Canadian Firm Moves Ahead with New Way to Process Vanadium

VanadiumCorp Resource has signed an agreement with Electrochem to develop a “green” chemical process to make vanadium, valued for its energy storage use.

VanadiumCorp Resource (TSXV:VRB) has signed a partnership deal with Electrochem Technologies & Materials to develop a “green” chemical process for producing vanadium and other co-products.

Adriaan Bakker, CEO of VanadiumCorp, said in a Tuesday (January 16) release that the monetization of vanadium, iron and titanium “provides a distinct advantage” for the company’s 100-percent-owned VTM (vanadiferous titanomagnetite) resources.

The company owns the Lac Dore and Iron-T VTM projects in Quebec. Lac Dore is its flagship asset and its resource measures 621 million pounds of V2O5 from VTM concentrate grading 1.08 percent V2O5.

“Our collaboration with Electrochem first began by addressing the industry need for a better process method for vanadium electrolyte,” Bakker added. Vanadium electrolyte is one of the most important components of the vanadium redox flow battery (VRFB).

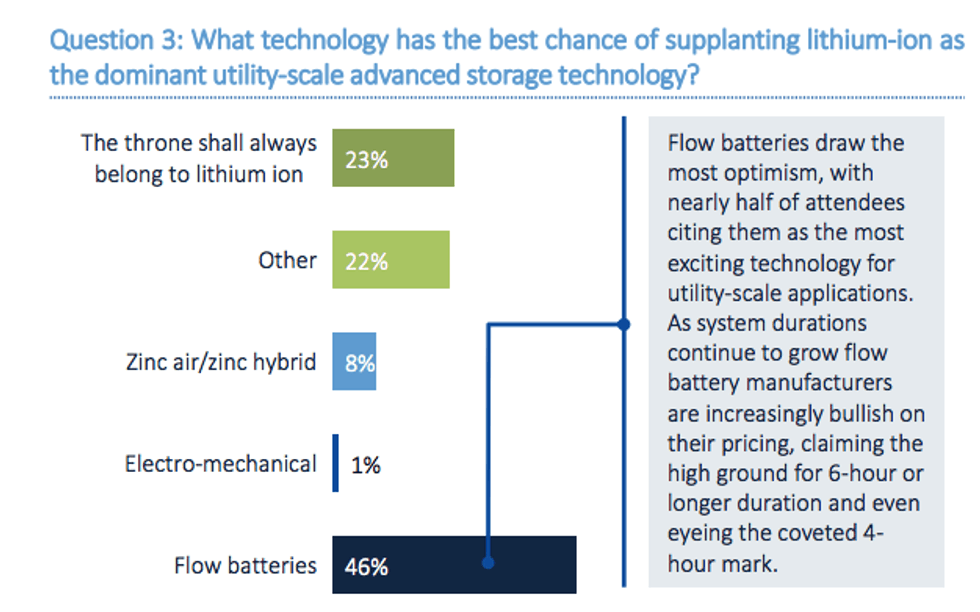

An audience poll conducted at Greentech Media’s Energy 2017 Storage Summit revealed that 46 percent of participants believe VRFBs could supplant lithium-ion batteries as the dominant utility-scale advanced storage technology.

Chart via GTM Research.

“Utilizing a custom reactor and combining technologies, Phase II testing and trial production subsequently confirmed the ability to process magnetite regardless of origin and various feedstocks that many companies had considered waste until now,” said Bakker.

The firm notes that the recovery of vanadium as vanadyl sulfate is used a precursor for the preparation of vanadium electrolyte, and can be processed to meet any vanadium battery specification.

One of the concerns about about VRFBs is cost. Chris Berry, founder of New York-based research firm House Mountain Partners, recently told Mining Technology that VRFBs are “not cost competitive with the lithium-ion battery,” and range between $300 to $500 per kilowatt hour in comparison to lithium-ion batteries, which are closer to $250 per kilowatt hour.

Vanadium accounts for about 40 percent of the cost of a VRFB, but energy storage is an emerging application for the metal as 90 percent of vanadium is used in steel.

The company acknowledges the “higher cost structure for electrolyte” in Tuesday’s release, noting that it is due to limited supply and impurities associated with conventional processing methods. VanadiumCorp adds that the chemical process it has created with Electrochem dissolves the feedstock in a solution, which allows for impurities to be removed more easily.

Their 50/50 agreement includes the development and licensing of the “carbon-free” VanadiumCorp-Electrochem Chemical Process Technology. The partners are targeting pilot plant demonstration, commercialization and scaled production applied to VanadiumCorp’s projects with a buyout provision.

VanadiumCorp said its partnership agreement furthers collaboration from a previously signed memorandum of understanding. Under the deal, the companies filed US provisional patent applications for the new chemical process and are working on a production development outline for Lac Dore. VanadiumCorp released a preliminary economic assessment (PEA) for Lac Dore in November 2017, outlining a mine life of 20 years.

“Vanadium electrolyte is a critical battery material that can be re-used indefinitely and has far reaching benefits for a sustainable future,” Bakker said, commenting on the PEA.

At close of day Wednesday (January 17), VanadiumCorp’s share price was up 4.35 percent at C$0.12.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Shaw, hold no direct investment interest in any company mentioned in this article.