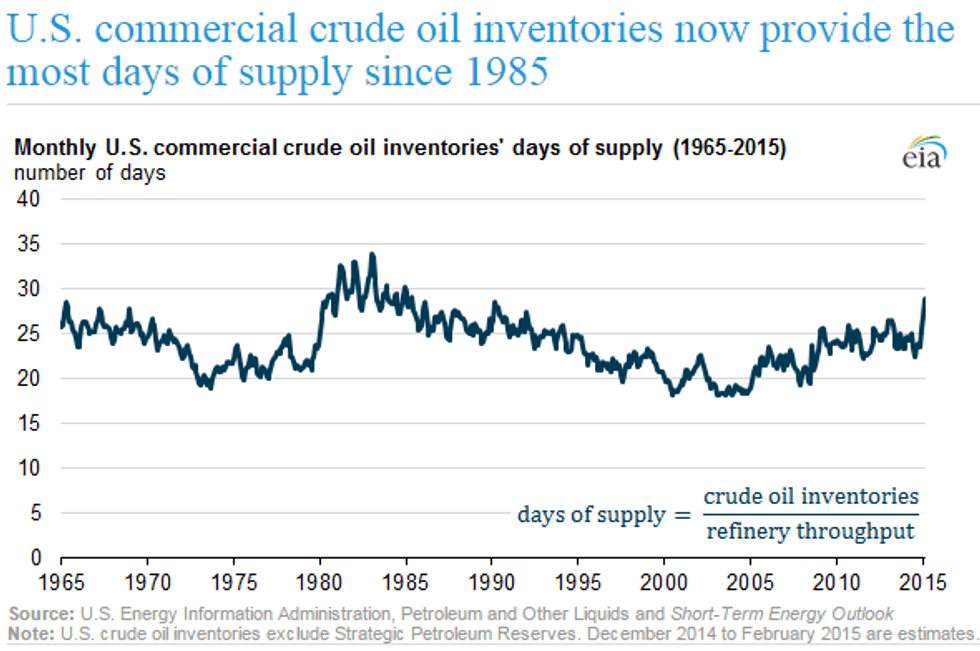

US Commercial Crude Oil Inventories Provide the Most Days of Supply Since 1985

The US Energy Information Administration reported that the U.S. commercial crude oil inventories at the end of February provided the most days of supply since the mid-1980s due to lower refinery runs and increases in domestic crude oil production.

The US Energy Information Administration reported that the U.S. commercial crude oil inventories at the end of February provided the most days of supply since the mid-1980s due to lower refinery runs and increases in domestic crude oil production. The number of days is calculated by dividing the commercial crude oil inventory level at the end of the month by the forecast crude oil refinery runs in the following month and excludes government -held inventories.

As quoted in the market news:

The days-of-supply calculation is an indicator of how loose or tight oil markets are by showing the number of days current commercial inventories will last given the future consumption rate at refineries. Refinery runs (or throughput) are the amount of crude oil that refineries process and are used as a proxy to measure the consumption rate.

Commercial crude oil inventories across all Organization for Economic Cooperation and Development (OECD) countries are also high, but to a lesser extent than U.S. inventories considered alone. OECD crude oil inventories in January were sufficient to supply almost 28 days of OECD crude oil demand. However, unlike in the United States, OECD inventories have exceeded 28 days of supply in several months over the previous two years.

Click here to read the full US Energy Information Administration report.