Greenlane Renewables: Upgrading Natural Gas into a Renewable Energy Source

Learn more about Greenlane Renewables Inc. (TSXV:GRN) and its three patented biogas upgrading technologies on the Investing News Network.

Greenlane Renewables Inc. (TSXV:GRN) has launched its campaign on the Investing News Network’s Energy and Technology channels.

Greenlane Renewables is a leading global provider of biogas-upgrading systems that produce clean, low-carbon, renewable natural gas (RNG) from organic waste sources such as landfills, wastewater treatment plants, farms and food waste facilities. The RNG is then used as fuel for vehicles, such as those adopted by UPS (NYSE:UPS), or for injection into the natural gas grid.

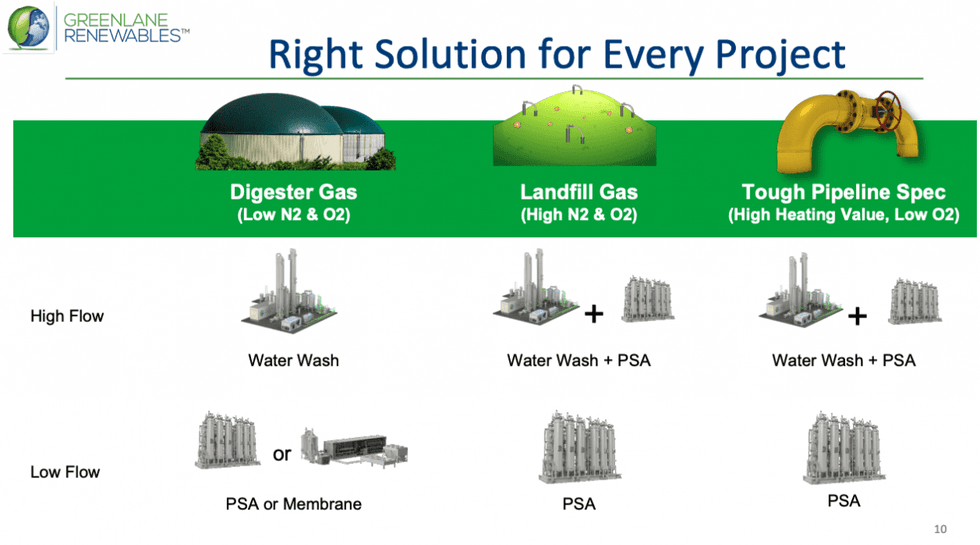

In response to end-user demands for a lower carbon footprint and renewable fuels, Greenlane Renewables is the only RNG pure play that offers the three main biogas upgrading technologies. These technologies remove impurities and separate biomethane in raw biogas to create clean RNG for pipeline injection, liquefaction or direct use as a vehicle fuel.

To date, Greenlane Renewables has installed over 100 units in 18 countries across the globe, including one of the largest RNG operations in both Europe (Germany) and Canada (Quebec). Greenlane Renewables has also completed a project in California that upgrades and injects RNG into the SoCalGas (OTCMKTS:SOCGP) (part of the Sempra group of utilities) natural gas pipeline network.

To learn more about Greenlane Renewables Inc. (TSXV:GRN), click here.

Greenlane Renewables’ Company Highlights

- Greenlane Renewables is a market leader in upgrading low-energy biogas to RNG.

- The company has 14 patents and 28 device titles.

- The company offers three patented biogas upgrading technologies to customers across the globe.

- Each technology unit is worth between $1 million and $7 million.

- Revenue generated in 2018 totaled $18 million.

- The company has installed over 100 units in 18 countries.

- Greenlane Renewables plans to expand beyond equipment into more lucrative long-term contracts under a “build, own, operate” business model.

- The company is comprised of industry leaders with over 30 years of experience.

- Insiders own approximately 37 percent and institutional shareholders own approximately four percent of the company’s shares.