Brien Lundin: New Metals Bull Market Ahead, Gold to Maintain Momentum

Brien Lundin of Gold Newsletter said in a webinar that a new metals bull market is coming fast and hard as a result of COVID-19.

As the world and the global economy enter another phase of the COVID-19 outbreak, there’s little doubt that the virus has hit markets hard around the world.

For Brien Lundin, editor of Gold Newsletter, as terrible as the coronavirus pandemic is and has been, it has created an economic situation that is extremely compelling for precious metals.

Giving a presentation at a webinar together with members of the Discovery Group last week, Lundin said a new metals bull market is coming fast and hard, spurred on by COVID-19.

“The coronavirus isn’t the reason for the next round of currency creation, it’s just the excuse. It affects only the timing,” he said, noting that he wouldn’t have been surprised to see a round of massive stimulus even without the coronavirus.

“I was expecting a lot of the things we are seeing right now to unfold in the next three to five years,” he added. “In fact, much of it unfolded in three to five days; everything is coming at us hard and fast … we have to be ready for it and we have to be able to react and get positioned for it.”

Talking about the US Federal Reserve’s actions in the past years and its most recent interest rate cuts, Lundin said markets are addicted to easy money.

“Like an addict that is addicted to a drug, they create a tolerance to the drug,” he said. “So the markets don’t need easy money, they need even easier money.”

During his 20 minute presentation, the host of the New Orleans Investment Conference also highlighted the Federal Reserve’s debt, saying it is out of control.

“Right now, and we are just in May, the US federal budget deficit is at US$2.61 trillion, with the Congressional Budget Office estimating it will come at about US$3.5 trillion, and when have we seen (it) overestimate the deficits?” he said. “I think that’s the ‘under,’ and I will take the ‘over’ on that — I think it is going to be much more.”

The typical response to an economic slowdown is for the Federal Reserve to not only expand its balance sheet, but also reduce interest rates.

“The Federal Reserve has responded to every economic downturn with a policy of lowering interest rates, and it worked fine for awhile,” he said.

“But after every campaign of rate cuts, the next return to normalcy never got past the previous high, and not only that, but the next rate cut would have to go lower and lower.”

After 2008, rates got to zero, Lundin explained, saying that pre-2008 it was hard to believe that interest rates could go negative.

“Negative interest rates, quantitative easing and a lot of things we are accepting these days were crazy talk pre-2008; now crazy talk has become normalized,” he said. “So I am not discounting that the Federal Reserve can bring the rate fund to negative levels.”

For Lundin, the US will see negative real rates — he said he believes there’s no way the country can have consistent positive rates going forward with such a large amount of debt.

Notably, an environment with negative real rates is bullish for precious metals. Speaking specifically about gold, Lundin said there are some parallels and differences between current market conditions and the financial crisis of 2008.

“During the 2008 financial crisis we had tremendous volatility in the gold price, but fear turned to greed and investors bought gold in reaction to, at that time, unprecedented monetary stimulus,” he said.

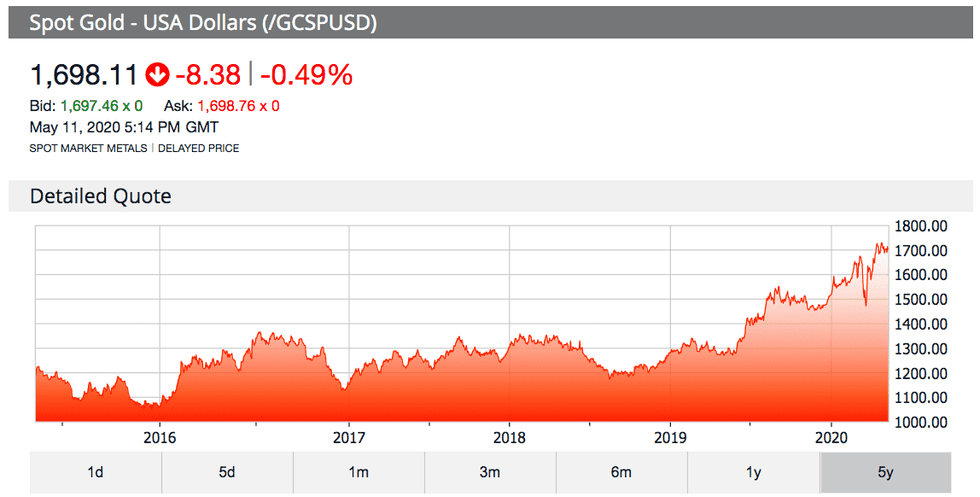

The gold price went from a low of US$700 per ounce to US$1,900, essentially more than tripling. Even though there was some volatility to get to that level, the trend was one of profitability for gold investors and mining stocks.

Looking at how the gold price has performed since its 2018 low of US$1,184, prices have increased significantly and are now trading at around US$1,700.

“What I anticipate is that we are going to have another long-term, multi-year period where we are going to be at a high level, so we will have momentum maintained in the gold market,” Lundin. “And we are going to have a similar period where there will be a lot of profits made in junior mining stocks if you get into the right companies.”

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.