Eagle Graphite Confirms Substantial Increase in Graphite Resource

Eagle Graphite Incorporated (TSXV:EGA) (FRANKFURT:NJGP) (OTC:APMFF) (“Eagle Graphite”, “Eagle”, “We”, or the “Company”) is pleased to announce the filing on SEDAR of its Technical Report confirming the previously released resource estimate for its 100%-owned Black Crystal graphite quarry in southeastern British Columbia.

Eagle Graphite Incorporated (TSXV:EGA) (FRANKFURT:NJGP) (OTC:APMFF) (“Eagle Graphite”, “Eagle”, “We”, or the “Company”) is pleased to announce the filing on SEDAR of its Technical Report confirming the previously released resource estimate for its 100%-owned Black Crystal graphite quarry in southeastern British Columbia.

Highlights

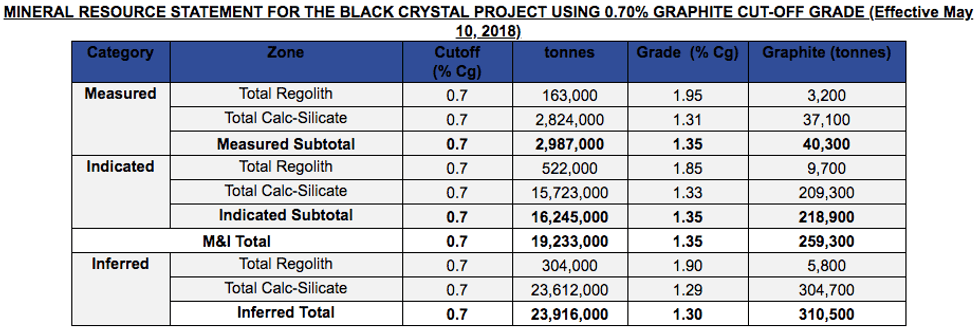

- Total Measured and Indicated (“M&I”) resource of 19.23 Million tonnes (“Mt”) averaging 1.35% crystalline flake graphite (“Cg”) is more than 3.5 times the previous estimate of 5.41 Mt averaging 1.28% Cg1;

- Total Inferred resource of 23.92 Mt averaging 1.30% Cg is more than 4.5 times the previous estimate of 5.11 Mt averaging 1.29% Cg1;

- Total M&I contained graphite increased to over 250,000 tonnes1;

- Total Inferred contained graphite increased to over 300,000 tonnes1;

1A cut-off grade of 0.7% Cg was applied to all estimates.

The resource estimate in Black Crystal’s previous Technical Report was first reported in 2002 (AMEC) and confirmed in 2014 (Discovery Consultants). Several exploration work programs have been conducted since 2002, including drill program results announced February 18, 2016. Tetra Tech has verified and incorporated data from those programs to arrive at updated resource estimates presented below.

Notes

1Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

2Mineral resources are classified as Measured, Indicated and Inferred resources and are effective as of May 10, 2018. Measured and Indicated mineral resources do not have demonstrated economic viability. Inferred mineral resources have a greater amount of uncertainty as to their existence and potential economic and legal feasibility, do not have demonstrated economic viability, and are exclusive of mineral reserves. No mineral reserves have been established for Black Crystal. Given the continuity of the mineralization present at Black Crystal, it is the QP’s opinion that most of the Inferred category has the potential to be upgraded to indicated resources upon additional exploration.

3The Mineral Resources in this release were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council.

4All numbers are rounded. Overall numbers may not be exact due to rounding.

Black Crystal Resource Estimation Parameters

Tetra Tech Canada Inc. (Tetra Tech) of Vancouver, British Columbia, completed the updated estimate based on 2,633 Cg assays obtained from 79 diamond drill holes (totalling 5,394 metres) and 180 trenches (totalling 547 metres). The resource estimate in Black Crystal’s current Technical Report was first reported in 2002 (AMEC) and confirmed in 2014 (Discovery Consultants). Several exploration work programs have been conducted since 2002, including drill program results announced February 18, 2016.

The mineral resource estimate is based on the combination of geological modeling, geostatistics, and conventional block modeling using the Ordinary Kriging method of grade interpolation in Datamine Studio RM software. The mineral resources were estimated using a non- rotated block model with parent blocks of 5m X 5m X 5m split two times into sub-blocks. The QAQC protocols and corresponding sample preparation and shipment procedures have been reviewed by Tetra Tech.

During the site visit, Tetra Tech collected a total of 70 coarse reject and pulp duplicates which were sent off to ALS labs in Vancouver for third-party sample verification. Results of these assays have been reviewed and verified by Tetra Tech.

Mineral resources were estimated in conformance with the CIM Mineral Resources definitions. The confidence classification of the resource is based on an understanding of geological controls of the mineralization, the drill hole pierce point spacing in the resource area, the amount of samples present, and the number of drill holes contained within each search ellipse. The Measured resources required assays from a minimum of three drill holes and a minimum of eleven composites per block within an ellipsoid of 50 m x 50 m x 15 m. The Indicated resources required a minimum of six composites and no less than 2 drill holes per block within an ellipsoid of 100 m x 100 m x 30 m. The Inferred resources required a minimum of two composites per block within an ellipsoid of 150 m x 150 m x 45 m. The resource has not been pit constrained.

The 0.7% C cut-off grade utilized in the above table was derived from the following assumptions:

- Revenue of C$1,172/t Graphite concentrate at 95% Cg;

- Mining costs of C$1.63/t for overburden, C$4.87/t for quarry waste, and C$10.60/t for plant feed at 20% Cg concentration;

- Processing cost of C$9.65/t with 92% processing recovery;

- G&A cost of $5.10/t of plant feed.

Geology of the Black Crystal Deposit

The Property, a disseminated flake graphite deposit hosted within a porphyroblastic and granoblastic marble, is located within the Valhalla Complex, a structural or domal culmination of high-grade metamorphic (upper amphibolite grade) rocks. There are three subculminations within the complex; the project is located on the west central flank of the northernmost of these — the Valhalla dome. The other two subculminations, the Passmore dome and the Southern Valhalla complex, are lithologically and structurally distinct from the Valhalla dome.

The Valhalla assemblage on the west flank of the Valhalla dome consists of an approximately 1.5-kilometre thick, heterogeneous package of upper amphibolite facies pelitic schist, marble, calc-silicate gneiss, psammitic gneiss metaconglomerate, amphibolite gneiss, and ultramafic schist. The base of the section is composed of a sequence of conglomerate, calc-silicate gneiss, and marble, interlayered with 50- to 100-metre thick units of aluminum-poor, semi-pelitic schist. Thick marble and calc-silicate gneiss units interlayered with quartzite and sillimanite-bearing pelitic schist characterize the middle portion, which also contains layers of amphibolite gneiss and ultramafic schist.

At the Black Crystal Quarry location, a 30-40m thick bed of graphite bearing calc-silicate is present which immediately underlays the overburden. This bed is dipping sub-parallel to topography and is mapped in surface outcrop and roadcuts across much of the project location. Additionally, surface weathering of the calc-silicate units has resulted in the formation of an enriched graphitic sand (regolith) which is on average 2-4 meters thick.

Eagle Graphite CEO Jamie Deith states, “These results give an enormous boost in our confidence with respect to our graphite resource, and provide a solid underpinning for advancing the engineering studies and preliminary economic assessment planned for late 2018. Clearly, such an increase to the contained graphite has a number of commercial implications, such as our capacity to accomodate more and bigger offtake agreements, which we also need to work through now for the benefit of all stakeholders.”

In accordance with National Instrument 43-101, the Company advises that a decision to enter into production would not be based on a feasibility study of minerals reserves demonstrating economic and technical viability. Readers are cautioned that production may not be economically feasible and historically these projects have a much higher risk of economic or technical failure.

Torey Marshall, Eagle’s EVP of Business Development, adds, “Each step we take to demonstrate the value of the Eagle Graphite business is of strategic importance to all our shareholders and we continue to advance the business in both conventional and unconventional ways. Our leading position on project maturity is translating into a global position of strength.”

Qualified Persons

The resource estimate and Technical Report were prepared by Tetra Tech of Vancouver, a company which is independent from Eagle Graphite. The technical information pertaining to the mineral resource estimate in this release was reviewed and approved by Cameron Norton, P. Geo, of Tetra Tech, who is an independent Qualified Person as defined by National Instrument 43‑101.

Torey Marshall, Bsc (Hons), Msc (Geology), MAusIMM(CP), a non-independent Qualified Person as defined by National Instrument 43-101, has approved the scientific and technical information in this press release.

About Eagle Graphite

Eagle Graphite Incorporated is an Ontario company that owns one of only two natural flake graphite production facilities in Canada or the USA, located 35 kilometres west of the city of Nelson in British Columbia, Canada, and 70 kilometres north of the state of Washington, USA, known as the Black Crystal graphite quarry. The Company’s shares are listed on the TSXV under the symbol “EGA”, on the Frankfurt Stock Exchange under the symbol “NJGP”, and on the US OTC market under the symbol “APMFF”.

Cautionary Statements

Disclosure Regarding Forward-Looking Statements: This press release contains certain “forward-looking information” within the meaning of applicable securities legislation. Such information is based on assumptions, estimates, opinions and analysis made by management in light of its experience, current conditions and its expectations of future developments as well as other factors which it believes to be reasonable and relevant. Forward-looking information involves known and unknown risks, uncertainties and other factors that may cause our actual results to differ materially from those expressed or implied in the forward-looking information and accordingly, readers should not place undue reliance on such information. Although the Company believes, in light of the experience of its officers and directors, current conditions and expected future developments and other factors that have been considered appropriate, that the expectations reflected in this forward-looking information are reasonable, undue reliance should not be placed on them because the Company can give no assurance that they will prove to be correct. In evaluating forward-looking information, readers should carefully consider the various factors which could cause actual results or events to differ materially from those expressed or implied in the forward looking information. The statements in this press release are made as of the date of this release. The Company undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of the Company or its securities, its financial or operating results, as applicable.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Source: www.fscwire.com