International Engineering Firm Appointment for Kachi

Lake Resources NL (ASX:LKE) announced today that international engineering company, Hatch Pty. Ltd. (Hatch), has been engaged to provide engineering and design services for Lake’s flagship Kachi Lithium Brine Project in Argentina.

- International engineering firm, Hatch, appointed to provide engineering and design services for Lake’s Kachi Lithium Brine Project, Argentina.

- Hatch has substantial lithium sector experience, including South American brine projects and is familiar with direct extraction processes and Lake partner Lilac Solutions’ ion exchange technology.

- Lake is examining the project’s technical and economic viability, including potential for significant cost reductions and superior recoveries based on direct extraction compared to evaporation ponds as part of the Pre-Feasibility Study (PFS) underway at Kachi.

- The Kachi project is ranked amongst the top 10 global lithium brine resources1, with a Phase 1 Engineering Study2 showing the potential for production costs to be in the lowest cost quartile, with high recoveries (85-90%) and lithium brine concentrations in excess of 25,000 mg/L lithium.

- Currently in discussions with parties regarding production development funding for Kachi.

Lake Resources NL (ASX:LKE) announced today that international engineering company, Hatch Pty. Ltd. (Hatch), has been engaged to provide engineering and design services for Lake’s flagship Kachi Lithium Brine Project in Argentina. This will give the Company’s 100% owned flagship project a further boost as it targets rapid, low-cost lithium production with minimal environmental impact.

Lake is currently undertaking a pre-feasibility study (PFS) at the Kachi project including reviewing and assessing the project’s technical and economic viability, including both conventional processing and direct extraction methods, project engineering design, product specifications, optimisation of recovery, and operating and capital costs. Hatch will provide input into this process.

Significant cost reductions (projected to be within the lowest quartile cash costs) and superior recoveries are expected to be demonstrated on site for the direct extraction process offered by Lake’s partner, U.S.-based Lilac Solutions, compared to traditional evaporation ponds used in South American brine projects.

As part of the project’s development, design and engineering work has commenced on a pilot plant to be built on-site to further assess Lilac’s ion exchange technology (refer ASX announcement 7 May 2019). The design and engineering phase is expected to take three months, followed by an estimated three months of construction, with planned delivery of the plant and commissioning in late 2019.

Lake is currently in discussions with a number of parties regarding production development funding for the Kachi project that will assist with financing the definitive feasibility study that is likely to follow from the PFS.

Level 5, 126 Phillip St, Sydney, NSW 2000, Australia 1 T: +61 2 9299 9690

Lake’s 100% owned Kachi project is considered one of the Top 10 largest lithium brine resources globally1.

It is located in a highly prospective area for lithium brine, being situated south of Livent/FMC’s lithium production centre, which has been operating for more than 20 years, and near Albemarle’s Antofalla project in Catamarca Province.

The region has been subject to significant corporate transactions recently involving lithium brine assets, implying an acquisition cost of US$50-$110 million per 1 million tonnes of LCE resources.

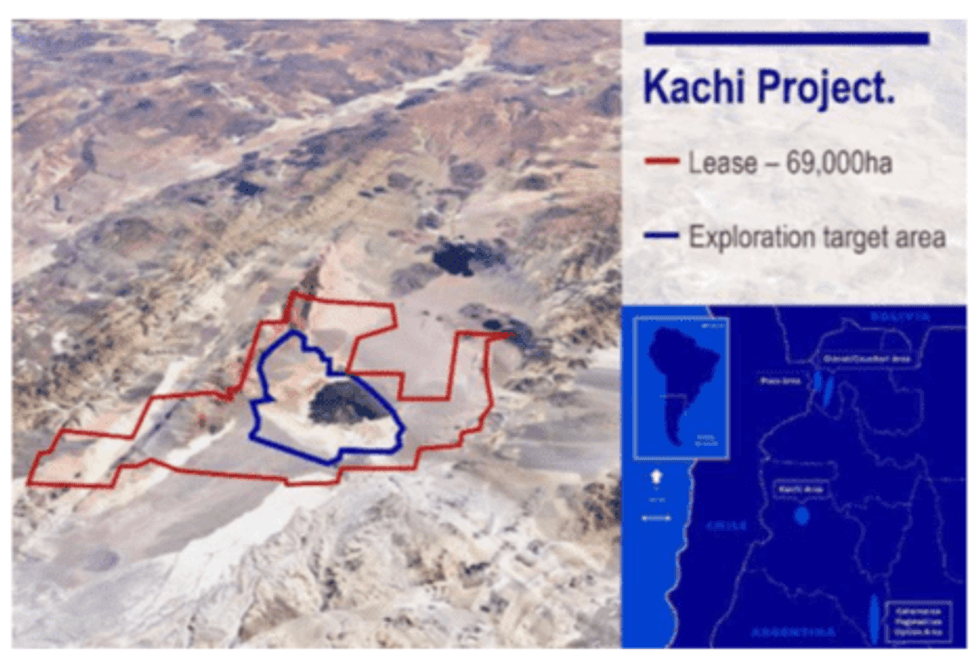

Lake recently announced a maiden resource for Kachi of 4.4 million tonnes lithium carbonate equivalent (LCE) (Indicated 1.0Mt and Inferred 3.4Mt) within a much larger exploration target (refer ASX announcement 27 November 2018). This occurs within consolidated mining leases which covers almost the entire salt lake (69,000 hectares).

Lilac’s extraction technology also offers the potential for reduced environmental impact compared to traditional processes used in Argentina, due to the removal of evaporation ponds.

Commenting on the latest update, Lake’s Managing Director Steve Promnitz said: “The appointment of an experienced international engineering firm for Kachi is another important milestone, not only for our flagship project, but also for the high-productivity, high purity process offered by Lilac’s direct extraction technology. Hatch has substantial experience in the lithium sector, including in South America and with direct extraction processes.

“Our aim is to produce a PFS that clearly shows that Kachi can be a technically viable and commercially profitable operation that delivers superior recoveries and returns from direct extraction methods, in the lowest quartile of cash costs globally, amid rising competition for large proven lithium resources.

“Meanwhile, drilling is progressing well at Cauchari and we are witnessing encouraging signs with early samples for this project, which is located next to some of the Lithium Triangle’s largest near-term production.

“Lake is exceptionally well-placed to deliver considerable value in the near-term as we progress our key projects towards production in an environment of rising global demand for lithium, increasing merger and acquisition activity and constrained lithium supply.”

For further information please contact: Steve Promnitz

Managing Director

+61 2 9188 7864 steve@lakeresources.com.au

Follow Lake Resources on Twitter:

https://twitter.com/Lake_Resources https://www.lakeresources.com.au

Footnotes:

(*1): Kachi Mineral Resource Statement in ASX market release titled “Large Maiden 4.4mt LCE Resource Estimate for Kachi Project” on 27 November 2018.

(*2): Phase 1 Engineering Study in ASX market release titled ”Lilac Extraction Process Shows Potential For High Lithium Recoveries At Lowest Quartile Costs At Kachi” on 10 December 2018.

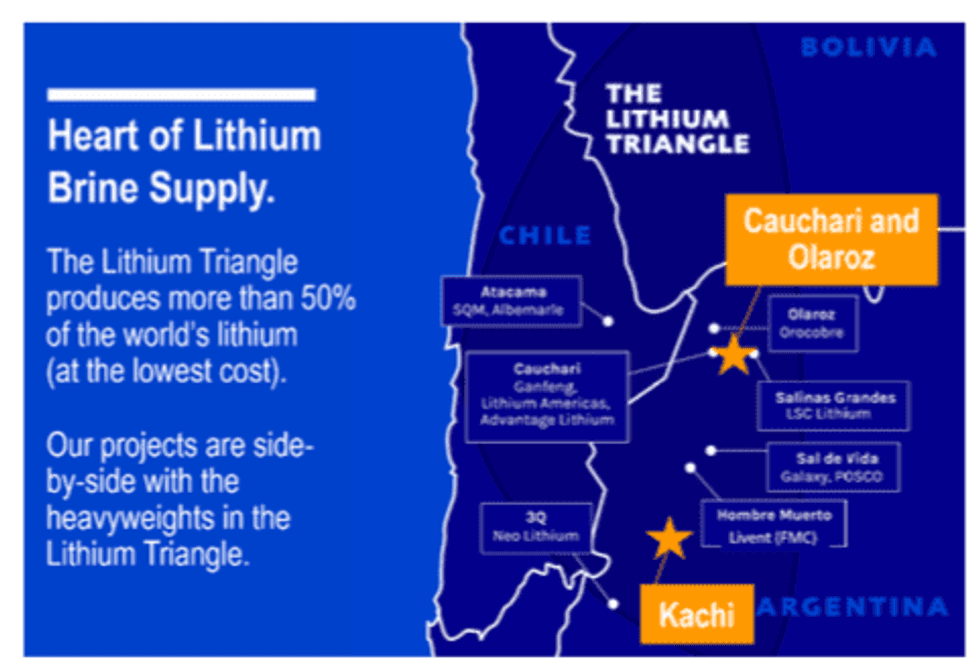

Figure 1. Lake’s Kachi Lithium Project location with respect to other lithium brine projects in Chile/Argentina.

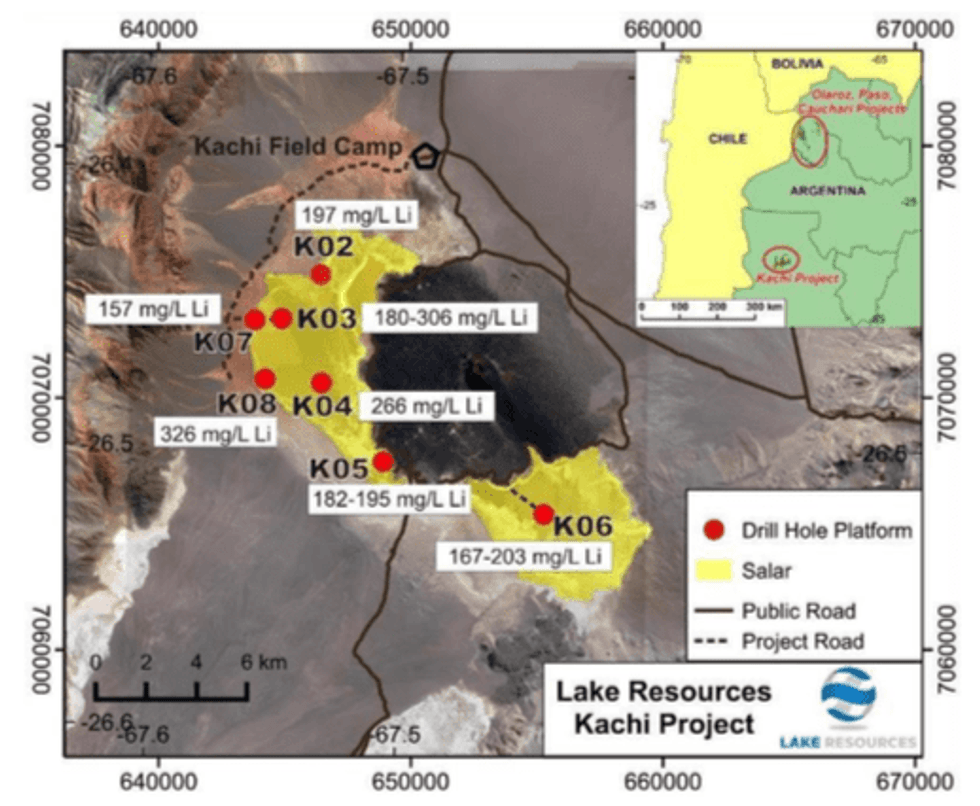

Figure 2. Kachi Lithium Project showing drilling locations and details of the drilling platforms with averaged lithium concentrations for each drill hole.

Figure 3. Kachi Lithium Project showing lease area and dominance of the salt lake basin.

About Lake Resources NL (ASX:LKE)

Lake Resources NL (ASX:LKE, Lake) is a lithium exploration and development company focused on developing its three lithium brine projects and hard rock project in Argentina, all owned 100%. The leases are in a prime location among the lithium sector’s largest players within the Lithium Triangle, where half of the world’s lithium is produced. Lake holds one of the largest lithium tenement packages in Argentina (~200,000Ha) secured in 2016 prior to a significant ‘rush’ by major companies. The large holdings provide the potential to provide consistent security of supply demanded by battery makers and electric vehicle manufacturers.

The Kachi project covers 69,000 ha over a salt lake south of FMC’s lithium operation and near Albemarle’s Antofalla project in Catamarca Province. Drilling at Kachi has confirmed a large lithium brine bearing basin over 20km long, 15km wide and 400m to 800m deep. Drilling over Kachi (currently 16 drill holes, 3100m) has produced a maiden indicated and inferred resource of 4.4 Mt LCE (Indicated 1.0Mt and Inferred 3.4Mt) within a 8-17 Mt LCE exploration target grading in the range of 310 mg/L to 210 mg/L lithium 1(refer ASX announcement 27 November 2018).

A direct extraction technique is being tested in partnership with Lilac Solutions, which has shown 80-90% recoveries and lithium brine concentrations in excess of 25000 mg/L lithium. Phase 1 Engineering Study results have shown operating costs forecast at US$2600/t LCE in the lowest cost quartile 2. This process is planned to be trialled on site in tandem with conventional methods as part of a PFS to follow the resource statement. Scope exists to unlock considerable value through partnerships and corporate deals in the near term.

The Olaroz-Cauchari and Paso brine projects are located adjacent to major world class brine projects either in production or being developed in the highly prospective Jujuy Province. The Olaroz-Cauchari project is located in the same basin as Orocobre’s Olaroz lithium production and adjoins Ganfeng Lithium/Lithium Americas Cauchari project, with high grade lithium (600 mg/L) with high flow rates drilled immediately across the lease boundary.

An additional new rig is being deployed to increase the depth capacity and speed of the drill rig currently at Cauchari. High fluid pressures, while encouraging, have meant that conditions are challenging. Results are expected to extend the proven resources in adjoining properties into LKE’s area. This will be followed by drilling extensions to the Olaroz area in LKE’s 100% owned Olaroz leases.

Significant corporate transactions continue in adjacent leases with development of Ganfeng Lithium/Lithium Americas Cauchari project with Ganfeng announcing a US$237 million for 37% of the Cauchari project previously held by SQM, followed by a further US$160 million to increase Ganfeng’s equity position to 50% on 1 April 2019, together with a resource that had doubled to be the largest on the planet. Ganfeng then announced a 10 year lithium supply agreement with Volkswagen on 5 April 2019. Nearby projects of Lithium X were acquired via a takeover offer of C$265 million completed March 2018. The northern half of Galaxy’s Sal de Vida resource was purchased for US$280 million by POSCO in June-Dec 2018. LSC Lithium was under offer in Jan 2019 for C$111 million by a mid-tier oil & gas company with a resource size half of Kachi. These transactions imply an acquisition cost of US$55-110 million per 1 million tonnes of lithium carbonate equivalent (LCE) in resources.

For more information on Lake, please visit https://www.lakeresources.com.au/home/

About Hatch

Hatch– “Tackling the tough issues to drive positive change”; “Entrepreneurs with a technical soul.”

Hatch is committed to the pursuit of a better world and to develop better ideas with partners that are smarter, more efficient, and innovative, with over six decades of experience. A global network of 9,000 professionals work on the world’s toughest challenges over 150 countries around the world in the metals, energy, infrastructure, digital, and investments market sectors.

Hatch is employee-owned and independent with diverse teams that combine vast engineering and business knowledge, working in partnership with clients to manage and optimize production, develop new game-changing technologies, and design and deliver complex capital projects.

Hatch works closely with communities to ensure that the solutions optimize environmental protection, economic prosperity, social justice, and cultural vibrancy. Hatch believes in long-term relationships with their partners, and are committed to their clients’ lasting success.