Desert Gold Closes Oversubscribed Financing and Provides Exploration Guidance

Desert Gold Ventures is pleased to announce that it has closed its previously CAD $500,000 non-brokered private placement

Desert Gold Ventures Inc. (TSXV:DAU) (FSE:QXR2) (OTC:DAUGF) (the “Company”) is pleased to announce that it has closed its previously CAD $500,000 non-brokered private placement (the “Financing) The Company raised CAD $1,283,000 through the sale of 16,037,500 Units. Securities issued as a result of closing of the Financing will be subject to a statutory hold period.

Pursuant to the terms of the Financing, each Unit was priced at CAD $0.08 and consists of one common share in the equity of the Company and one-half common share purchase warrant (a “Warrant”). Each full Warrant entitles the holder to purchase one additional common share of the Company at a price of $0.15 per share for a period of three (3) years from the closing of the Financing. In connection with closing, the Company will pay finders’ fees of CAD $46,550 and issue 581,875 non-transferable brokers warrants (a “Broker Warrant”). Each Broker Warrant entitles the holder to purchase one common share of the Company at a price of $0.15 for a period of three (3) years.

Desert Gold’s CEO Jared Scharf commented, “We were encouraged by the strong market support for this financing as the macroeconomic setting for gold continues to improve. The oversubscribed placement will allow us to do additional exploration work over several high priority targets at our roughly 400 km2 Senegal Mali Shear Zone Project.

The proceeds of the Financing will be used for drilling and other exploration related activities at the Company’s Senegal Mali Shear Zone Project in Western Mali (“SMSZ Project”) and for general corporate purposes. The Financing is subject to final exchange approval.

Exploration Guidance

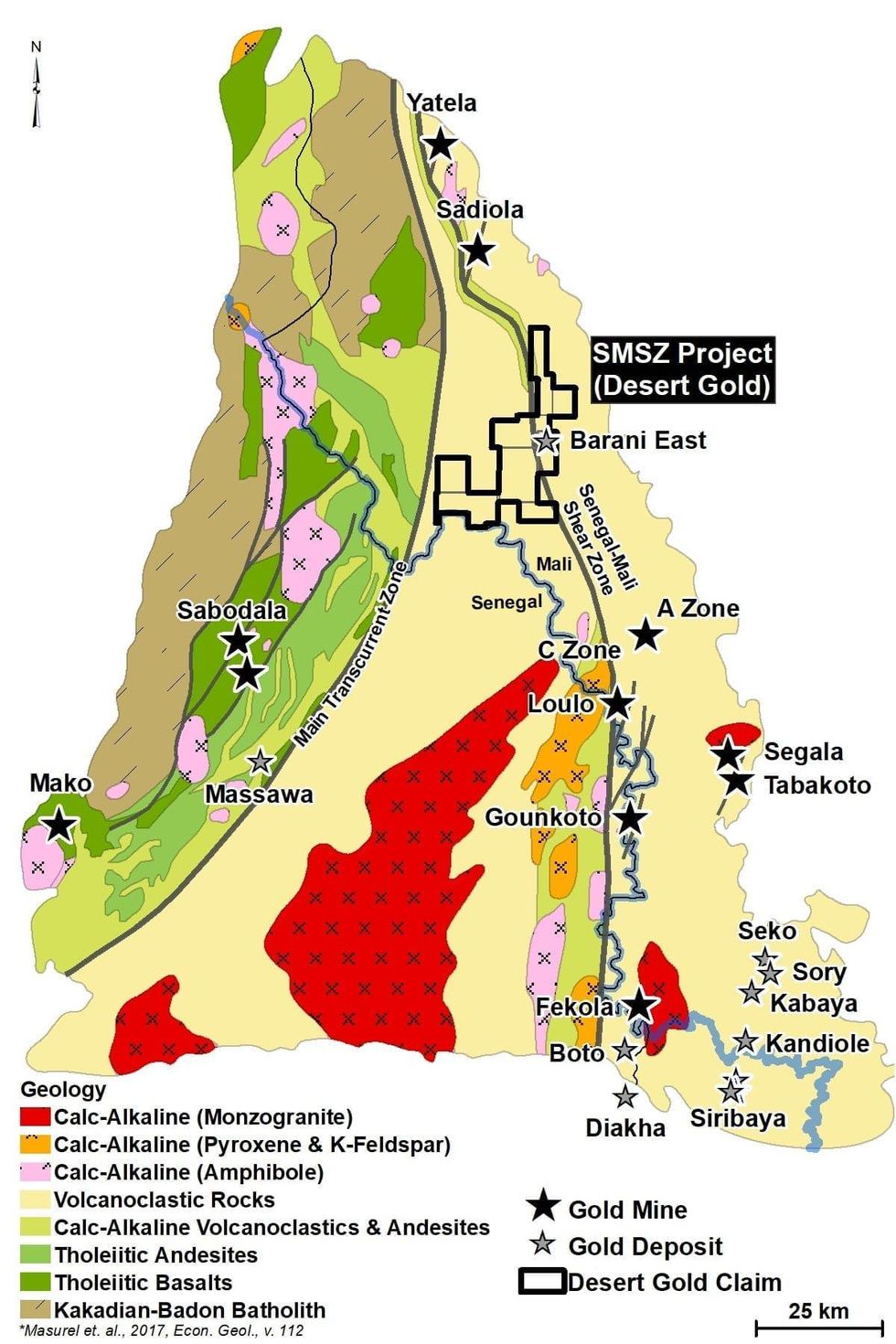

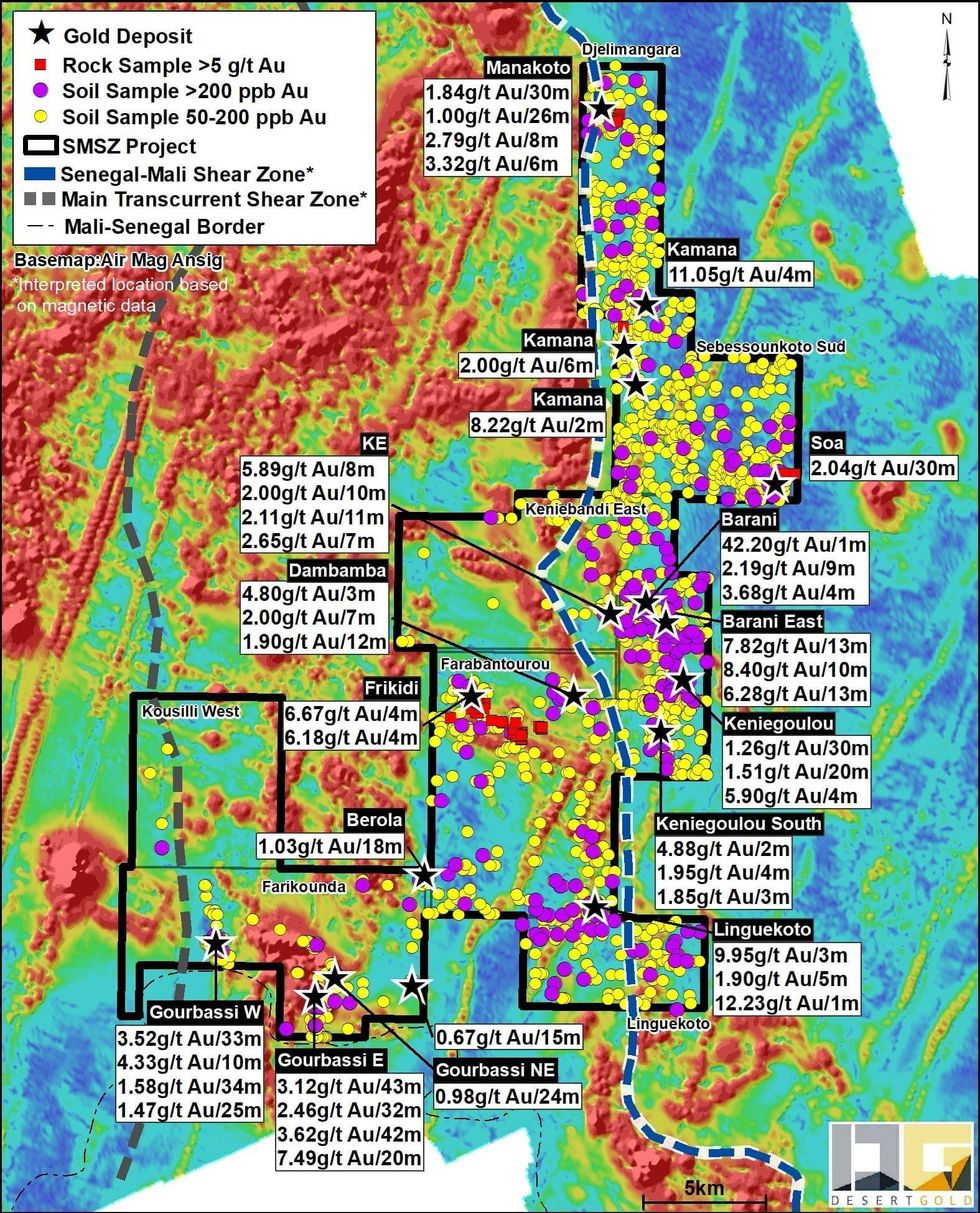

The planned program will be evenly split between mining camp-scale conceptual targets and high value drill targets that have already been defined. The bulk of the conceptual targeting comprises approximately 10,000 metres of auger drilling on wide-spaced drill fences (1.7 to 4.7 km apart) that will test below laterite-covered areas, proximal to the east side of the Senegal Mali Shear Zone, where regionally, the largest gold deposits have been discovered, including Fekola, Gounkoto, Loulo, to the south along strike, and Sadiola, to the north along strike (see Figure 1). Additional auger holes will test for extensions to gold-bearing hydrothermal breccias and along other mineralized trends that require additional definition. Core and reverse circulation drilling is planned at the Gourbassi East, Gourbassi West and Barani East areas (Figure 2), with all holes targeting extensions to know mineralization, including follow-up of an at surface intercept of 3.52 g/t gold over 33 metres (estimated 28 metres true thickness) at Gourbassi West and down plunge testing of an intercept at Barani East of 6.28 g/t gold over 13 metres (estimated 11 metres true thickness).

Note that this program is subject to work restrictions related to Covid 19 and while, currently, the planned program appears able to proceed, there is no guarantee that operating conditions will not change in the future.

This press release contains certain scientific and technical information. The Company is solely responsible for the contents and accuracy of any scientific and technical information related to it. Don Dudek, P.Geo a director of Desert Gold and a Qualified Person under National Instrument 43-101, has reviewed and approved the scientific and technical information contained in this press release.

Figure 1 – SMSZ Project Location, Regional Geology and Major Deposits in Western Mali and Eastern Senegal

Figure 2 – SMSZ Project on Color-Contoured Magnetic base with major zones and soil anomalies

On Behalf of the Board

“Jared Scharf”

___________________________

Jared Scharf

President & Director

About Desert Gold

Desert Gold Ventures Inc. is a gold exploration and development company which holds 2 gold exploration permits in Western Mali (SMSZ Project and Djimbala) and its Rutare gold project in central Rwanda. For further information please visit www.SEDAR.com under the company’s profile. Website: www.desertgold.ca

Contact

Jared Scharf, President and CEO

Email: jared.scharf@desertgold.ca

Tel. No.: +1 (858) 247-8195

This news release contains forward-looking statements. These forward-looking statements entail various risks and uncertainties that could cause actual results to differ materially from those reflected in these forward-looking statements. Such statements are based on current expectations, are subject to a number of uncertainties and risks, and actual results may differ materially from those contained in such statements. These uncertainties and risks include, but are not limited to, the strength of the capital markets, the price of gold; operational, funding, liquidity risks, the degree to which mineral resource estimates are reflective of actual mineral resources, the degree to which factors which would make a mineral deposit commercially viable, and the risks and hazards associated with mining operations. Risks and uncertainties about the Company’s business are more fully discussed in the company’s disclosure materials filed with the securities regulatory authorities in Canada and available at www.sedar.com and readers are urged to read these materials. The Company assumes no obligation to update any forward-looking statement or to update the reasons why actual results could differ from such statements unless required by law. Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release does not constitute an offer to sell or a solicitation of an offer to buy the securities described herein in the United States. The securities described herein have not been and will not be registered under the united states securities act of 1933, as amended, and may not be offered or sold in the United States or to the account or benefit of a U.S. person absent an exemption from the registration requirements of such act.