Here’s how The Outsider Club’s Nick Hodge decides which juniors to invest in.

The International Metal Writers Conference featured many companies and experts, and one talk the Investing News Network was able to attend was put on by The Outsider Club’s Nick Hodge.

At The Outsider Club, Hodge encourages investors to take their finances into their own hands and manage their own investments. Fittingly, his presentation focused on the three questions he asks before he buys a stock.

Read on to learn more about how Hodge decides which juniors to invest in.

1. What is the share structure?

According to Hodge, it is very important to find out who owns what shares of a company at what price, as these factors could impact how much the stock appreciates.

“The first question investors should ask is ‘who owns all the cheap paper?’ If there are a lot of shares that were sold at a cheap price to raise money, those people who own the cheap shares are incentivized to sell earlier rather than later,” Hodge said.

Other things to consider when looking at share structure is whether past financings include warrants and how many shares are outstanding.

2. What is the goal of the project?

Hodge went on to explain the importance of understanding what the company is going to do with shareholders’ capital. “Make sure [companies] are specific about what they want to execute and what they are going to do with your capital that is going to drive value,” he said.

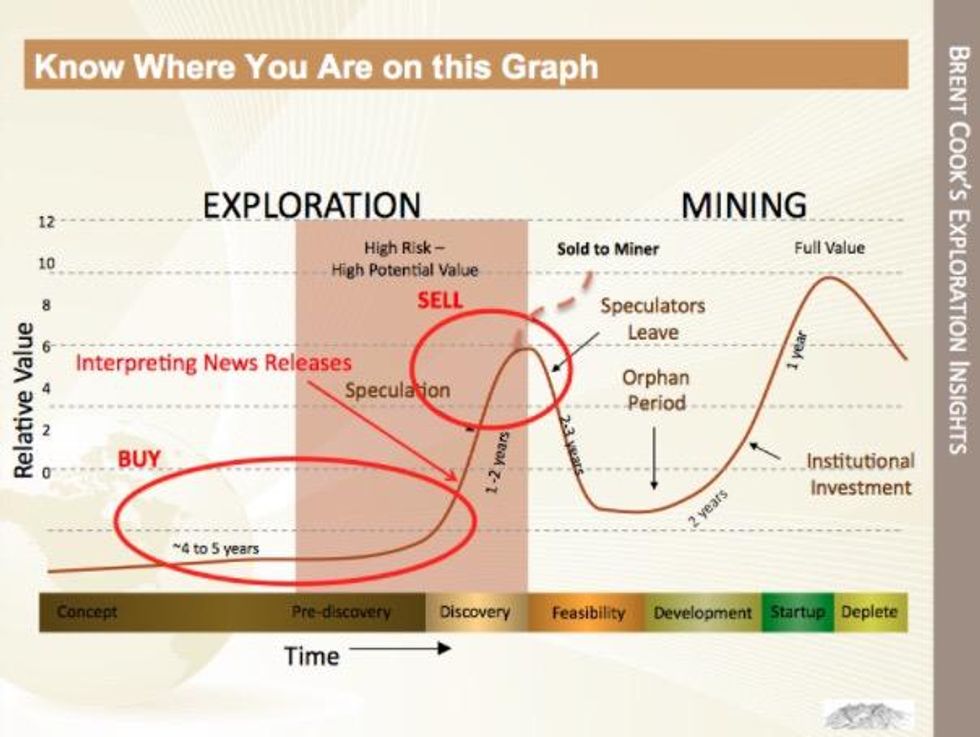

It is also key for investors to know what stage a company’s main project is at. Depending on whether it’s at the discovery stage or development stage it could be “not as sexy of a story” — Hodge used the chart below from Exploration Insights to illustrate his point.

“Be skeptical if [a company] is saying ‘we have a project that is going to become a mine,’ as it is not as easy. We know that only one project in every 1,000 will become a mine,” he added.

Chart via Exploration Insights.

3. Does the company have the expertise to follow through?

If a company passes the first two tests, investors should look at its management team.

“[Investors] want to look for good people who have done what they are doing now successfully before, and who have provided value to shareholders in the past — [people who] have had success stories in the past, where all people made money, not just the first people,” he said.

To wrap up his presentation Hodge mentioned two junior companies that he is following: Skyharbour Resources (TSXV:SYH) and Atlantic Gold (TSX:SVU).

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Related reading:

International Metal Writers Conference 2017, Day 1: Notes from the Floor

International Metal Writers Conference 2017, Day 2: Notes from the Floor