Zenyatta’s Albany Graphite Could be Used in Lithium-ion Batteries

The company said Thursday that initial testing on Albany graphite shows that it is “in the range of materials” currently used in lithium-ion batteries.

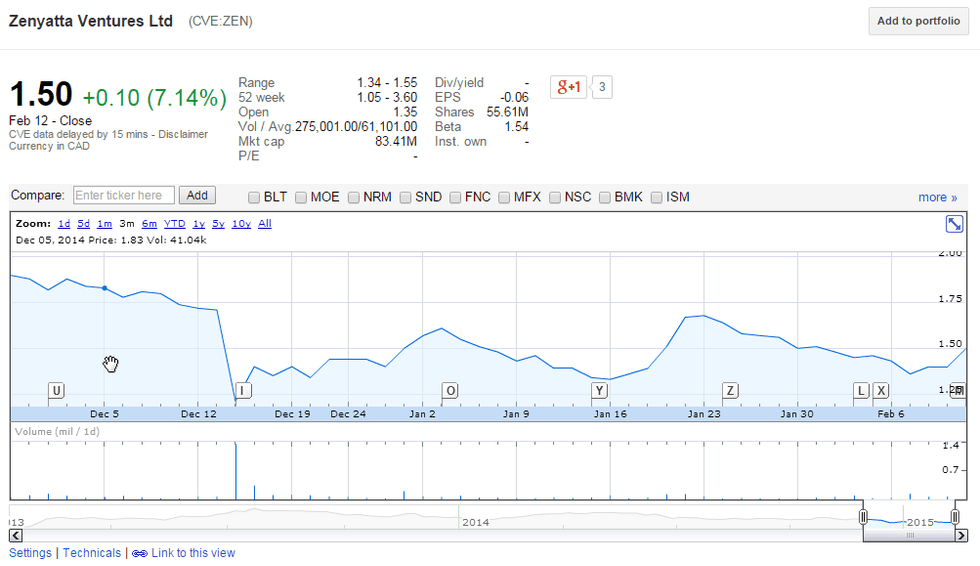

Zenyatta Ventures (TSXV:ZEN) last made headlines on Graphite Investing News back in December, when a nearly 40-percent drop took the company’s share price from $1.71 to $1.05. The precipitous fall came as investors dumped shares following the release of a metallurgical process update.

Their disappointment stemmed from two main issues. First, shareholders realized that the preliminary economic assessment (PEA) for the company’s Albany hydrothermal graphite deposit was unlikely to be released by the end of 2014 — a prediction that turned out to be correct. Second, investors were not happy with the flotation concentrate grade announced. While it was raised to 92.5 percent graphitic carbon (Cg) from the previous figure of 78.3 percent Cg, for many that wasn’t high enough.

Zenyatta’s share price has not yet bounced back to where it was prior to that news, but it’s definitely doing better. It reached a 2015 high of $1.68 on January 23, though the company didn’t release any news that day, and at close of day Thursday was up 7.14 percent, at $1.50, after announcing that initial testing on Albany graphite shows that it is “in the range of materials” currently used in lithium-ion batteries.

Specifically, the company’s press release states, testing conducted by an independent lab shows that Albany graphite “is equivalent to the leading high quality natural and synthetic graphite in commercial usage today.” That means it may be possible to use it to make lithium-ion batteries.

Those who’ve cast an eye on the graphite sector over the last year or so know that’s significant in large part due to the fact that Tesla Motors (NASDAQ:TSLA) is in the midst of building a lithium-ion battery gigfactory in Nevada. It’s looking to build batteries for electric cars, and will need a lot of lithium, graphite and cobalt to do it. Further afield, LG Chem (KRX:051910) and Foxconn Technology (TPE:2354) have their own megafactories in the works.

Those developments have gotten prospective miners of all three metals excited, but it’s worth noting that for graphite at least there are some strings attached. First and foremost is the fact that Tesla may not even use natural graphite at its gigafactory. As Simon Moores of Benchmark Mineral Intelligence said last month, “whilst natural graphite has cost advantages and has a lower carbon footprint to the synthetic material, at the end of the day [Tesla needs] to get the raw material first and foremost. And if there isn’t enough supply at the right price, then Tesla will have to use synthetic.”

Zenyatta is also urging investors not to get too excited — at least not just yet. Thursday’s press release comes with a slew of caveats, including the statement that the results “do not mean that Zenyatta can extract and process Albany graphite for high purity graphite applications on an economic basis.”

Nevertheless, Dr. Bharat Chahar, vice president of market development at Zenyatta, is encouraged and noted, “[d]ue to simple mineralogy, high crystallinity and desirable particle size distribution, Zenyatta graphite has shown first testing specification ranges needed for the Li-ion battery industry. While further tests are ongoing by potential customers to verify other performance characteristics, this initial feedback on results is extremely encouraging. We now plan to carry out advanced testing with a full cell made from the Zenyatta graphite anode.”

The company plans to release periodic updates on developments on the lithium-ion battery front, and moving foward investors will no doubt stay on the lookout for the Albany PEA. Zenyatta also recently launched a small one- or two-hole drill program on a buried geophysical target north of Albany. The company is doing the work in order to fulfill obligations required to acquire 100 percent of Albany.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Related reading:

Investors Dump Zenyatta as Metallurgical Process Update Disappoints

Simon Moores: Expect Supply Chain Focus for Megafactory Metals