Initial 2019 Crater Lake Drilling Results Indicate Encouraging Scandium and Rare Earth Grades Over Significant Widths

Imperial Mining Group Ltd. (TSXV:IPG) is pleased to announce that encouraging initial scandium and rare earth (REE) assays have been received from the first two holes completed during the winter 2019 diamond drilling of the TG Zone target, Crater Lake project, northeastern Québec (Figure 1).

Highlights:

- Partial TG Zone drilling results returned up to 48.2 m grading 385 g/t Scandium Oxide (Sc2O3), including 8.8 m grading 528 g/t Sc2O3 and including 12.5 m grading 474 g/t Sc2O3.

- Elevated levels of total rare earth oxides plus yttrium (TREO+Y) of up to 0.622% characterize the scandium horizon.

- The entire scandium mineralized package was found to be between 60 and 90 m in true thickness and is open at depth below 200 m down-dip and along strike.

Imperial Mining Group Ltd. (TSXV:IPG) is pleased to announce that encouraging initial scandium and rare earth (REE) assays have been received from the first two holes completed during the winter 2019 diamond drilling of the TG Zone target, Crater Lake project, northeastern Québec (Figure 1).

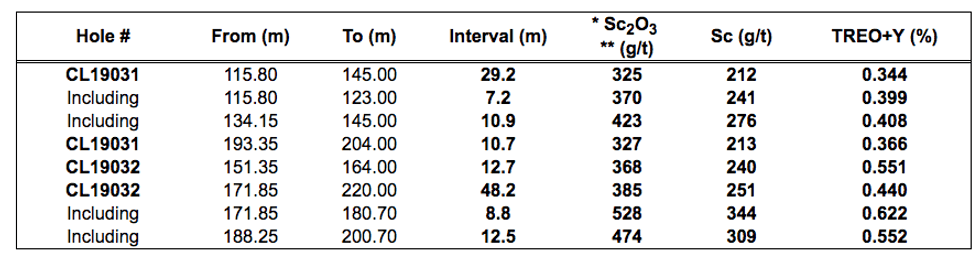

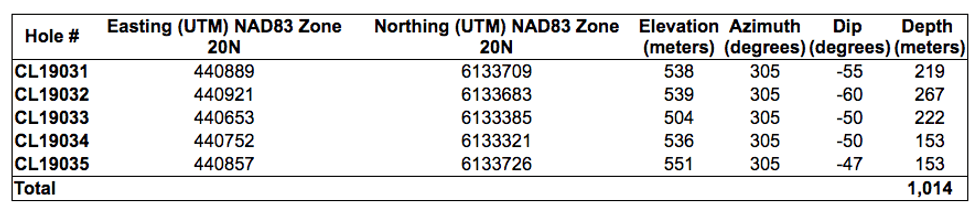

A five-hole diamond drilling program for 1,014 m was completed on April 20, 2019 over the TG Zone (TGZ) target to evaluate the scandium potential of a high-intensity magnetic anomaly (Figure 2, Table 2). The new drilling is located 600 m north of a historical drill hole which had returned scandium grades of up to 506 g/t Sc2O3 over 19.0m along the western side of the Crater Lake intrusion on the same magnetic trend. The current results represent partial analyses from the first two holes of the drill program (CL19031 and CL19032, Table 1). Results for the remainder of holes CL19031 and CL19032 as well as CL19033-19035 are pending. The diamond drill contractor was Avataa Rouillier Drilling Inc. of Amos, Quebec.

Table 1 – Crater Lake Drilling Partial Assay Results:

NOTES: – * 1 ppm of Sc metal equals 1.5338 ppm scandium oxide (Sc2O3) ; ** 1 g/t equals 1 ppm

“We are very pleased with the initial diamond drilling results from the winter program, as they confirm that the high-intensity magnetic anomalies tested to date on the property represent areas of significant scandium and rare earth enrichment,” said Peter Cashin, Imperial’s President & Chief Executive Officer. “From the evaluation of our geophysical surveys completed on the property to date, we interpret the scandium-bearing horizon to now be traceable for at least 4.5 km in strike length. The evident increase in scandium grades with depth is also very encouraging, however more work remains to be done to fully quantify the scandium and REE resource potential on the property.”

TG Zone Geology

Drilling has intersected a 60-90 m thick, steeply east-dipping, arcuate Crater Collapse ring-fault zone breccia containing large fragments and clasts of felsic syenite in a matrix of pyroxenite-rich material. The felsic fragments, which contain little to no scandium, can constitute up to 60 % of the rock in the mineralized interval. These can probably be removed after primary crushing using low-cost, ore-sorting technology. The pyroxenite-rich matrix contains all of the scandium and REE in the mineralized system. Individual assays from this material grade as high as 730 g/t Sc2O3. The mineralized zone has been traced from surface to at least 200 m down-dip and remains open at depth and along strike. A 15-20 m wide alteration halo is observed in the rocks adjacent to the scandium mineralized ring structure. There is an apparent increase in scandium grade at depth along the drill section.

In addition to the diamond drilling, two (2), 100 kg bulk samples were collected from the split core and will be sent for metallurgical testing. Initial testwork completed in 2018 by SGS Lakefield indicates that a combination of low-cost gravity and magnetic or electrostatic separation methods will yield a high-grade scandium mineral concentrate from the zone. The bulk samples are currently being prepared for shipment to a Canadian-based metallurgical contractor.

Table 2 – TG Zone Diamond Drilling Locations

Scandium Markets

The broader adoption of scandium in the aluminum alloys sector has been constrained by the limited availability of scandium in western commercial markets from the primary supply sources in China and Russia. The lack of reliable long-term supply sources to provide material for additional applications has also limited scandium market growth. This has resulted in much higher prices for Sc compared to competing alloy materials, such as titanium, and has limited its broader use. The current price of the metal oxide published by USGS indicates that it trades in a range of approximately US$2,000-4,000/kg for 99.99% purity.

Scandium acts as a grain-refiner and hardener of aluminum alloys. Aluminum-scandium alloys combine high strength, ductility, weldability, improved corrosion resistance and a lower density. The combination of all these properties makes aluminum-scandium alloys well-suited for the aerospace, automotive and defense industries. Scandium-modified aluminium alloys is highly valued as an important lightweighting material as it is one-third the weight of steel and is 60 % of the weight of titanium alloys.

As new technologies motivate manufacturers to identify new sources for scandium, the element could be widely adopted by major industries in the years to come. Likely early adopters of scandium-modified aluminum alloys will be the automotive manufacturers seeking to lighten electric vehicle (EV) and combustion-engine cars and trucks to extend battery range and improve fuel efficiency, respectively. Recent data from Nemak, S.A.B. de C.V. (2019), one of the world’s largest automotive OEM, shows that high strength aluminium components is an $11-billion dollar target market by 2025 for them. Estimates show that as much as 0.17 kg of scandium could be required for high-strength and high-temperature applications in new EVs. If 30 million EVs are produced annually by 2030 (Bloomberg, 2018), this could equate to annual demand of 5,100 tonnes of Sc2O3 for this platform alone.

QA-QC Protocol

Strict QA/QC protocols have been implemented for the Crater Lake Project, including the insertion of certified reference materials (standards), duplicates and blanks at regular intervals throughout the sequence of samples.

A total of 179, including 12 QA-QC, samples were sent to an analytical laboratory. All sample preparation and analytical work was carried out by Actlabs at their facilities in Ancaster, Ontario. Several analytical techniques were used to characterize the samples, which are combined at Actlabs into the analytical package “8-REE”. This package includes whole-rock and trace element analytic techniques. Whole Rock analyses are done via a lithium metaborate/tetraborate fusion inductively coupled plasma (ICP) finish. Trace elements are also analyzed by fusion ICP/MS.

The technical content in this press release was prepared, reviewed and certified by Pierre Guay, P. Geo., Imperial’s Vice-President, Exploration, a Geologist and Qualified Person as defined by NI43-101.

ABOUT IMPERIAL MINING GROUP LTD.

Imperial is a Canadian mineral exploration and development company focussed on the advancement of its copper-zinc, gold and technology metals properties in Québec. Imperial is publicly listed on the TSX Venture Exchange as “IPG” and is led by an experienced team of mineral exploration and development professionals with a strong track record of mineral deposit discovery in numerous metal commodities.

For further information please contact:

Peter J. Cashin

President and Chief Executive Officer

Tel: +1 (514) 360-0571

Email: info@imperialmgp.com

URL: www.imperialmgp.com

This press release may contain forward-looking statements relating to the Company’s operations or to its business environment. Such statements are based on the Company’s operations, estimates, forecasts, and projections, but are not guarantees of future performance and involve risks and uncertainties that are difficult to predict or control. Several factors could cause actual outcomes and results to differ materially from those expressed. These factors include those set forth in the corporate filings. Although any such forward-looking statements are based upon what management believes to be reasonable assumptions, the Company cannot guarantee that actual results will be consistent with these forward-looking statements. In addition, the Company disclaims any intention or obligation to update or revise any forward-looking statements, for any reason. We also do not commit in any way to guarantee that we will continue reporting on items or issues that arise. Investors are cautioned that this press release contains quoted historical exploration results. These are derived from filed assessment reports and compiled from governmental databases. The Company and a QP have not independently verified and make no representations as to the accuracy of historical exploration results: these results should not be relied upon. Selected highlight results may not be indicative of average grades. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/2d192bc2-8a6b-4df3-bc04-ead07797b309

https://www.globenewswire.com/NewsRoom/AttachmentNg/9b46a82c-3f81-49a3-baf2-bc315179f947

https://www.globenewswire.com/NewsRoom/AttachmentNg/97edf9ef-76f3-4f2a-b1d5-49eb0c2b1e87

Click here to connect with Imperial Mining Group Ltd. (TSXV:IPG) for an Investor Presentation.

Source: www.globenewswire.com