isn’t the only firm seeing additional pressure for gold. Although the gold price rose every so slightly during Monday trading hours, it remained around $1,168 per ounce, or 3 percent lower than where it sat prior to the release of the latest round of US jobs data on Friday.

This article was first published on Gold Investing News on March 19 2015.

Following a precipitous drop in the gold price on Friday, UBS (NYSE:UBS) has lowered its price target for the yellow metal, and it isn’t the only firm seeing additional pressure for gold.

Although the gold price rose every so slightly during Monday trading hours, it remained around $1,168 per ounce, or 3 percent lower than where it sat prior to the release of the latest round of US jobs data on Friday. The US released better-than-expected numbers for the month of February, prompting some to believe that the Federal Reserve may raise interest rates sooner than expected.

“[G]ood US economic figures led market participants to expect the Fed to raise interest rates, which triggered the gold price slide,” states Commerzbank (OTCMKTS:CRZBY) in a recent note. The firm also points out that the positive jobs data bolstered an already strong US dollar, providing more pressure for gold. Meanwhile, investors continued to withdraw from gold ETFs, with outflows of nearly 5 tonnes from the space.

On the back of that news, UBS has brought down its price targets, setting its one-month forecast for the gold price at $1,200 per ounce, down from $1,240, and bringing its three-month target down from $1,200 to $1,170, according to The Bullion Desk. “Within a three-month time-frame, we expect the precious metals complex to come under pressure mainly on the back of gold, as market participants anticipate the first Fed rate hike,” the news outlet quotes the Swiss bank as saying.

To be sure, platinum and silver fell in tandem with gold on Friday, losing 2.4 percent and 4.4 percent, respectively. Palladium held up a bit better, remaining steady around $819 per ounce.

That said, it wasn’t all bad for gold. Commerzbank notes that the slide in the gold price across the pond was “more moderate” due to the strength of the US dollar against the euro, and the firm is positive on the outlook for the gold price in euros going forward.

“We expect the gold price in euros to continue climbing,” its note reads. “It would appear that the markets are still unable to ignore the Greek situation – according to media reports at the weekend, the country’s financial state is evidently more precarious than previously assumed, meaning that Greece could require fresh funds sooner than anticipated.” Commerzbank also points out that on Monday, the European Central Bank will begin purchasing government bonds and other securities worth 60 billion euros per month.

For its part, UBS believes that seasonal patterns in the market could also be affecting gold. “Seasonality suggests that gold may be vulnerable to the downside up ahead,” The Bullion Desk quotes it as saying. “According to historical patterns, physical demand tends to be slow during this period, but some restocking in China and the anticipation of the Akshaya Tritiya festival in India in late April could offer some support to the market in the weeks ahead, limiting further downside.”

That said, another article from The Bullion Desk states that gold buying from China has not been as robust as expected in the wake of Friday’s fall in prices, leaving some market watchers nervous about gold prices in the near term. Certainly, gold bugs will be keeping a close eye on the market to see what happens next.

Company news

Last Thursday, Goldsource Mines (TSXV:GXS,FWB:G5M) reported that it is fully financed and permitted for the start of construction at its Eagle Mountain gold project in Guyana. Phase 1 development at the project will include a 1,000-tonne-per-day open-pit mine.

The next day, Scorpio Gold (TSXV:SGN) announced plans to raise US$15 million by partnering with Coral Reef Capital. Scorpio will raise the funds through a private placement with Coral Reef, after which the firm will own approximately 49.8 percent of Scorpio’s outstanding shares. “We view Coral Reef as a sophisticated, stable, long term-strategic investor that will provide Scorpio Gold the support and financial capability to accelerate the growth of the Company,” CEO Peter Hawley said in Friday’s release.

On the exploration side of things, Algold Resources (TSXV:ALG) reported assay results of up to 57.2 grams per tonne gold in rock chip samples from its Legouessi property in Mauritania. The company reported transecting numerous quartz veins in trenches situated between two prospects at the property.

Securities Disclosure: I, Teresa Matich, hold no direct investment interest in any company mentioned in this article.