Altamira Identifies Multiple Targets and is Granted an Additional 42,000ha at Apiacas Project, Alta Floresta Belt, Brazil

Altamira Gold Corp. (TSXV:ALTA) (FSE: T6UP) (OTC Pink: EQTRF), (“Altamira” or the “Company”) is pleased to report that it has been granted an additional 42,000ha within the Apiacas district in Brazil, located close to the northern margin of the Alta Floresta Belt, which is in contact with sediments of the Cachimbo Graben.

Altamira Gold Corp. (TSXV:ALTA) (FSE: T6UP) (OTC Pink: EQTRF), (“Altamira” or the “Company”) is pleased to report that it has been granted an additional 42,000ha within the Apiacas district in Brazil, located close to the northern margin of the Alta Floresta Belt, which is in contact with sediments of the Cachimbo Graben.

Highlights include;

- Granting of 42,000ha at Apiacas bringing the total land position controlled by Altamira at Apiacas to 82,000ha, including the highly prospective Mutum target which is characterized by widespread phyllic alteration and disseminated pyrite.

- Recent surface sampling by Altamira returned gold values ranging from 9.0 to 46.1 g/t gold from 9 grab samples of a total of 17 samples from the Paulinho Troca-Tiro target.

- Recognition of widespread disseminated gold mineralization associated with hydrothermal alteration over several square kilometres at the Mutum target.

Background

The Alta Floresta Gold Belt has historically produced an estimated 7-10Moz of placer gold which led Altamira to build up a large land position on several project areas previously identified by the artisanal miners In September 2017, Anglo American and Nexa Resources staked a total of 3.5M ha within the belt following the reported discovery of a porphyry copper deposit at Jaca by Anglo American, and academic research studies by The Geological Service of Brazil and the University of Campinas in late 2015. Codelco, subsequently acquired an additional 800,000ha in the belt. Altamira remains the largest junior license holder in the area.

Apiacas

The Apiacas district is located in the north-west part of the Alta Floresta Gold Belt and was one of the most prolific historic placer areas in the belt having produced an estimated 1Moz of placer gold. Altamira has completed some previous surface exploration work at Apiacas which has identified a number of prospective targets including Papagaio, Osmar, Bragatte, Paulinho Troca- Tiro, Casa Branca, Joao Fidelis and Mutum. Thus far, Altamira has completed no drill program on any of these targets.

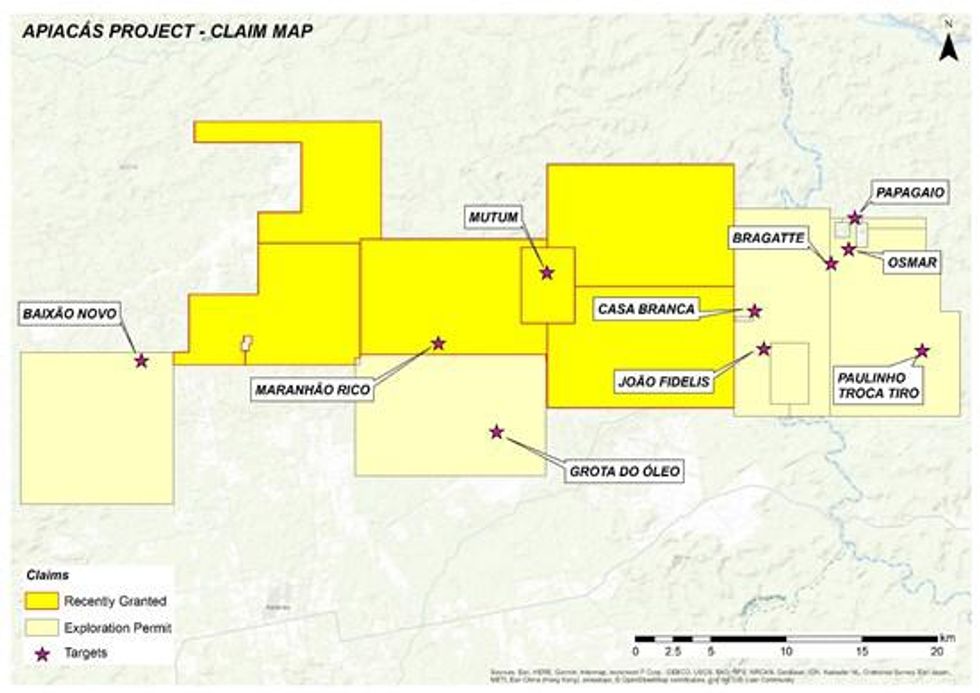

Until recently, Altamira controlled parts of the district with claims totaling 42,000ha. However, the central part of the district and critically the key Mutum target remained under application for a period of four years. The Company was however recently advised that it has been granted an additional five blocks totaling 40,000ha over the central part of the district including the Mutum target (Figure 1).

Figure 1: Map showing Altamira’s land holdings in Apiacas district (including recently granted claims) and location of principal targets identified thus far

To view an enhanced version of Figure 1 please visit:

https://orders.newsfilecorp.com/files/4500/42629_f7060671441cc890_001full.jpg

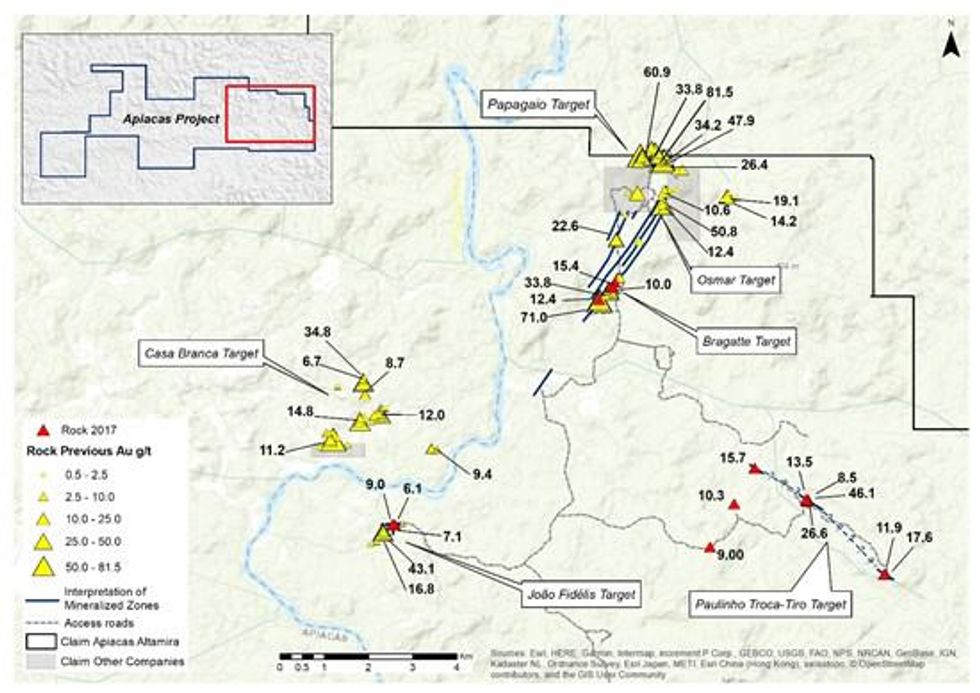

Surface rock sampling completed in the eastern claim blocks at Apiacas by Altamira has so far identified several targets with high grade gold values on surface (Figure 2). These include;

- Papagaio – located in NE corner of claim block – series of narrow NNE trending quartz veins within an altered dacite intrusive extending over at least 1sq.km. Of 15 surface grab samples collected by Altamira, 12 returned values ranging from 14.3 to 118.7g/t gold.

- Osmar – located 1km south of Papagaio. Several NE trending veins have been mapped on surface. Of 17 surface grab samples collected, 3 returned values of 12.4 – 50.8 g/t gold.

- Bragatte – well defined NE trending structure 3-4m in width which has been traced so far for 900m on surface. Of 26 surface grab samples collected, 5 returned values ranging from 10.0 to 71.0 g/t gold.

- Paulinho Troca-Tiro – a series of recently identified but poorly defined NW trending structures in eastern part of district. Of 17 grab samples recently collected on surface, 9 returned values ranging from 9.0 to 46.1 g/t gold.

- Casa Branca – located 8km south-west of Papagaio. Of 33 grab samples collected on surface, 6 returned values ranging from 6.7 to 34.8g/t gold.

- Joao Fidelis – located approximately 2km south of Casa Branca. Of 13 grab samples collected thus far, 5 returned gold values of 7.1 to 43.1g/t gold.

Figure 2: Map showing surface sampling gold results (g/t) from eastern part of Apiacas district

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/4500/42629_f7060671441cc890_002full.jpg

Gold mineralization at all of the above targets appears to be confined to high-grade structures.

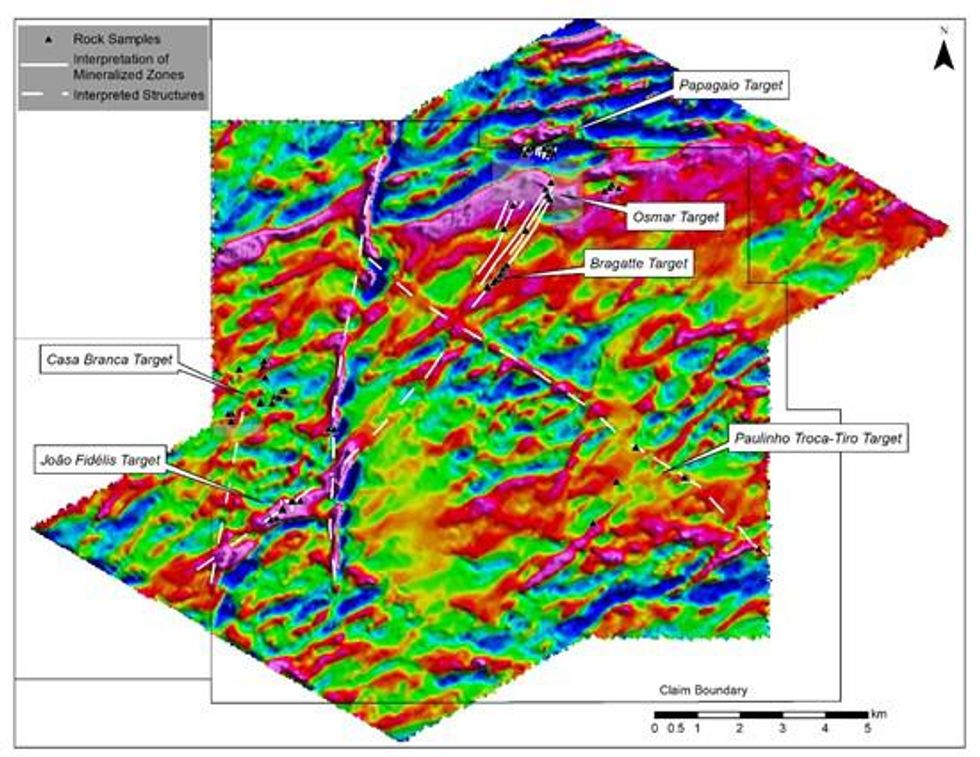

The airborne magnetic data from the area (Figure 3) shows that the Papagaio, Osmar, Bragatte and Joao Fidelis targets all appear to be controlled by a pronounced NE trending structure extending over approximately 15km. The outcropping gold mineralization at the Papagaio target appears to be situated very close to where this NE trending structure transects a boundary between two distinct magnetic domains which likely represent a change in rock type.

The Paulinho Troca-Tiro target appears to be largely controlled by a NW trending structure which may extend up to 5km (Figure 3).

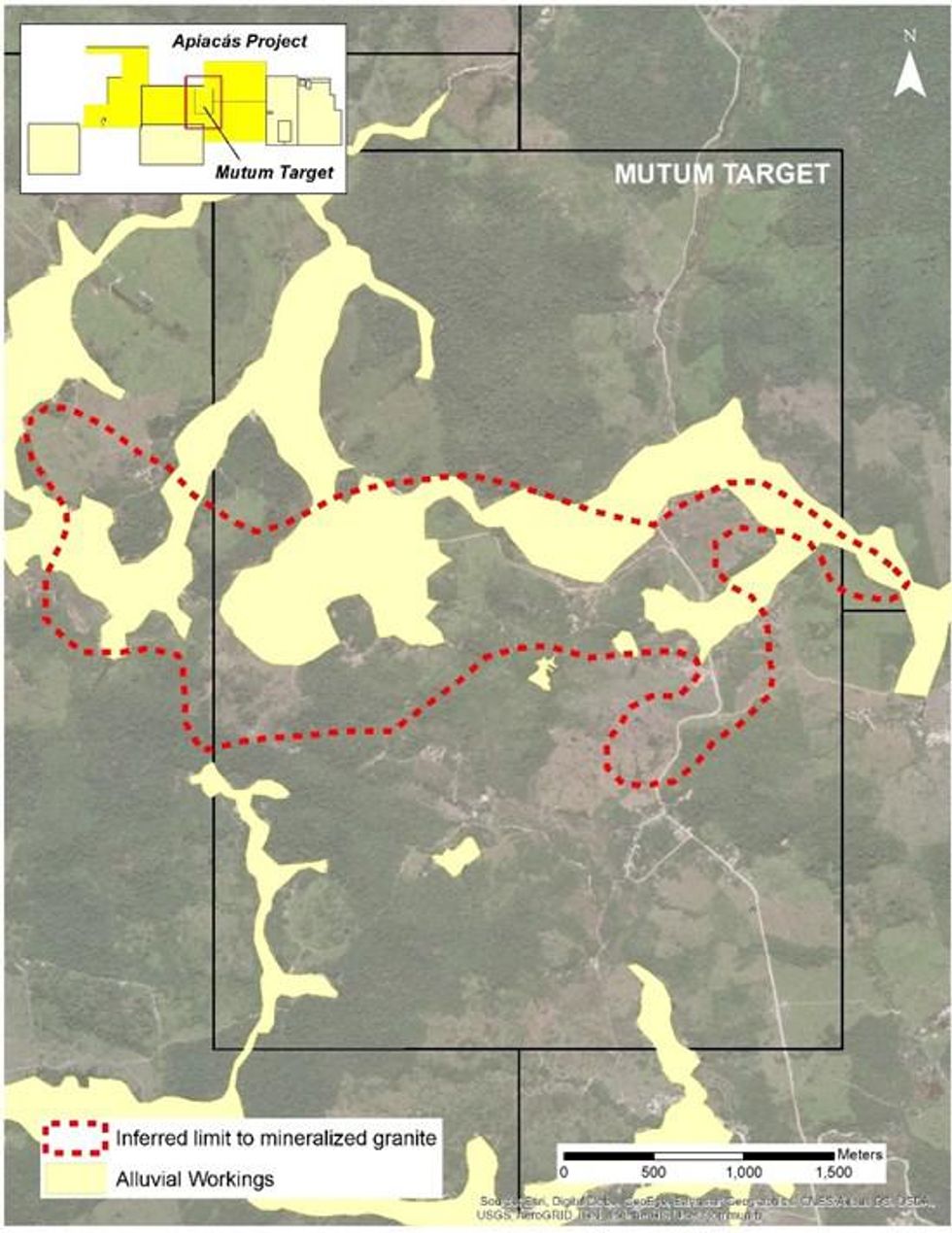

No drilling has thus far been conducted on any of the above targets. However, an estimated 90% of the placer gold that was mined in the district was obtained from a target area called Mutum in the central part of the district and within the claims recently granted to Altamira.

Figure 3: Map showing airborne magnetic data, main targets and interpreted principal structures from eastern part of Apiacas district.

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/4500/42629_f7060671441cc890_003full.jpg

Mutum Target

As outlined above, the Mutum target area is estimated to have produced at least 90% of the placer gold within the Apiacas district. Unlike the other known targets that are described above, the Mutum target is characterised by widespread quartz-sericite-pyrite alteration of granitic rocks with minor quartz veinlets (Figures 4 and 5) which extends over at least 4 square kilometres. Artisanal mining of this altered material has taken place at several places suggesting that the altered and pyritized rocks contain gold. This suggests that a large disseminated gold deposit may be present at Mutum.

A program of geological mapping and sampling is currently in progress with results expected later in February.

Figure 4: Map showing Mutum target at Apiacas with distribution of placer gold workings which produced an estimated 90% of the gold from the district, and the inferred limit of quartz-sericite pyrite alteration

To view an enhanced version of Figure 4, please visit:

https://orders.newsfilecorp.com/files/4500/42629_f7060671441cc890_004full.jpg

Figure 5: Quartz-sericite-pyrite alteration from Mutum target, Apiacas. Note pyrite clots. This type of mineralization is widespread at Apiacas and has been previously mined by artisanal miners

To view an enhanced version of Figure 5, please visit:

https://orders.newsfilecorp.com/files/4500/42629_f7060671441cc890_005full.jpg

Michael Bennett Altamira Gold’s President and CEO commented “We are extremely pleased to have been granted an additional 42,000 Ha within the Apiacas district, which is one of the largest historic producer of placer gold in the Alta Floresta Belt. Limited surface sampling to date has already identified a number of high-grade targets, but the recognition of widespread hydrothermal alteration and disseminated pyrite mineralization at Mutum which produced an estimated 90% of the placer gold at Apiacas, also opens up the possibility of a larger body of disseminated mineralization.”

The Company follows industry standard procedures with a quality assurance/quality control (QA/QC) program. Two blank, two duplicate and two standard samples were inserted in each batch of forty samples. Sample preparation and analysis was done at SGS GEOSOL in Vespasiano, Minas Gerais, Brazil. Analysis is performed by fire assay with 50g fusion Atomic Absorption Spectroscopy.

Grant of Options

The Company also announces that it has granted 1,075,000 stock options to directors, officers and employees of the Company. The stock options are exercisable for a term of five years at an exercise price of $0.10 per common share under the terms of the Company’s Stock Option Plan.

About Altamira Gold Corp.

The Company is focused on the exploration and development of gold deposits within western central Brazil. The Company holds 12 projects comprising approximately 300,000 hectares, within the prolific Juruena gold belt which historically produced an estimated 7 to 10Moz of placer gold. The Company’s advanced Cajueiro project has an NI 43-101 compliant resources of 8.64Mt @ 0.78 g/t Au (for 214,000oz) in the Indicated Resource category and 9.53Mt @ 0.66 g/t Au (for 204,000oz) in the Inferred Resource category and an additional 1.37Mt @ 1.61 g/t Au in oxides (for 79,000oz in saprolite) in the Inferred Resource category.

On Behalf of the Board of Directors,

ALTAMIRA GOLD CORP.

“Michael Bennett”

Michael Bennett

President & CEO

Tel: 604.676.5660

Toll-Free: 1-833-606-6271

info@altamiragold.com

www.altamiragold.com

Guillermo Hughes, P. Geo., a consultant to the Company as well as a Qualified Person as defined by National Instrument 43-101, supervised the preparation of the technical information in this news release.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Statements in this document which are not purely historical are forward-looking statements, including any statements regarding beliefs, plans, expectations or intentions regarding the future. It is important to note that actual outcomes and the Company’s actual results could differ materially from those in such forward-looking statements. Except as required by law, we do not undertake to update these forward-looking statements.

Source: www.newsfilecorp.com