What happened on day two of the International Mining Investment Conference? We run through key highlights in this pictorial overview.

The International Mining Investment Conference (IMIC) just wrapped up, and the two-day event was a busy one for the Investing News Network (INN) team.

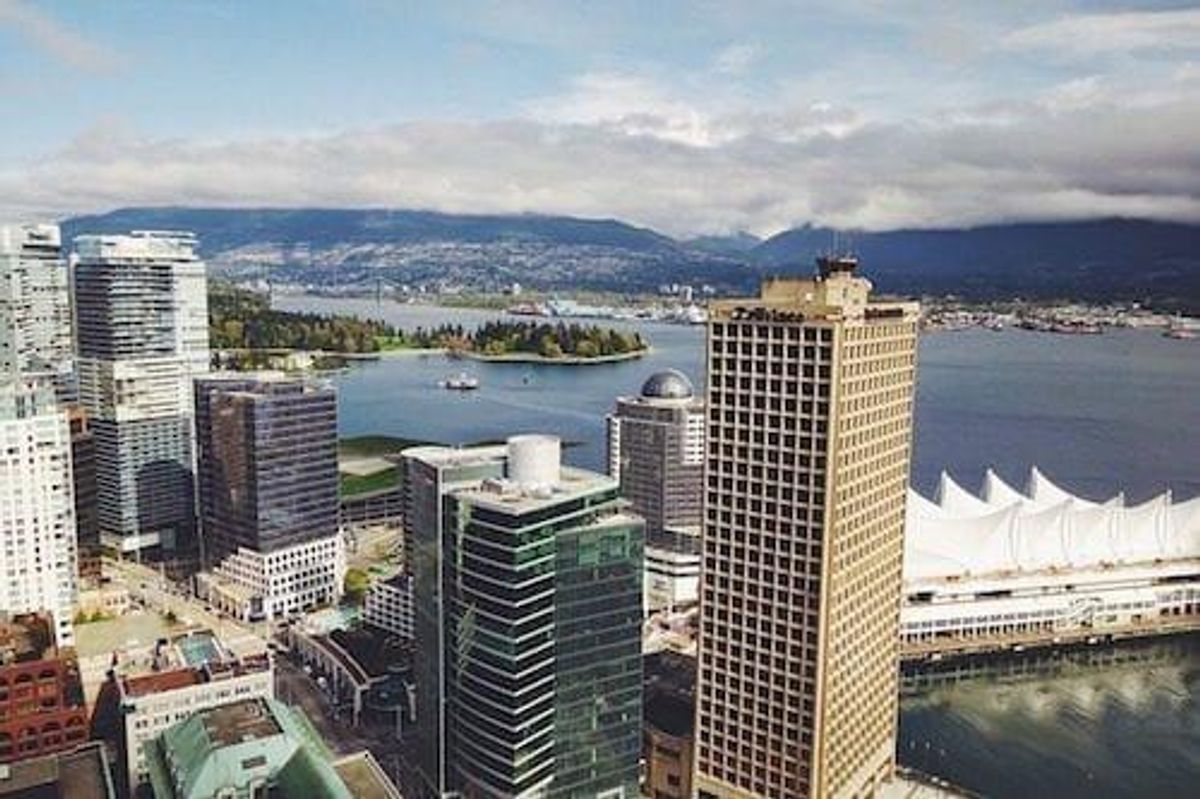

Held in Vancouver, the second day of the show brought attendees presentations and panels on mainstays like gold and silver, as well as hot topics like battery metals, cannabis and cryptocurrencies.

Scroll on to see what happened on the second day of the show, and click here for our recap of day one.

Day two kicked off bright and early with a panel that pitted gold, cryptocurrencies and bitcoin against each other. Led by James Black of the CSE, the event included Chris Parry of Equity Guru, David Morgan of the Morgan Report and Jason Hamlin of Gold Stock Bull.

Overall, the panelists agreed that cryptocurrencies and cryptocurrency-related companies will likely see the best returns this year, but also emphasized the merits of gold and cannabis.

Watching the #gold vs. #cannabis vs. #crypto panel at #IMIC18! @equitydotguru says growing weed is a terrible business – the opportunity is in weed products

— Resource Investing (@INN_Resource) May 16, 2018

.@goldstockbull agrees that there’s potential for value-added products, but says #cannabis is a high-margin business so he’s also bullish on some growers #IMIC18

— Resource Investing (@INN_Resource) May 16, 2018

.@silverguru22 says he sees the currency crisis accelerating in the next five years, with #gold and #silver benefiting – the 1980s bull market will be put to shame #IMIC18

— Resource Investing (@INN_Resource) May 16, 2018

Morgan led his own talk later in the morning — among other things, he shared where he believes the silver price could be by the end of 2018.

#Silver looks set to end 2018 higher, says @silverguru22 – maybe at $20. But the real increases will come in 2019, and later in 2021/2022 #IMIC18

— Resource Investing (@INN_Resource) May 16, 2018

“If you want to make money you need to dial in to the companies that are actually making money” Workshop 3 with David Morgan @silverguru22 #IMIC18 pic.twitter.com/rNhpSgGCKl

— Cambridge House (@Cambridge) May 16, 2018

Battery metals investors were also in for a treat on the second day of IMIC — Benchmark Mineral Intelligence brought its World Tour to the conference, hosting a number of presentations from top minds in the space, including Simon Moores.

Simon Moores (Managing Director, Benchmark Mineral Intelligence) bringing his Benchmark World Tour 2018 to the International Mining Investment Conference in Vancouver #lithiumionbattery #lithiumion #battery #supplychain #IMIC18 pic.twitter.com/ox4Pqo8qfL

— Zimtu Capital Corp. (@Zimtu) May 16, 2018

“The advantages of the lithium-ion battery are increasing,” says @sdmoores at @benchmarkmin seminar in Vancouver

— Resource Investing (@INN_Resource) May 16, 2018

The Benchmark pavilion was not the only place attendees could find commentary on battery metals. At his presentation, Sid Rajeev of Fundamental Research shared his picks in the cobalt and nickel space, while Parry encouraged investors to exercise caution when looking at cobalt stocks.

Sid Rajeev of @FRCorp sharing #cobalt and #nickel stock picks at #IMIC18 – names Fortune Minerals, @EnergyMetals and @giga_metals

— Resource Investing (@INN_Resource) May 16, 2018

“I saw cobalt companies where I am pretty sure they just bought some cobalt off of Amazon, threw it in a cow field and said I have a cobalt mine” Investing for Millenials workshop with @equitydotguru #IMIC18 pic.twitter.com/90DbPHtbfz

— Cambridge House (@Cambridge) May 16, 2018

Jayant Bhandari was one of the INN team’s interviews on day two, and he also spoke in the afternoon at the show about his approach to investing in junior miners. Stay tuned for our interview.

.@JayantBhandari5 is our first interview today at #IMIC18 – stay tuned for the video! pic.twitter.com/z7Y7VnjgsW

— Resource Investing (@INN_Resource) May 16, 2018

According to @JayantBhandari5, a good way to understand the country you are investing in is to travel there and “understand how much a cup of coffee is” as part of your homework. #IMIC18 #mining

— Resource Investing (@INN_Resource) May 16, 2018

Other afternoon events included a panel featuring Ivan Bebek of Auryn Resources (TSX:AUG,NYSEAMERICAN:AUG) and Brian Paes-Braga of Fiore Group. Another panel involved Brent Cook of Exploration Insights, David Erfle of JuniorMinerJunky and Mercenary Geologist Mickey Fulp — they shared what stocks they are buying right now.

Cook, Erfle and Fulp all stopped by the INN booth for interviews — keep an eye out for those in the coming days.

Finding and building an asset are very different things, says Ivan Bebek of @AurynResources – you need two different management teams #IMIC18

— Resource Investing (@INN_Resource) May 16, 2018

Mickey joins Brent Cook and David Erfle on this panel at @Cambridge #Vancouver #IMIC18: “Getting down and dirty – What stocks are we buying?” Moderated by Cory Fleck. pic.twitter.com/Qq6gTFem9M

— Mickey Fulp (@mercenarygeo) May 16, 2018

The day wrapped up with more panels, including one on gold and one on energy — definitely two of the major themes at the show. Paes-Braga and Stephen de Jong of Integra Resources (TSXV:ITR) and VRify also took the stage at the end of the day to discuss where the mining industry is headed.

Brent Cook of Exploration Insights, Ivan Bebek of @AurynResources and E.B. Tucker of Casey Research discuss what every investor should know about #investing in #gold right now at #IMIC18 pic.twitter.com/XwmGrUmHnW

— Resource Investing (@INN_Resource) May 16, 2018

Brian Paes-Braga of Fiore Group and Stephen de Jong of @integraresources talk about what’s next for the industry at #IMIC18 pic.twitter.com/UP13ikN4e2

— Resource Investing (@INN_Resource) May 16, 2018

IMIC is now officially over, and INN will be posting video interviews with many of the speakers over the course of the next week or so. Check our website and our YouTube channel for the latest uploads.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Global Energy Metals (TSXV:GEMC) is a client of the Investing News Network. This article is not paid-for content.