NOT FOR DISSEMINATION IN THE UNITED STATES OF AMERICA OR TO US WIRE SERVICES

- Extremely high-grade nickel associated with W4 Zone including 8.66% Ni over 1.11 metres in hole EV21-01

- Very high nickel tenors ranging from 18% to >40% Ni (estimated content of nickel in 100% sulphide) associated with the W4 Zone anticipated to be reflected in concentrate grades when metallurgical testing is initiated

- Drilling has intersected the mineralized ultramafic unit to the west of the defined boundary of the W4 zone

EV Nickel Inc. (TSXV:EVNI) ("EVNi" or the "Company") is pleased to announce that exploration drilling on the Langmuir Nickel Project ("Langmuir" of the "Property") from the inaugural drill program with significant intersections from within and along the eastern and western boundaries of the W4 Nickel Zone

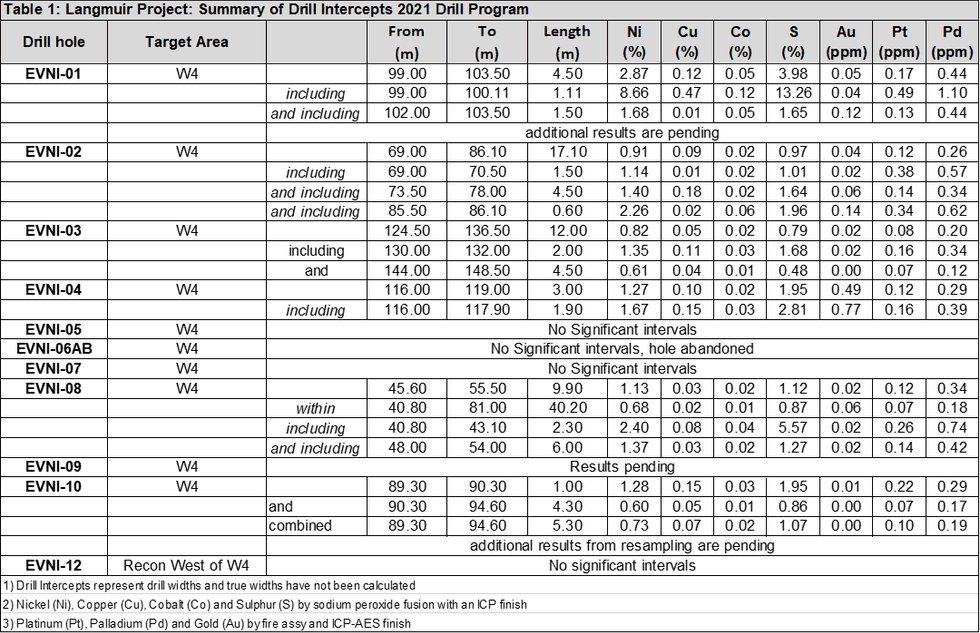

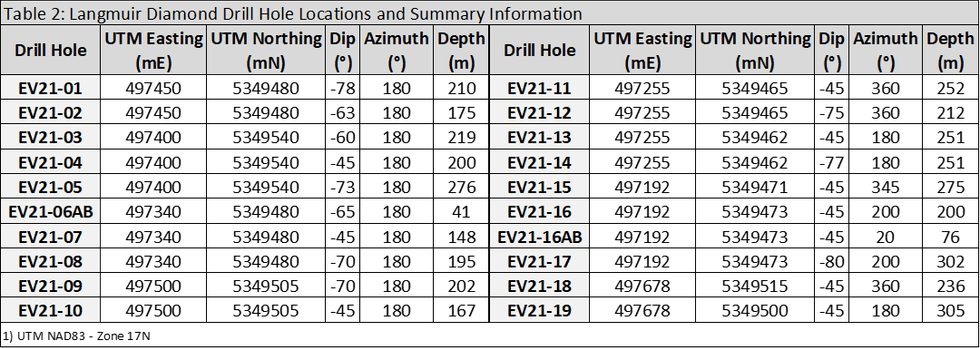

Since June 2021, a total of 20 holes representing 4,192 metres of diamond drilling on the Langmuir Nickel Project. Assay results for 10 holes of the 2021 exploration drill program are reported in the Table 1 below. Drill hole information including the location of the collars, dip and azimuth of the holes and the final depth are provided in Table 2.

"We are very excited to start getting assay results and these begin to confirm our excitement for the potential of the Langmuir Project and the Shaw Dome more broadly," said Sean Samson, President & CEO of EVNi "This is a district which has produced nickel with the sorts of grades that get turned into mines."

"I am extremely encouraged by the mineralization observed within the W4 Zone," states Paul Davis, EVNi's Vice President of Exploration. "The unique characteristics of this deposit with a lower magnetic susceptibility and disseminated sulphides with a high nickel tenor opens up additional priority targets for exploration on the Langmuir Property. We are gearing up to start our Phase 2 drill program testing additional high priority targets along the favourable geologic trends to the east and west of W4."

The drill program was designed to test gaps within the W4 Zone historic drilling and provide EVNI with representative intersections of the W4 mineralization, test the eastern and western boundaries of the W4 Zone and explore the favourable ultramafic horizon to the east and west of the W4 mineralization.

Drilling within the W4 Zone intersected significant nickel mineralization associated with disseminated, blebby, veined and massive sulphides hosted in a serpentinized ultramafic unit including 40.2 metres grading 0.68% Ni in hole EV21-08; 17.10 metres grading 0.91% Ni in EV21-02; and 1.11 metres grading 8.66% Ni in EV21-01. These results confirm the high-grade nature of the sulphides mineralization associated with the W4 Zone. EV Nickel has implemented the analysis of sulphur for all drill core samples, allowing the Company to determine the nickel tenors, (nickel content in 100% sulphide) that have been calculated between 18% to >40% within the W4 Zone. This indicates that significant nickel mineralization is associated with low sulphide concentrations of less than 5% sulphide within the host ultramafic host. Assay results are pending for 10 holes of the Phase I drill hole program.

The type of nickel mineralization associated with the W4 Zone is not typical of the other nickel deposits hosted within the Shaw Dome, south of Timmins, Ontario. The sulphide composition of the mineralized zones is composed almost exclusively of pentlandite resulting in significant nickel grades being associated with low sulphide contents. The sulphide mineralization is also finely disseminated within the zone and has led the Company to expand the sampling in holes EV21-01 and EV21-10 to include intersections adjacent to those reported in Table 2 for which the assays are still pending. This style of mineralization also presents with a different geophysical signature than the traditional deposits and opens up additional target areas within the Langmuir Property.

Assay QA/QC

Drill core samples from the 2021 drill program at the Langmuir Project are cut and bagged at the core logging facility located near the property and transported to ALS Canada Ltd for analysis. Samples, along with standards and blanks that are included for quality assurance and quality control, were prepared and analyzed at the laboratory. Samples are crushed to 70% less than 2mm. A riffle split is pulverized to 85% passing 75 microns. Nickel, copper, cobalt and sulphur are analyzed by sodium peroxide fusion with an ICP finish and platinum, palladium and gold by fire assay and ICP-AES finish. These and future assay results may vary from time to time due to re‒analysis for quality assurance and quality control.

About EV Nickel Inc.

EV Nickel is a Canadian nickel exploration company, focused on the Shaw Dome area, south of Timmins, Ontario. The Shaw Dome area is home to its Langmuir project which includes W4, the basis of a 2010 historical estimate of 677K tonnes @ 1% Ni, ~15M lbs of Class 1 Nickel. EV Nickel's objective is to grow and advance a nickel business, targeting the growing demand for Class 1 Nickel, from the electric vehicle battery sector. EV Nickel has almost 9,100 hectares to explore across the Shaw Dome and has identified 30km of additional favourable strike length.

Qualified Person

The Company's Projects are under the direct technical supervision of Paul Davis, P.Geo., and Vice-President of the Company. Mr. Davis is a Qualified Person as defined by NI 43-101. He has reviewed and approved the technical information in this press release. There are no known factors that could materially affect the reliability of the information verified by Mr. Davis.

Cautionary Note Regarding the Langmuir project's 2010 historical estimate:

Historical mineral resources for Langmuir were estimated by SRK Consulting (Canada) Inc., as documented in a report entitled, "Golden Chalice Resources Inc., Mineral Resource Evaluation, Langmuir W4 Project, Ontario, Canada", dated June 28, 2010 (the "Historical Report"). A qualified person, as defined by NI 43-101, has not done sufficient work to verify the historical assay results and technical information reported herein. The Company is not treating the Historical Report as current. The reader is cautioned not to rely upon any of the historical report, or the estimates therein. The historical estimates presented herein as geological information only, as a guide to follow-up technical work, and for targeting of confirmation and exploration drilling.

Cautionary Note Regarding Forward-Looking Statements:

This press release contains forward-looking information. Such forward-looking statements or information are provided for the purpose of providing information about management's current expectations and plans relating to the future. Readers are cautioned that reliance on such information may not be appropriate for other purposes. Any such forward-looking information may be identified by words such as "proposed", "expects", "intends", "may", "will", and similar expressions. Forward-looking statements or information are based on a number of factors and assumptions which have been used to develop such statements and information, but which may prove to be incorrect. Although EV Nickel believes that the expectations reflected in such forward-looking statements or information are reasonable, undue reliance should not be placed on forward-looking statements because the Company can give no assurance that such expectations will prove to be correct. Factors that could cause actual results to differ materially from those described in such forward-looking information include, but are not limited to, changes in business plans and strategies, market conditions, share price, best use of available cash, the ability of the Company to raise sufficient capital to fund its obligations under various contractual arrangements, to maintain its mineral tenures and concessions in good standing, and to explore and develop its projects and for general working capital purposes, changes in economic conditions or financial markets, the inherent hazards associated with mineral exploration, future prices of metals and other commodities, environmental challenges and risks, the Company's ability to obtain the necessary permits and consents required to explore, drill and develop its projects and if obtained, to obtain such permits and consents in a timely fashion relative to the Company's plans and business objectives, changes in environmental and other laws or regulations that could have an impact on the Company's operations, compliance with such laws and regulations, the Company's ability to obtain required shareholder or regulatory approvals, dependence on key management personnel, natural disasters and global pandemics, including COVID-19 and general competition in the mining industry. These risks, as well as others, could cause actual results and events to vary significantly. The forward-looking information in this press release reflects the current expectations, assumptions and/or beliefs of EV Nickel based on information currently available to the Company. Any forward-looking information speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or expressly qualified by this cautionary statement.

Contact Information

For further information, visit www.evnickel.com

Or contact: Sean Samson, Chief Executive Officer at samson@evnickel.com.

EV Nickel Inc.

200 - 150 King St. W,

Toronto, ON M5H 1J9

www.evnickel.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy of this release.

SOURCE: EV Nickel Inc.

View source version on accesswire.com:

https://www.accesswire.com/676491/EV-Nickel-Announces-High-Grade-Nickel-Intersections-From-Langmuir-Project