Analyst Commentary: Standard Graphite Acquires Advanced Graphite Project in Quebec

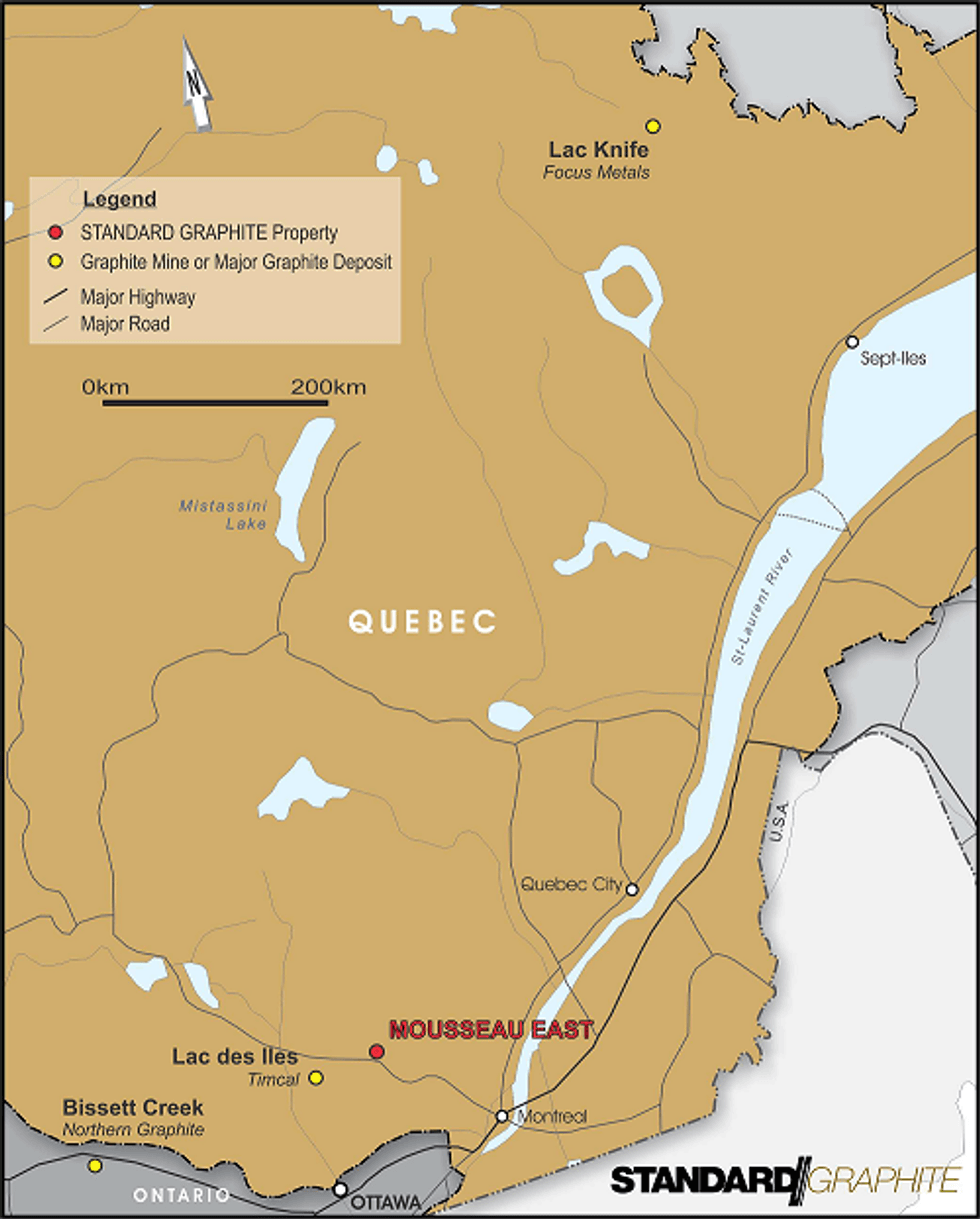

Standard Graphite (TSXV: SGH) has recently inked a deal to acquire the Mousseau East graphite deposit, situated just 50 km from Timcal Canada’s producing Lac-des-Iles graphite mine.

This acquisition provides Standard Graphite with an advanced flagship project that if proven to be metallurgically attractive can potentially be fast-tracked to production.

Standard Graphite (TSXV: SGH) has recently inked a deal to acquire the Mousseau East graphite deposit, situated just 50 km from Timcal Canada’s producing Lac-des-Iles graphite mine.

This acquisition provides Standard Graphite with an advanced flagship project that if proven to be metallurgically attractive can potentially be fast-tracked to production.

In addition, the company holds 14 highly prospective graphite properties within known graphite districts in both Quebec and Ontario and plans to aggressively evaluate and advance the best ones.

Southwestern Quebec is host to some of the most favourable geological terrain for graphite exploration in Canada and is known for hosting quality graphite resources such as the Lac-des-Iles mine operated by Timcal.

The Lac-des-Iles graphite mine, located 50 km from the Mousseau East deposit and 150 km northwest of Montréal, Québec (Refer to figure 1), has been in operation for 20 years producing graphite products of various sizes and purities. The deposit contains close to 25 million tonnes, including 5.2 million tonnes to be mined by open pit at a grade of around 7.42% Cg (Carbon in graphite).

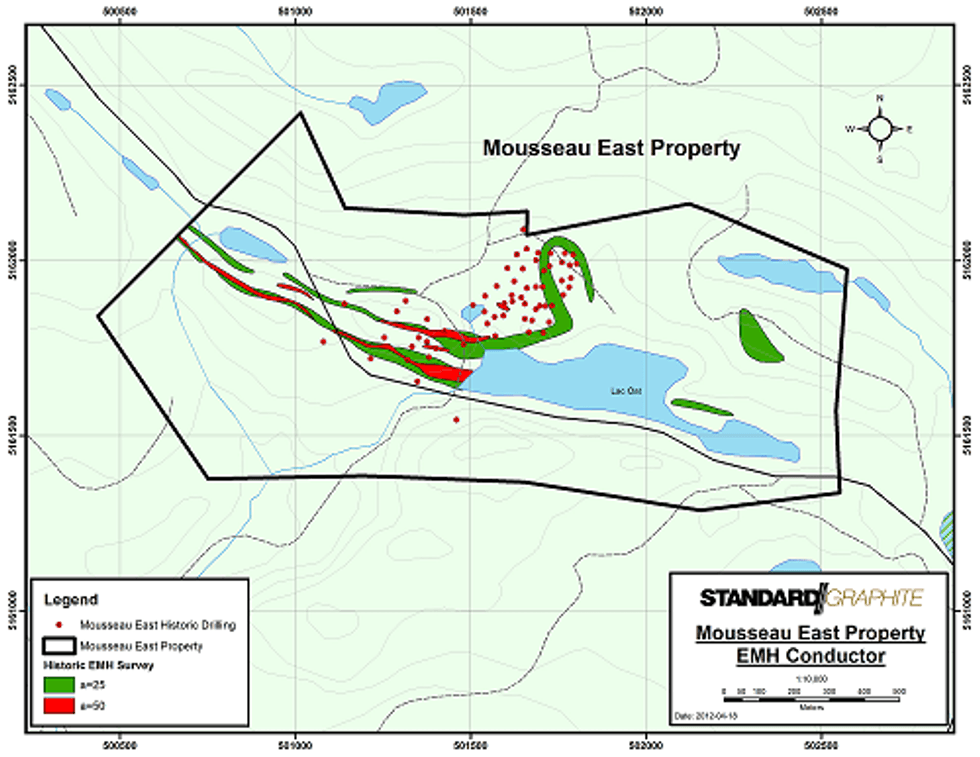

The Mousseau East Deposit was originally discovered in 1983 and outlined by 62 diamond drill holes (4,996 m). Two historical resource estimates were calculated but under current reporting standards they do not comply with NI-43-101 requirements. (Refer to Figure 2).

The project is blessed with good infrastructure and lies next to a highway. In addition, the current historical resource was only calculated to a depth of 40 m. As a result, there is excellent potential to expand the resource along strike as well as to depth.

The historical resource calculated by Graphicor weighs in at 598,400 tonnes averaging 8.29% Cg (carbon in graphite) in the Proven category, 219,450 tonnes averaging 8.13% Cg in the Probable category and 288,760 tonnes averaging 7.85% Cg in the Possible category. (This is not NI-43-101 compliant).

Standard Graphite intends to complete the work necessary to verify the resource estimate at Mousseau East and bring it up to current NI-43-101 standards. At last report the company planned to spend in excess of $5 million this year to evaluate and advance its project portfolio.

Evaluating Graphite Deposits

When looking at graphite deposits one of the most important things to note is the percentage of flake verses fine graphite. Flake graphite is high value and high growth while fine graphite has lower value and is sometimes not even salable. Another key aspect when evaluating graphite deposits is to determine the carbon content of the concentrate – the higher the carbon concentrate the purer the product and the higher price it can fetch. These questions can only be answered by metallurgical testing and in-situ valuations based on grade alone should not be relied upon.

Graphite price increases with flake size and concentrate purity. Currently concentrates are being sought after with in excess of 94% carbon content and that are medium to large flake in grain size. Some examples of flake size/purity and price are as follows:

• +32 mesh (0.5 mm) super flake with 98% carbon purity is +$3000 per tonne

• +50 mesh (0.297 mm) jumbo flake with 97% carbon purity is +$3000 per tonne

• +80 mesh (0.177 mm) large flake with 96% carbon purity is +$2750 per tonne

• +150 mesh (0.105 mm) medium to fine flake with 94% carbon purity is +$2000 per tonne

• -150 mesh is unsuitable for new applications and sometimes not salable

What does mesh size mean?

Mesh basically refers the number of holes in a sieve. As the number describing the mesh size increases, the size of the particles decreases. Higher mesh numbers refer to finer material. Mesh size is not a precise measurement of particle size.

A minus or plus symbol in front of the mesh size indicates whether the material is coarser or finer that that mesh size. For example A –150-mesh would mean that all particles smaller than 150-mesh would pass through the sieve. A +150 mesh means that all the particles 200-mesh or larger are retained.

Market for flake graphite

Global market consumption of natural graphite has increased from approximately 600,000 tonnes in 2000 to roughly 1.2 million tonnes in 2011. Demand for graphite has been increasing by approximately 5% per year since 2000 due to the continuing modernization of China, India and other emerging economies, resulting in strong demand from traditional end-users such as the steel and automotive industries.

Applications, such as lithium-ion batteries, fuel cells, and nuclear and solar power, have the potential to create significant incremental demand growth. There is roughly 10 to 20 times more graphite in a lithium-ion battery than there is lithium. Demand for graphite is expected to rise as electric vehicles and lithium battery technology are adopted.

Natural graphite comes in several forms: flake, amorphous and lump. Of the 1.2 million tonnes of graphite produced annually, about 40% is of the most desirable flake type. China, which produces about 70% of the world’s graphite, is seeing production and export growth levelling, and export taxes and a licensing system have been instituted.

Bottom line

The market for high quality flake graphite is expected to continue to grow. Standard Graphite has acquired an advanced graphite project that has good access and infrastructure in a stable region in Canada known for producing quality graphite.

The next major catalysts that will most likely propel Standard Graphite will be the verification of the resource at its Mousseau East Deposit and the determination of the metallurgical quality of the graphite in the deposit.

The company has a tight share structure with only 24 million shares outstanding and a market capitalization of about $11 million and about $1 million in the bank.

Figure 1 Location Map

Figure 2 Property map with drill collar locations

Read Standard Graphite’s most recent press releases:

Standard Graphite Not to Proceed with Private Placement

Standard Graphite Signs Definitive Agreement for the Acquisition of Mousseau East Deposit

Standard Graphite Completes EM Survey

Thomas Schuster, Analyst Bio

With a degree in Geological Sciences from the University of Toronto, Thomas started his career in the 1990s as an exploration geologist in the famous Timmins mining camp in Northern Ontario. He then moved to Vancouver and took a position as staff Journalist at the well-known mining publication, The Northern Miner, reporting the merits and shortcomings of Canadian exploration and mining projects worldwide. This built a foundation for his later work as a Mining Analyst for the Toronto-based institutional investment firm, Fraser Mackenzie. Thomas is currently based in Vancouver working as an independent mining analyst.

Disclosure: No positions at time of writing.

Standard Graphite is a client of Dig Media. Dig Media was paid a fee for the creation and dissemination of this commentary.