ScoZinc Announces Robust Results of Its Scotia Mine Pre-Feasibility Study: Pre-Tax NPV of C$156M and IRR of 52%

ScoZinc Mining Ltd. (TSXV: SZM) is pleased to announce the results of its Pre-Feasibility Study, including its first NI 43-101 Mineral Reserve Estimate for its wholly-owned and fully-permitted Scotia Mine.

ScoZinc Mining Ltd. (TSXV: SZM) (“ScoZinc” or the “Company”) is pleased to announce the results of its Pre-Feasibility Study (the “PFS”), including its first NI 43-101 Mineral Reserve Estimate (“2020 Mineral Reserve”) for its wholly-owned and fully-permitted Scotia Mine (“Scotia Mine” or the “Project”), located in Nova Scotia, Canada. The PFS was prepared in collaboration with the independent engineering firms of Ausenco Engineering Canada Inc., MineTech International Limited, SRK Consulting (U.S.), Inc., and Terrane Geoscience Inc.

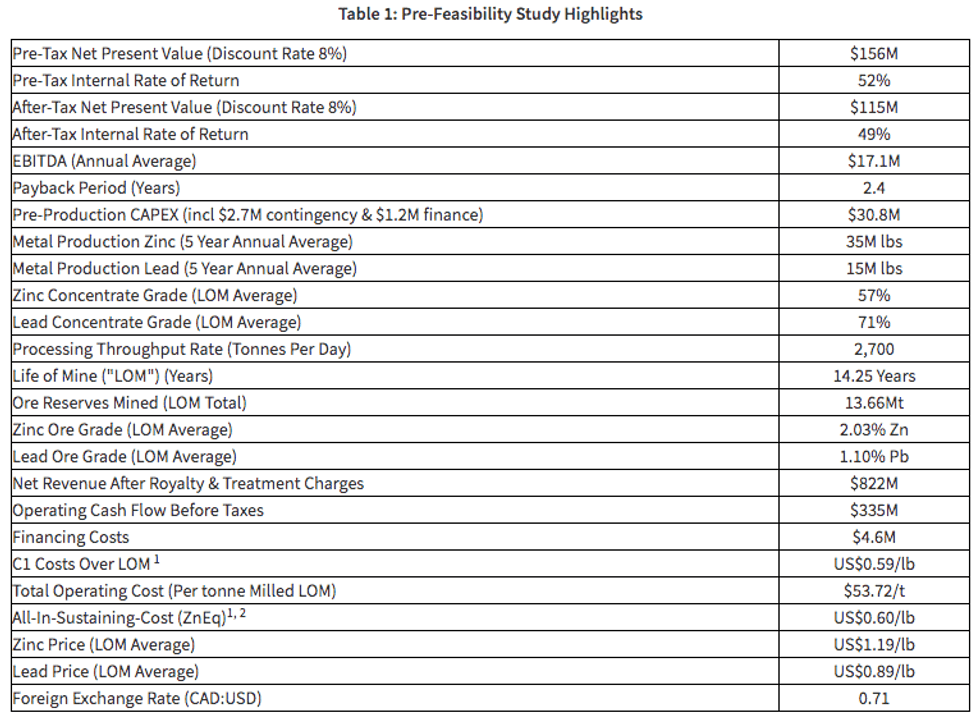

Highlights of the PFS are tabled below, with additional details of the NI 43-101 Technical Report (“2020 PFS”) to be filed on www.sedar.com under ScoZinc’s profile within the next 45 days.

All dollar amounts are expressed in Canadian Dollars unless otherwise noted

1 After Lead credits deducted

2 All-In-Sustaining-Costs (“AISC”) are C1 Costs plus Sustaining Capital and Financing Costs

The President and CEO, Mr. Mark Haywood, commented: “We are very excited to deliver the results of our Scotia Mine’s PFS by our independent panel of mining industry experts. The Project’s economics are very robust, with relatively low capital requirements and a short payback period which includes proposed financing costs structured to be greatly non-dilutive to our shareholders.

“The Project is set to produce high quality Zinc and Lead concentrates for over 14 years, at low operating costs, via conventional open pit mining methods, with a steady ore processing rate of 2,700 tonnes per day. Through detailed planning and analyses, we believe the technical team have resolved many of the mine’s historical bottlenecks and poor performance issues to develop a low-risk development and life of mine production plan.

“Importantly, the PFS shows that commercial Zinc and Lead concentrate production can be achieved within 9 to 12 months of project financing of approximately $30M, with an average annual cash flow of $14M. The extensive facilities already in place on site, combined with the short pre-stripping period, enable the Scotia Mine to potentially demonstrate a free cash flow of $8.4M in the first year of commercial production alone.

“ScoZinc is also of the view that there are additional opportunities to further improve the Project’s economics and extend the operation’s 14-year mine life.

“On the basis of these very positive PFS results, ScoZinc will be actively pursuing the necessary finance to begin commercial production as soon as possible.”

A summary of the Pre-Feasibility Study is provided below. The complete NI 43-101 Technical Report will be provided on the Company’s website at www.ScoZinc.com once the report has been filed on SEDAR.

Location, Ownership & History

The Scotia Mine consists of a fully permitted mine and mill which are 100% owned by ScoZinc. The Scotia Mine is located at approximately 45°02′ North, 63°21′ West, or 62 kilometres northeast of Halifax, Nova Scotia, in the Halifax Regional Municipality. Year-round access to the Project is by paved highway roads and is approximately 15 kilometres off the Nova Scotia provincial highway along Route #224. The Halifax International Airport is located 33 kilometres southwest of the mine site. The Project consists of 648 hectares of mineral rights in the form of three contiguous mineral leases, including land with exploration potential for zinc and lead mineralization. ScoZinc also owns real estate property of 712.5 hectares, which includes the mineral leases and adjoining areas.

In February 2011, Selwyn Resources Limited (“Selwyn”) purchased ScoZinc Limited and all of its assets, including the Scotia Mine and ScoZinc’s exploration claims, for $10 million less a deduction relating to increased reclamation bonding requirements that were being determined at the time of the acquisition. Selwyn changed its name to ScoZinc Mining Ltd., and owns 100% of the ScoZinc Limited subsidiary, which in turn holds the mineral rights to the Main and Getty Zones, the mining rights and surface rights (real property rights) for the Scotia Mine deposit and an environmental assessment (environmental registration) for the Scotia Mine.

ScoZinc also currently holds five exploration licenses covering 41 claims in the immediate vicinity of the Scotia Mine Deposit. Each individual claim covers an area of approximately forty acres (16.2 hectares). In total, the 41 claims cover approximately 664 hectares (1,641 acres). These licenses are located along strike from the Scotia Mine Deposit and include favourable host rocks similar to that at the mine site.

Geology and Mineralization

The Scotia Mine Deposit consists of three main zones of mineralization referred to as the Main (formerly Gays River deposit), Getty and Northeast Zones. The Main zone lies along the southside of the Gays River main branch, immediately east of the confluence with the Gays River south branch. The Getty zone lies just northwest of the Main and North-East zones on the western side of Gays River. The two zones are separated by less than one kilometre.

The Gays River Formation mineralization has long been considered a Mississippi Valley-type lead-zinc deposit. This type of deposit is carbonate-hosted, classified as a typical open space filling type, and hosted in a dolomitized limestone. The limestone developed as a carbonate build-upon an irregular pre-Carboniferous basement topographic high where conditions allowed for growth of reef-building organisms.

The zinc/lead-bearing Gays River Formation trends in an east-north east direction across the Property. Locally, the mineralisation dips up to 45º on average, and up to vertical in places, to the north-northwest which is the depositional slope of the front of the Gays River reef unit. The dip tends to be horizontal in the back reef area (south of the main trend). The mineralisation is present as sphalerite and galena and grades from massive Pb-Zn mineralized material in the fore reef to finely disseminated, lower grade material in the back reef. In the mine area, the Gays River Formation is overlain either by the evaporites of the Carroll’s Corner Formation and/or overburden.

Exploration and Data Management

The Scotia Mine has extensive diamond drilling and blast-hole drilling on a large portion of its mining leases and associated exploration licences. A total of 1,831 holes or 121,870 metres has been drilled to date. All of the data from these holes has been included in this Pre-Feasibility Study and the 2019 mineral resource estimation by SRK (the “2019 MRE”).

Royalties

For the Scotia Deposit, ScoZinc owns the real property covering all the defined mineral resources on the mining leases, so no royalty to any landowner is applicable. However, there is a small 25-acre portion on ScoZinc’s real property that is subject to a sand, gravel and fill royalty of $1.00 per metric tonne to Gallant Aggregates. This royalty does not impact the Scotia Mine’s Pre-Feasibility Study.

For the Getty deposit, ScoZinc has a 1% royalty with Globex Resources Ltd (“Globex”), which provides Globex with a 1% Gross Metal Royalty (“GMR”) interest in the associated claims. Agreement terms also allows ScoZinc to purchase 50% of the GMR for $300,000. ScoZinc’s Life of Mine plan indicates that such a royalty would only be applicable in the last few years of the 14-year mine life.

Nova Scotia provincial royalty of 2% also applies on all net revenue generated from the Project.

Mineral Resource Estimate

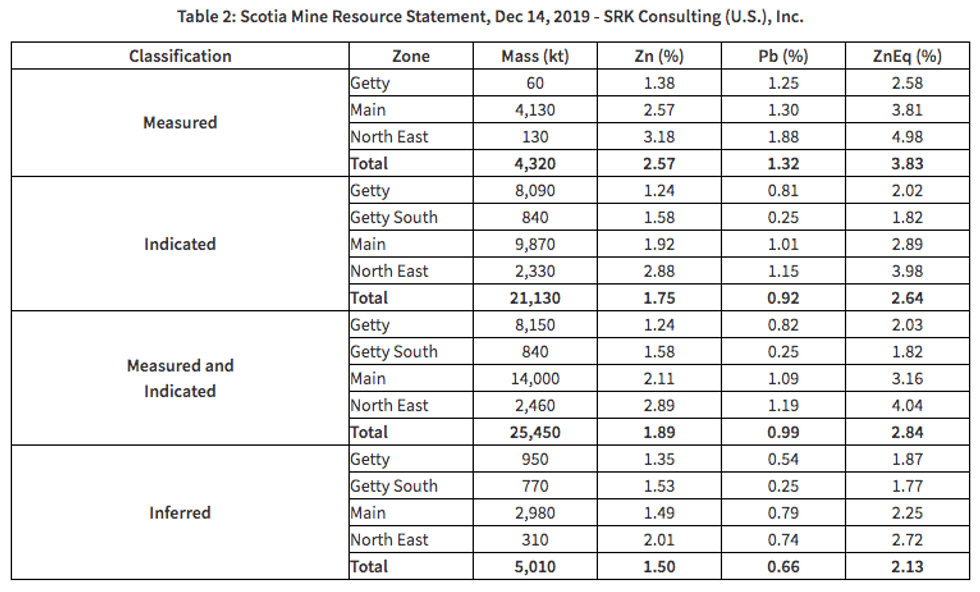

A Mineral Resource estimation was completed in December 2019 for the Scotia Mine Deposit, including the Main, Getty and Northeast Zones (“2019 MRE”). The mineral resources for the Scotia Mine Deposit have been classified as Measured, Indicated and Inferred categories based on CIM Definition Standards in accordance with NI 43-101 reporting guidelines, and are reported with respect to cut-off values calculated using the assumed processing costs and recoveries, and metal prices. The resource is also constrained by an optimized (WhittleTM) pit shell, which is based on optimistic metal prices, in order to demonstrate that the defined resources have reasonable prospects of eventual economic extraction, which is a CIM Definition Standards criterion. All classification categories (Measured, Indicated and Inferred) were considered in the resource pit optimization.

The Scotia Mine Deposit mineral resource summary statement in provided in Table 2, with an effective date of December 14, 2019.

The 2019 MRE resulted in an increase in Measured & Indicated tonnage of 105% (to 25,450,000 tonnes at a Zinc equivalent grade of 2.84%) and an increase in Inferred tonnage of 7% (to 5,010,000 tonnes at a Zinc equivalent grade of 2.13%) from previous resource estimates on the deposit.

Source: SRK, 2019

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that any part of the Mineral Resources estimated will be converted into Mineral Reserves;

- Open-pit resources stated as contained within a potentially economically minable open-pit; pit optimization was based on assumed prices for zinc of US$1.35/lb, and for lead of US$1.14/lb, a Zn recovery of 86% and a Pb recovery of 93%, mining and processing costs varying by zone, and pit slopes of 45 degrees in rock and 22 degrees in overburden;

- Open-pit resources are reported based on a Zinc Equivalent (ZnEq) cut-off grade of 0.90%. The ZnEq. grade incorporates Zn and Pb sales costs of US$0.19/lb and US$0.11/lb respectively, and a 2% royalty charge; and,

- Numbers in the table have been rounded to reflect the accuracy of the estimate and may not sum due to rounding.

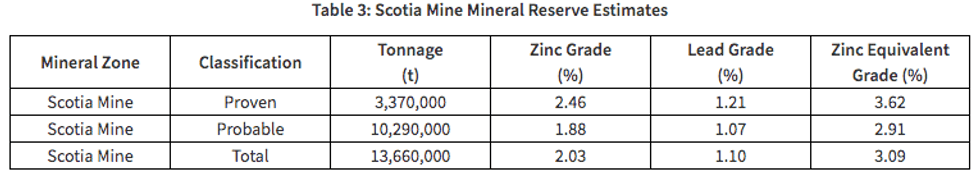

Mineral Reserve Estimate

The Scotia Mine Mineral Reserve Estimates are classified as either Proven Reserves or Probable Reserves and are provided in Table 3. Total Mineral Reserves are 13.66 million tonnes with a Zinc Equivalent grade of 3.09 percent.

Notes: 2020 Mineral Reserves are as of 01 May 2020 and based on a design cut-off grade of 1.5% ZnEq grade. Cut-off grades are based on a Zinc metal price of US$1.10/lb, recovery of 89%, a Lead metal price of US$0.95/lb, and mining recovery of 92%. Average unplanned dilution and mining recovery factors of 12% and 92%, respectively, are assumed.

Click here for the full press release.