ePower Metals Inc. Reports Cobalt, Gold and Copper Results from Panther Creek Cobalt Project, Idaho and Announces Winter Program

ePower Metals Inc. (the “Company” or “ePower”) (TSXV:EPWR) announces results of its fall exploration program at Panther Creek Cobalt Project located in the Idaho Cobalt Belt in Lemhi County, Idaho.

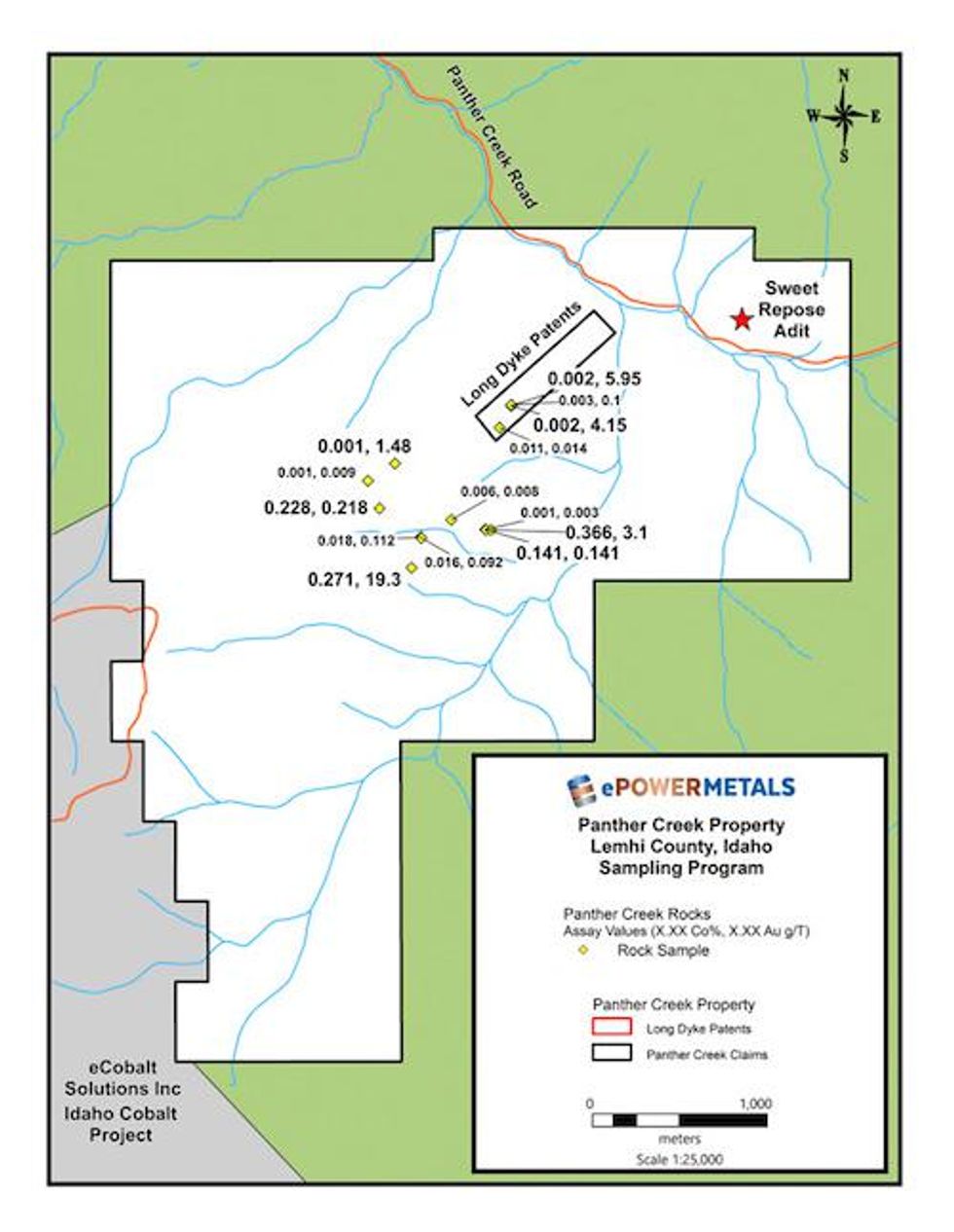

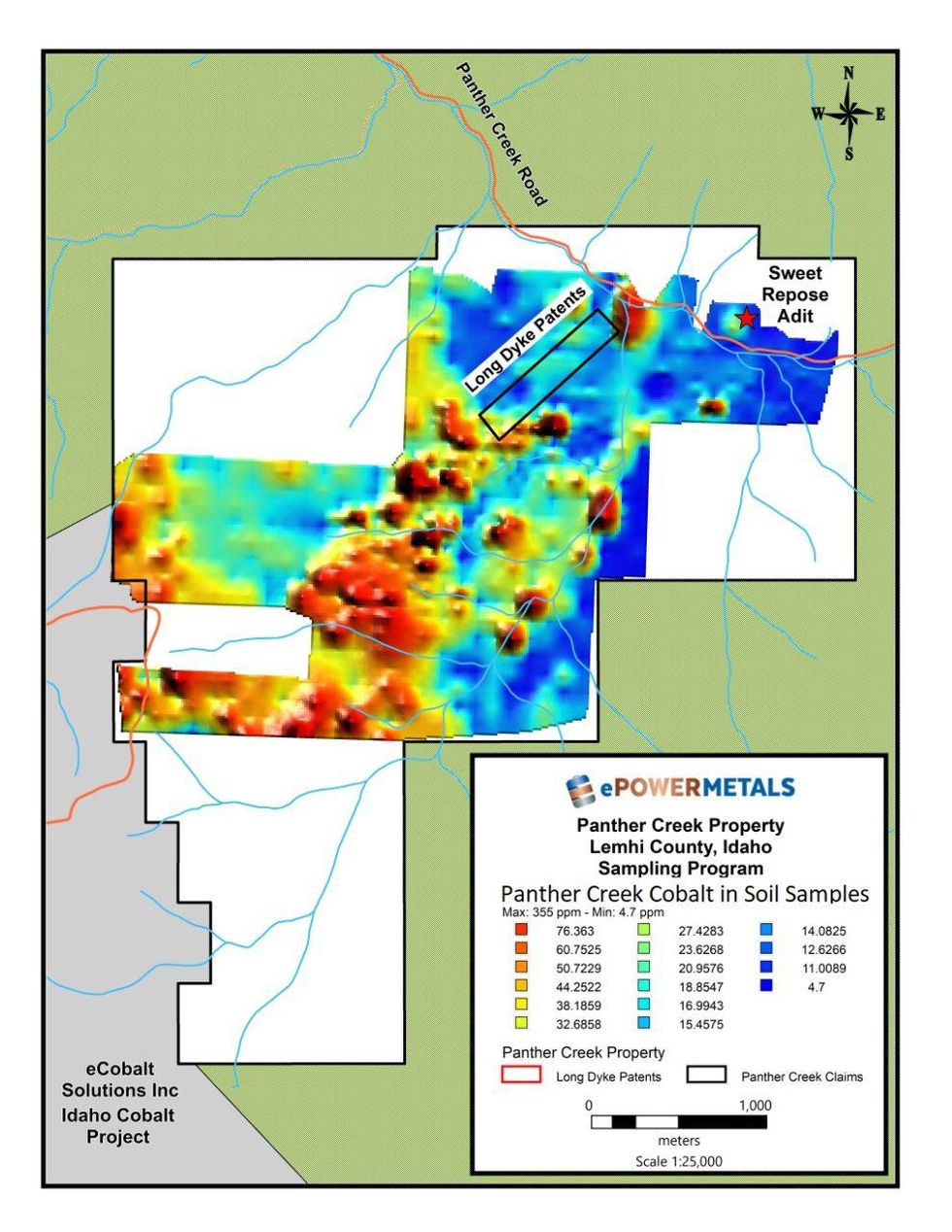

ePower Metals Inc. (the “Company” or “ePower”) (TSXV:EPWR) announces results of its fall exploration program at Panther Creek Cobalt Project located in the Idaho Cobalt Belt in Lemhi County, Idaho. Assays for 14 rock samples range from trace to 0.37% Co, and 0.014 to 19.3 g/T Au. 797 soil samples range from 4.7 to 355 ppm Co and have been received and highlights are reported below.

Highlights include:

Cobalt oxide and gold in outcrop (Figure 1 below)

0.37% Co, 3.10 g/T Au and 1.75% Cu over 5’ (1.5m) chip/channel sample quartzite,

0.27% Co, 19.3 g/T Au and 2.4% Cu over 1’ (0.3m) in oxidized quartz vein/gossan

0.23% Co, 0.22 g/T Au and 0.70% Cu over 2’ (0.6m) in biotite rich quartzite

0.002% Co, 4.15 g/t Au and 0.29 % Cu over 3’ (0.9m) in oxide stained quartz veining

0.002% Co, 5.95 g/t Au and 0.35% Cu over 3’ (0.9m) in oxide stained quartz veining with biotite

Delineation of two parallel soil anomalies which, (Figure 2 below)

intersect historic working on Long Dyke and Sweet Repose and

trend towards the Blackbird mine to the west along the Panther Creek trend

Reconnaissance mapping confirmed the presence of widespread cobalt-copper mineralization including erythrite in stratiform and vein-type occurrences

Michael Collins, President & CEO stated “These results demonstrate the robust nature of the mineralization on the Panther Creek trend and confirm our geological and exploration models as we search for the next cobalt deposit in the Idaho Cobalt Belt. The high gold grades in outcrop are also seen in the Ram and Blackbird deposits and indicates we are on the right track to discovery.”

“ePower is committed to creating significant shareholder value by putting together a high-quality property portfolio of cobalt projects that the Company believes are undervalued, strategically positioned and have the potential to provide future supply to the growing rechargeable battery sector.”

Winter Program

ePower is permitting a sampling and structural mapping program for both the Sweet Repose Adit, and Long Dyke Adit. Given the high grade gold values returned from outcrop samples, the pulp splits from the fall soil sampling program have been sent for gold assay. This work will help define drill targets below the two adits and will refine our exploration model for the Panther Creek Trend. Additional soil and outcrop sampling is planned to fully cover the Panther Creek project as soon as weather permits. This information will be integrated with the results presented here and used for targeting geophysical surveys and drilling.

The Panther Creek claims are contiguous with eCobalt Solution Inc.’s Ram deposit where a recently completed feasibility study outlined a Measured and Indicated Resource of 3.44 million tonnes grading 0.59% cobalt and 0.73% copper, (https://www.ecobalt.com/project/technical-reports).

The Panther Creek Cobalt Property

ePower has earned a 50% interest in the Panther Creek Cobalt Property and has the right to earn up to a 100% interest. The property comprises 156-lode mining claims totalling 3,060 acres and a 41.297-acre mining lease located in the heart of the Idaho Cobalt Belt. For full details on the property transaction please see the Company’s news release dated October 24, 2017 or ePower’s website at www.epowermetals.com.

Located in the Blackbird Mining district Lemhi County Idaho, the property is contiguous with the claims of eCobalt Solution’s (“eCobalt”) and their Ram cobalt-copper-gold mine. There are several historic mine workings both on the Long Dike patent claims and around the Sweet Repose Adit which form a linear trend that ends at the historic Blackbird Mine. A historic mine adit on the property was channel sampled by US Geological Survey and returned 1.04% cobalt and 4.14% copper across 10 feet or 3.04 metres (US Geol. Survey, Open File Report 98-478).

Surface sampling on the property by Utah Mineral Resources LLC returned values from trace to 0.91% cobalt and 3.63% copper and 0.74% cobalt and 0.27% copper. The cobalt-copper mineralization is hosted in the micaceous quartzites of the Apple Creek Formation which is a similar geological setting as the historic Blackbird Mine as well as eCobalt’s Ram Mine.

Idaho Cobalt Belt

The Idaho Cobalt Belt trends northwest-southeast for nearly 37 miles in east-central Idaho. Included within this belt are numerous historic mines and prospects of the centrally located Blackbird district and deposits of the Iron Creek area at the southeast end (U.S. Geological Survey, 2010). The Idaho Cobalt Belt contains the largest known cobalt resources in the United States and is important because it represents a stable and environmentally sustainable source of cobalt. eCobalt is developing the Idaho Cobalt Project, located to the west of the Panther Creek Cobalt Project in the Blackbird district. eCobalt has just completed a Feasibility Study with a Measured and Indicated Resource of 3.44 million tonnes grading 0.59% cobalt and 0.73% copper, (https://www.ecobalt.com/project/technical-reports).

The Company’s fall exploration program was conducted under contract by Brewer Exploration and Geological Services, Inc. of Salmon, Idaho and was conducted by, or under the direct supervision of Brian Brewer, Certified Professional Geologist and a Qualified Person, as defined by NI 43-101. The soil and rock samples were delivered under chain of custody to the ALS Laboratory in Reno Nevada. As an early stage exploration program, the company has relied on internal ALS laboratory standards and blanks for QA/QC. Samples were processed and analyzed for cobalt, copper and 46 other elements using the 4-acid digestion and ICP analytical procedure, (ICP AES with Au 30g gravimetric finish for over limits).

ON BEHALF OF THE BOARD OF DIRECTORS

Michael Collins

President and CEO

For further information, please contact:

ePower Metals Inc.

Suite 501 – 525 Seymour Street

Vancouver, BC, Canada V6B 3H7

Telephone: (604) 764-7094

Website: www.epowermetals.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

We seek safe harbor.

Source: www.newsfilecorp.com