Nouveau Monde Feasibility Study Shows Pre-tax NPV of $ 1,287 Million and IRR of 40.6 % and After-tax NPV of $ 751 Million and IRR of 32.2 % From Its All-electric Open Pit Mining Project

Nouveau Monde Graphite Inc. (TSXV:NOU) (“Nouveau Monde” or the “Company”) is pleased to announce the results of a Feasibility Study (“FS”) covering the West Zone deposit of the Tony Claim Block, part of its Matawinie graphite Property.

Nouveau Monde Graphite Inc. (TSXV:NOU) (“Nouveau Monde” or the “Company”) is pleased to announce the results of a Feasibility Study (“FS”) covering the West Zone deposit of the Tony Claim Block, part of its Matawinie graphite Property. The FS, detailing an all-electric open pit mining operation, was prepared by Met-Chem, a division of DRA Americas Inc. (“MC‑DRA”), an experienced and renowned independent engineering consulting firm specializing in the mining and metallurgy sector.

Nouveau Monde is pleased to provide a new corporate video outlining the most recent developments of the Company including the FS results available through this link: https://youtu.be/ua7iaBXmaLg.

All costs presented in this press release are in Canadian Dollars unless otherwise specified and “tonne” will signify metric ton.

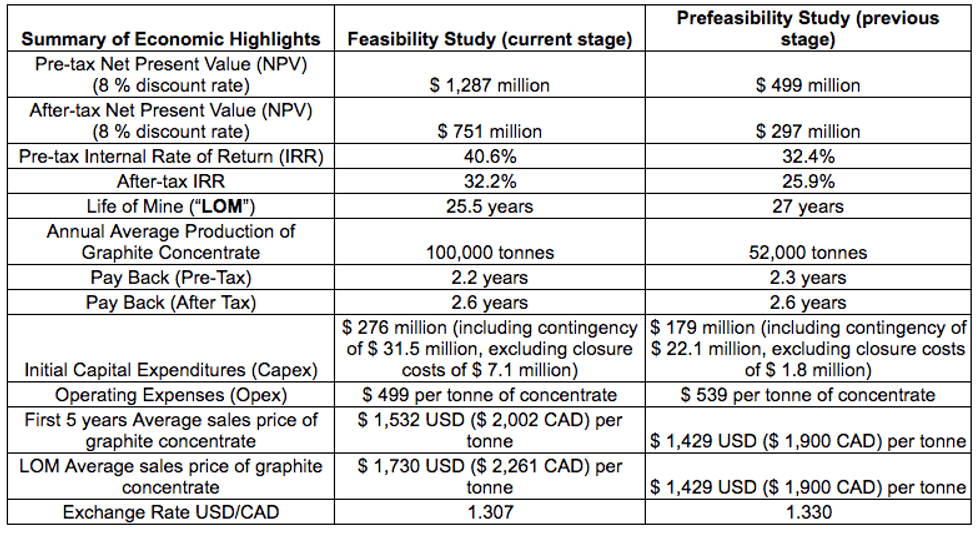

The following lists the highlights provided by the FS and compares its results to those of the Prefeasibility Study detailed in the press release dated October 25, 2017:

Cautionary Note: There is no certainty that the economic forecasts on which this FS is based will be realized.

Eric Desaulniers, President and Chief Executive Officer of Nouveau Monde stated: “We are very pleased to present these robust FS results which clearly demonstrates the competitive economics of our project and once again confirms that Nouveau Monde is on track to become a reliable long-term supplier of quality natural flake graphite.

On the basis of this FS, we are excited to move the project forward quickly by completing our Environmental and Social Impact Assessment (“ESIA”) as well as starting the Engineering, procurement, construction and management (“EPCM”) phase.”

The following files can be downloaded in support to this press release:

- Property Work Overview Map: https://staging.nouveaumonde.ca/wp-content/uploads/2018/10/PR_Tony_Block_20181024_EN_r.pdf

- General Site Layout: https://staging.nouveaumonde.ca/wp-content/uploads/2018/10/A1-J02761-0003-L-0B.pdf

MINERAL RESOURCES

In the following text, graphite is expressed in graphitic carbon percentage (% Cg).

The pit constrained resource located in the West Zone deposit includes 95.8 million tonnes grading 4.28 % Cg of Indicated Resources and 14.0 million tonnes, grading 4.19 % Cg of Inferred Resources, using a cut-off grade of 1.78 % Cg. Refer to the Company’s press release dated June 27, 2018 for further details.

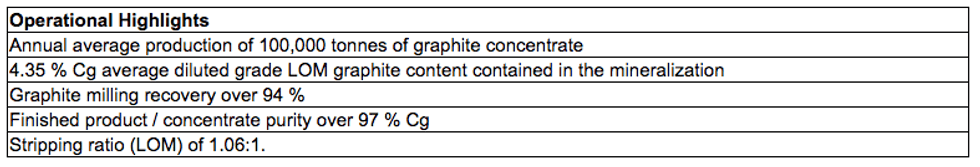

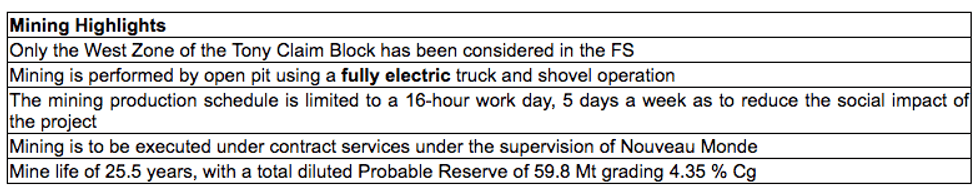

MINING

MINERAL RESERVES

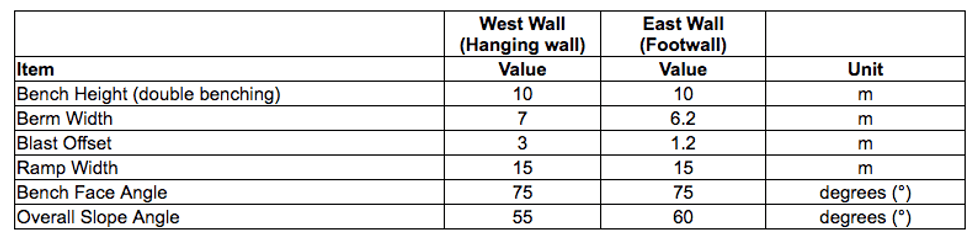

The Mineral Reserve estimate was prepared by MC-DRA, using the Mineral Resource Estimate completed by SGS Canada Inc. – Geostat from Blainville, Québec, which was released by Nouveau Monde on June 27, 2018. The Mineral Reserves include the Indicated Mineral Resources that have been identified as being economically extractable and which incorporate mining losses and the addition of waste dilution. In addition, Mineral Reserve estimation considers the design of an operational pit that will form the basis of the production plan. This pit design uses the economic pit shell as a guideline and considers geotechnical constraints, smoothing of the pit walls, adding ramps to access the pit bottom and ensuring that the pit can be mined using the initially selected equipment. Table 1 summarizes the pit design parameters.

Table 1 : West Zone Open Pit Design Parameters

The FS shows an average ROM feed rate of approximately 9,200 tonnes per day based on the current proposed mine work schedule of 5 days/week, two (2) 8-hr shifts per day (16 hr work day), a 25.5-year mine life and an average LOM waste to ore strip ratio of 1.06:1. The mineable portion of the reserves was developed based on an economic cut-off of 2.20 % Cg.

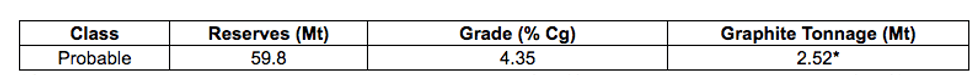

Once a dilution of 5 % and mining losses are considered, the Mineral Reserves extracted over the course of the mine life totals 59.8 Mt grading 4.35 % Cg in the Probable category as presented in Table 2 below:

Table 2 : Mine Reserves for the West Zone

*Graphite tonnage is based on an average graphite recovery of 94 % and concentrate product purity of 97 %.

Reserves categories are compliant with Canadian Institute of Mining, Metallurgy and Petroleum Definitions Standards for mineral resources in concordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects. The cut-off grade for the open pit Mineral Reserves is 2.20 % Cg.

The mine infrastructure has been designed to facilitate an environmentally friendly project while lowering the visual impact on neighbouring communities. The processing plant and the co-disposal pile of tailings and waste rock will be located less than 500 metres from the mine so as to minimize truck cycle times and lower the project’s operating costs. In addition, the mine plan conceived for the FS considers the progressive backfilling of waste rock and tailings within the pit to further minimize the project’s environmental footprint and allows site rehabilitation during the operating life of the mine. The innovative mine waste rock and tailings management plan, as well as the water management infrastructure was designed by SNC-Lavalin Inc.

The mine will be using an all-electric zero-emission mine fleet, consisting of electric battery-driven 36.3-tonne mining trucks, battery-driven front-end loaders, cable reel excavators and bulldozers, and battery-driven service vehicles. The mine will also be using an electric in-pit mobile crusher and overland conveyor system to feed crushed material to the plant. The technology used in this fleet has been developed by Medatech Engineering Services Ltd. and ABB Inc. which assisted MC-DRA in preparing a fully-electric equipment fleet estimate. This information was then passed to a mining contractor to establish a technical and commercial proposal for the mine operation on a contractual basis as well as on the basis of a fully-electric equipment fleet.

Mr. Desaulniers continued, “We have designed a state-of-the-art mine that not only maximizes efficiency but also aims to be one of the most ecofriendly mines in the world, having a very low carbon footprint relative to our peers. This is a key product differentiator, especially for our electric vehicle manufacturing customers whose environmental and social acceptability values align perfectly with our own.”

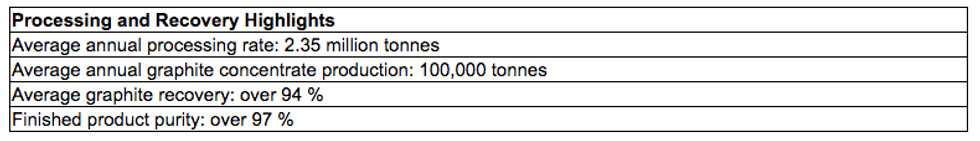

PROCESSING AND RECOVERY

The Matawinie concentrator combines proven technology and innovative ideas to conceive a robust flow sheet with remarkably high graphite recoveries. Since the Prefeasibility Study, additional variability test work and Locked Cycle Testing has been performed at SGS Mineral Services to confirm that a recovery of over 94 % is attainable while maintaining over 97 % product purity.

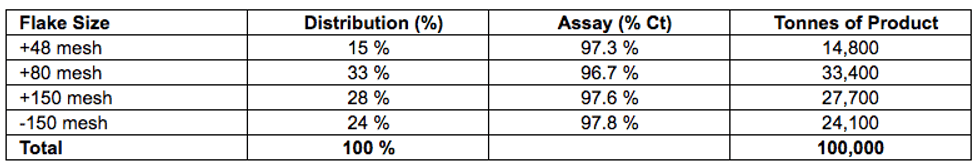

The flow sheet consists of in-pit crushing, followed by multiple steps of grinding and flotation separation circuits. The graphite concentrate is then filtered, dried and classified to produce four (4) high purity products.

Table 3 : Graphite Concentrate Distribution

The totals may not add up due to rounding.

The plant rejects are processed through flotation and magnetic separation to produce two (2) streams: sulphide and non-sulphide tailings. These streams are thickened and filtered before being sent for co-disposition.

GRAPHITE CONCENTRATE SALES PRICE ASSUMPTION

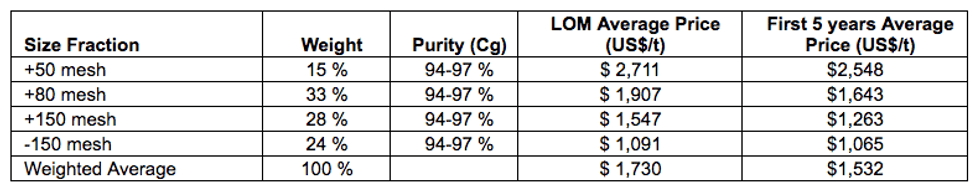

The graphite concentrate sales price used for the FS was established at $ 2,261 (1,730 USD) per tonne. The selling price was calculated using price forecasts provided by Benchmark Mineral Intelligence (Benchmark). Benchmark is an independent credible source who compiles international graphite prices for various commercial size fractions and concentrate purities. The Tony Block’s West Zone graphite concentrate value was calculated based on the weighted average of each size fraction and purity obtained during the metallurgical testing presented in Table 3. Table 4 presents graphite concentrate prices in USD for various size fractions calculated for years 2022 through 2047.

Table 4 : Price per Size Fraction

DESCRIPTION OF ECONOMIC EVALUATION

According to the FS, the Matawinie Property has demonstrated potential economic viability in regard to an open pit operation over the West Mineralized Zone.

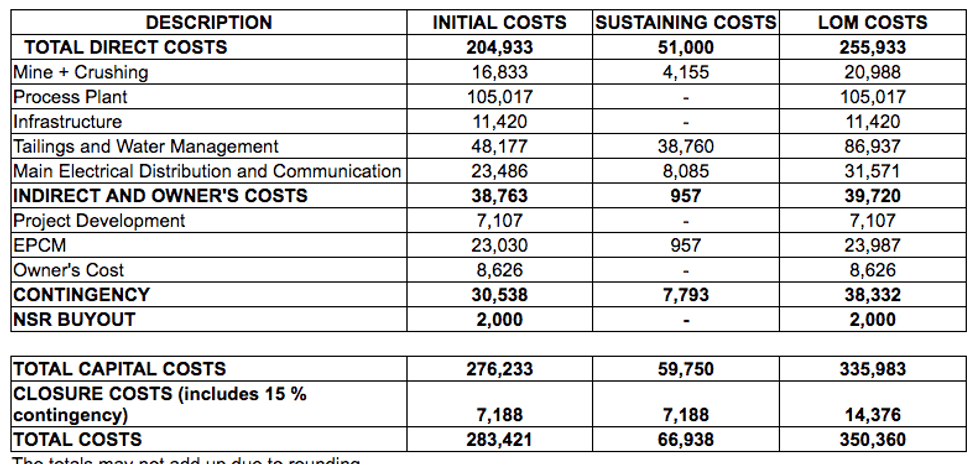

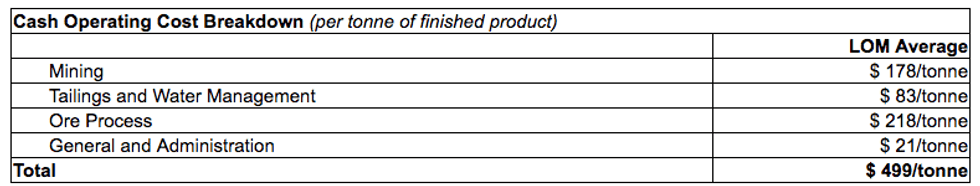

The capital cost estimate, summarized below, covers the development of the open pit, ore processing facilities, and infrastructure required for Nouveau Monde’s project. It is based on the application of standard costing methods of achieving a FS which provides an accuracy of ± 15 % and follows AACE (American Association of Cost Engineering) Class 3 Guidelines. The operating cost covers mining, transportation, processing, tailings and water management, general and administration fees, as well as infrastructure and services.

CAPITAL AND OPERATING COSTS

The capital expenditures and cash operating costs are summarized in Table 5 and Table 6. The mining costs have been estimated on contract service basis under the supervision of Nouveau Monde Graphite. Both cost estimates have a degree of accuracy of ± 15 %.

Table 5 : Capital Costs Summary ($’000 CAD)

Table 6 : Operating Costs Summary (in CAD)

The totals may not add up due to rounding.

TECHNICAL REPORT

A technical report detailing the FS, completed in accordance with the National Instrument (NI) 43-101 guidelines, will be filed and available on SEDAR within 45 days of this press release.

NEXT STEPS

Nouveau Monde has already started discussions for the EPCM phase and a letter of intent has been signed with the Mining Contractor. Furthermore, the Environmental and Social Impact Assessment is scheduled to be completed during the first quarter of 2019.

TOWARDS VALUE-ADDED GRAPHITE PRODUCTS

In a vertical integration and sustainable development perspective, Nouveau Monde is planning the establishment of a large-scale graphite secondary transformation facility in addition to its mining project. The goal is to transform part of its graphite concentrate into spherical graphite used in the booming Lithium-Ion battery market as well as develop expandable graphite products used in various industrial applications.

COMMUNITY RELATIONS

Since 2013, Nouveau Monde has held more than 50 meetings with people or groups from the town of Saint-Michel-des-Saints and nearby communities. During these presentations and consultations, important ties of trust have been forged between the population and Nouveau Monde. An accompanying committee, composed of citizens and regional experts, is working with Nouveau Monde’s technical team to ensure that the project grows while respecting the host environment and, above all, contributes to the regional dynamism.

PROJECT SUMMARY

In 2015, Nouveau Monde Graphite discovered a major and high-quality graphite deposit on its Matawinie property, located in Saint-Michel-des-Saints, 150 km north of Montreal, Quebec. This discovery eventually led to the completion of this Feasibility Study which reveal strong economics with a projected graphite concentrate production level of 100,000 tonnes per year over a 25.5-year period.

With over 60 years of experience in the world of graphite, NMG’s team develops its projects with the utmost respect of neighboring communities, while favouring a minimal ecological footprint. NMG is privileged by direct access to the workforce and infrastructure needed to operate its mining project, and it can also rely on an abundant, affordable and renewable source of hydroelectricity.

QUALITY CONTROL AND QUALITY ASSURANCE

The technical information derived from the FS presented in this news release was approved by Céline M. Charbonneau, P.Eng., M.Sc. of Met-Chem, a division of DRA Americas Inc., an independent Qualified Person as defined by National Instrument 43-101.

For further information, please contact:

Eric Desaulniers, P.Geo., M.Sc.,

President and Chief Executive Officer of Nouveau Monde Graphite

(819) 923-0333

Cautionary Statements Regarding Forward Looking Information

This press release contains “forward-looking information” within the meaning of the applicable securities legislation. All information contained herein that is not clearly historical in nature may constitute forward-looking information. Generally, such forward-looking information can be identified notably by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: (i) volatile stock prices; (ii) the general global markets and economic conditions; (iii) the possibility of write-downs and impairments; (iv) the risk associated with exploration, development and operations of graphite; (v) the risk associated with establishing title to mineral properties and assets; (vi) the risks associated with entering into joint ventures; (vii) fluctuations in graphite prices; (viii) the risks associated with uninsurable risks arising during the course of exploration, development and production; (ix) competition faced by the Company in securing experienced personnel and financing; (x) access to adequate infrastructure to support mining, processing, development and exploration activities; (xi) the risks associated with changes in the mining regulatory regime governing the Company; (xii) the risks associated with the various environmental regulations the Company is subject to; (xiii) risks related to regulatory and permitting delays; (xiv) the reliance on key personnel; (xv) liquidity risks;; (xvi) the risk of litigation; and (xvii) risk management.

Forward-looking information is based on assumptions management believes to be reasonable at the time such statements are made, including but not limited to, continued exploration activities, no material adverse change in graphite prices, exploration and development plans to proceed in accordance with plans and such plans to achieve their stated expected outcomes, receipt of required regulatory approvals, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking information. Such forward-looking information has been provided for the purpose of assisting investors in understanding the Company’s business, operations and exploration plans and may not be appropriate for other purposes. Accordingly, readers should not place undue reliance on forward-looking information. Forward-looking information is made as of the date of this press release, and the Company does not undertake to update such forward-looking information except in accordance with applicable securities laws.

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) has or approved or disapproved the contents of this press release.

Source: www.globenewswire.com