Graphite Supply Needs to Increase Nearly 500 Percent by 2050

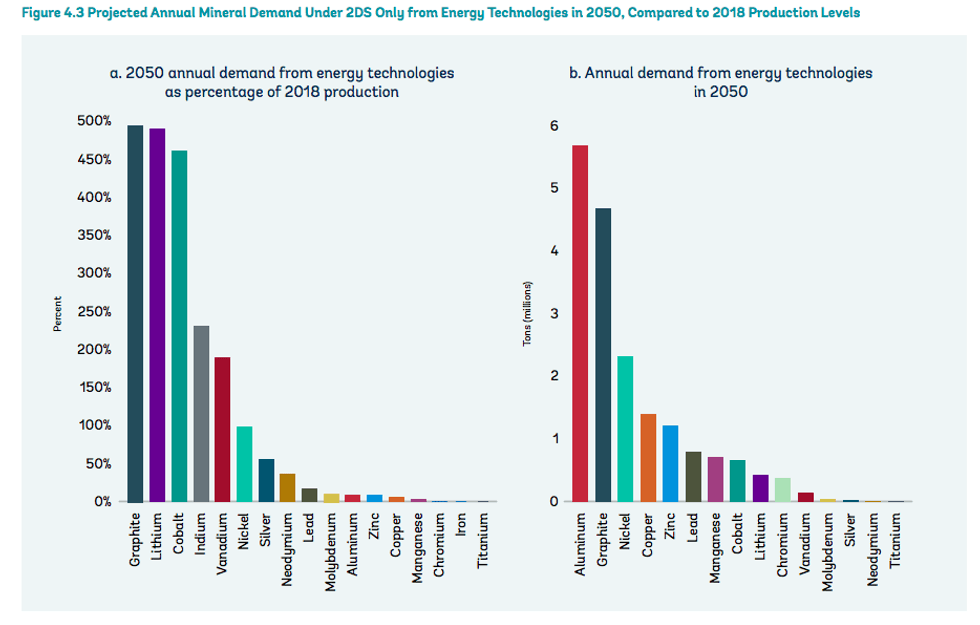

According to a new World Bank report, graphite output needs to jump by nearly 500 percent by 2050 to meet energy storage demand.

The energy revolution and the push for lower carbon emissions are unstoppable trends that will continue to unfold in the coming decades.

Demand for energy storage is expected to be so high that production of key battery metals such as graphite will need to ramp up to unprecedented levels.

According to a new World Bank report, just to meet the increasing demand from this segment, graphite output will need to jump by nearly 500 percent by 2050.

The World Bank’s forecast is based on a scenario with at least a 50 percent chance of limiting the average global temperature increase to 2 degrees Celsius by 2100, also called a 2 degree scenario.

For the World Bank, a low-carbon future will be very mineral intensive because clean energy technologies need more materials than fossil fuel-based electricity-generation technologies.

“Not only is low-carbon energy transition materially intensive, but that intensity increases with the level of decarbonization,” the report says.

This is also why any potential shortages in mineral supply could impact the speed and scale at which certain technologies may be deployed globally.

Looking at the share of mineral demand from energy storage, graphite accounts for nearly 53.8 percent of mineral demand up to 2050.

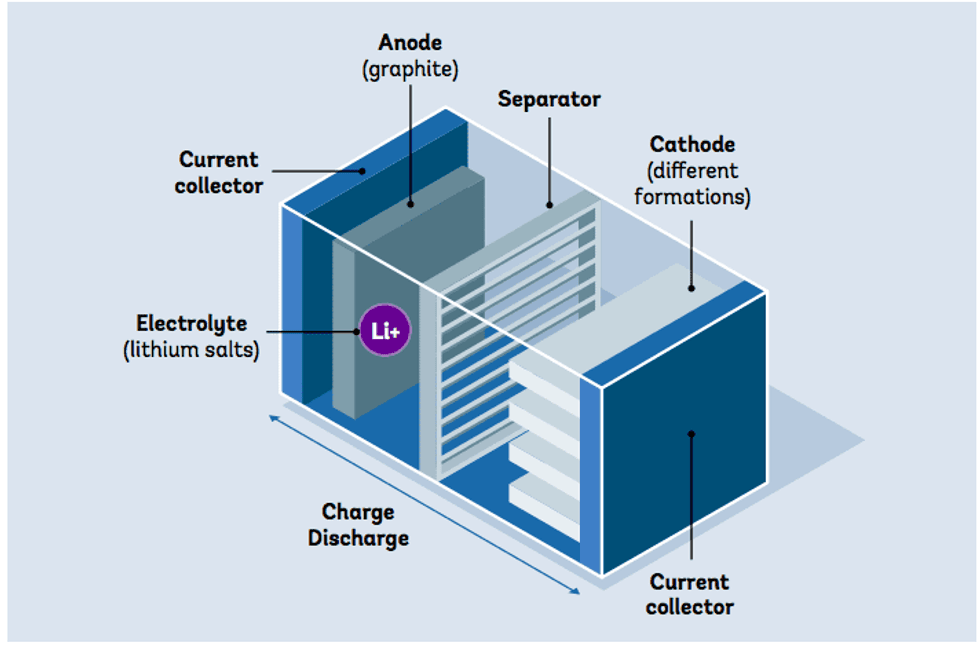

Graphite demand increases in both absolute and percentage terms since it is needed to build the anodes found in automotive, grid and decentralized batteries.

Image via the World Bank.

“About 4.5 million tons of graphite is needed to be produced annually by 2050, or a cumulative of 68 million tons, while graphite demand increases by nearly 500 percent from 2018 production figures, demonstrating the critical role graphite plays in the clean energy transition,” the report says.

Among many battery experts, the view is that lithium-ion batteries will dominate the battery sector in the next decade, and that is also the World Bank’s perspective. Lithium-ion batteries also need other essential minerals such as lithium, cobalt and nickel.

Image via the World Bank.

However, as demand levels grow, the technologies that might meet that demand become uncertain. As time goes on, more market space will be available for new battery technologies, with different mineral requirements, in particular post-2030.

As a result, concentrated metals such as graphite have the highest level of demand risk.

“Still, the storyline remains the same as that for energy generation technologies: Greater climate ambition leads to greater overall mineral demand,” the report reads.

Despite the higher mineral intensity of renewable energy technologies, the scale of associated greenhouse gas emissions is a fraction of that of fossil fuel technologies. But for the World Bank, the carbon and material footprints cannot be overlooked.

“While deploying renewable energy is one of the most effective ways to decarbonize the electricity sector, the mineral intensity of clean energy technologies must be addressed,” it says. “Greening the electricity sector will require that upstream- and downstream-related emissions are addressed.”

Commenting on the supply side of graphite, the report notes that more than 60 percent of output comes from China, which creates a supply risk for its high concentration.

The report also highlights other aspects of metals supply chains, including recycling and innovation.

“Understanding and analyzing the full mineral supply chain for low-carbon technologies are critical to effectively realize climate ambitions,” the World Bank notes.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.